Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending Feb. 21:

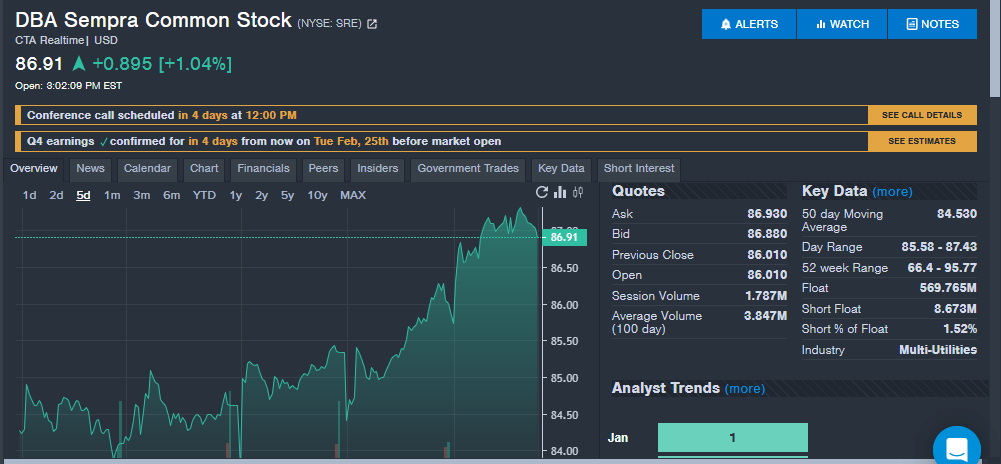

Sempra SRE: The utility company saw an increase of interest from Benzinga readers during the week. The company will report fourth-quarter financial results next week. Analysts expect the company to report earnings per share of $1.60, up from $1.13 in last year's fourth quarter according to data from Benzinga Pro. The company has missed analyst estimates for earnings per share in two straight quarters, while beating in eight of the last 10 quarters overall. Analysts expect the company to report fourth-quarter revenue of $4.36 billion. The company has missed analyst estimates in six straight quarters and seven of the last 10 quarters overall. Sempra's report could be followed closer than normal given the company's presence in the California market where wildfires took place.

The stock was up around 3% for the week, as seen in the Benzinga Pro chart below. Shares are up 21% over the last year.

Vistra Corp VST: Investors paid close attention to the energy company this week, which has been a top performing stock over the last year. With ties to the nuclear energy business, the stock has soared and is up over 200% in the last year. JPMorgan named the stock one of the top utility stocks for 2025 earlier this year. The company is scheduled to report fourth-quarter financial results Thursday Feb. 27. Analysts expect the company to report quarterly earnings of $1.14 per share. The company has beat analyst estimates in two straight quarter and four of the last 10 quarters. Analysts expect the company to report quarterly revenue of $3.89 billion. The company has beaten analyst estimates in two of the last three quarters, but missed estimates in seven of the last 10 quarters. Several analyst reiterated bullish ratings on the stock in recent weeks with BMO maintaining an Outperform and raising the price target from $151 to $191.

Alibaba Group Holdings BABA: The large Chinese e-commerce stock saw strong interest over the week thanks to earnings results and increased investments in the artificial intelligence sector. The company beat third-quarter revenue and earnings per share estimates. The company has now beaten analyst estimates for earnings per share in nine of the last 10 quarters, while missing revenue estimates in seven of the last 10 quarters. In the quarterly results, Alibaba saw revenue grow across many segments on a year-over-year basis. Alibaba said it expects its international e-commerce unit to be profitable in the next quarter. The company also said it expects to invest more in Cloud and AI in the next three years than in the last decade. Alibaba is focusing on cloud computing as the primary monetization effort for its AI efforts instead of AI models.

Multiple Alibaba analysts raised their price targets on the stock after the quarterly results, including Benchmark's Fawne Jiang who maintained a Buy rating and raised the target from $118 to $190. Jiang said the company's e-commerce business is rebounding along with the investments in cloud and AI.

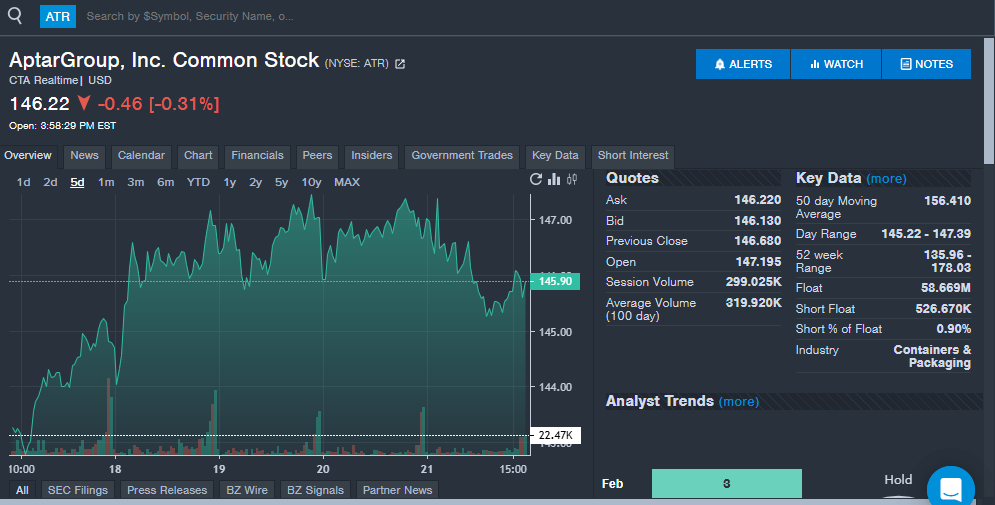

AptarGroup ATR: The dispensing systems company saw strong interest from Benzinga readers during the week. The company recently reported fourth-quarter financial results with earnings per share beating analyst estimates and revenue missing analyst estimates. The company saw several analysts recently maintain bullish ratings, while lowering their price targets. Given the rising interest in the stock and the $10 billion market capitalization, AptarGroup could be a stock to watch for investors. The stock was up around 2% in the last week and shares are up 5% over the last year.

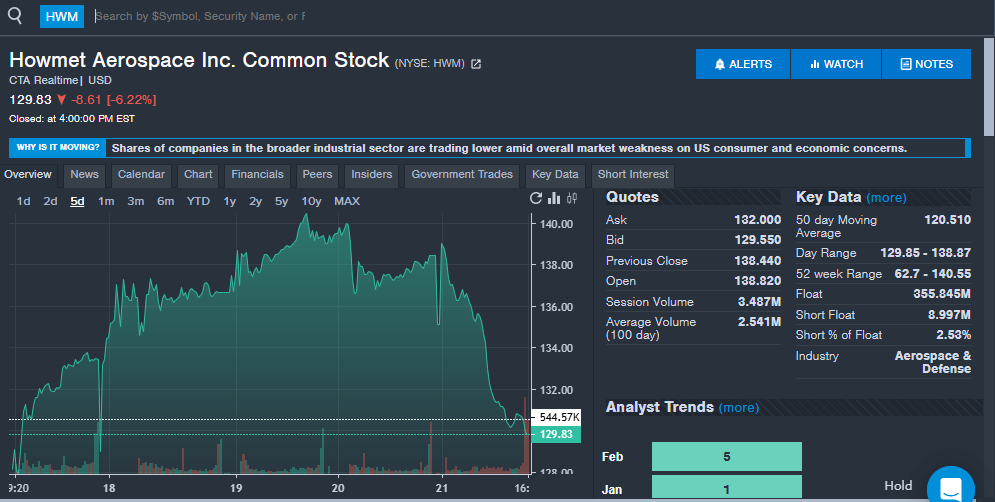

Howmet Aerospace HWM: The aerospace company recently reported fourth-quarter financial results with earnings per share and revenue topping estimates. The company has now beat analyst estimates for earnings per share in eight straight quarters and for revenue in nine of the last 10 quarters. In the quarter, the company saw double-digit growth across many of the reporting segments on a year-over-year basis. Several analysts raised their price targets on the stock after the financial results. Howmet executives said they expect aftermarket growth for spares of 20% to 25% year-over-year in 2025. Executives also cautioned on renegotiations of long-term contracts and the potential tariff impact.

The stock was up slightly during the week and shares are up over 100% in the last year.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.