Suzlon‘s share price band has been revised downwards by the exchanges. The changes will be applicable from Thursday’s session.

What Happened: Suzlon's share price band has now been revised downwards to 5% from 10%, which means that the stock can only move 5% in either direction. This comes just a month after the company’s price band was revised upwards following its removal from the Additional Surveillance Measure (ASM) framework.

Stock exchanges adjust price bands as a surveillance measure to manage excessive volatility. The BSE’s circuit filter mechanism limits the daily price fluctuation for listed securities, setting upper and lower limits on price movements.

See Also: Vodafone Idea Q2: Net Loss Shrinks 17% To ₹7,175 Cr, But Misses Estimates

According to the Securities and Exchange Board of India (SEBI), most individual stocks are subject to price bands that limit daily price fluctuations to a maximum of 20% in either direction. These price bands are intended to prevent excessive volatility and maintain market stability. However, stocks that have associated derivatives are excluded from this restriction, as more complex market factors influence their prices.

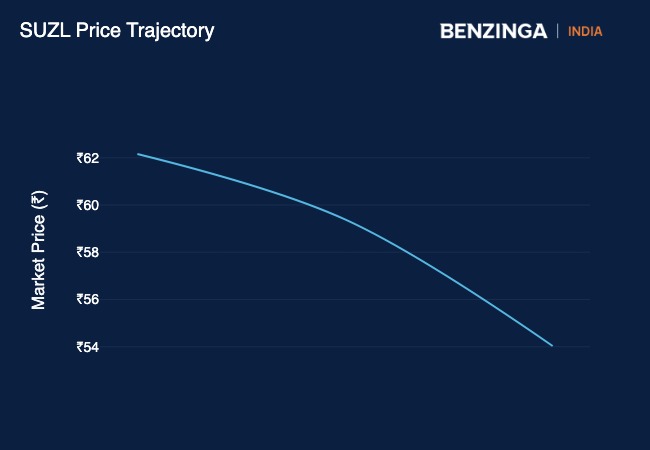

Shares of the wind energy major have been bleeding at the bourses for the past few weeks. Just in the last five sessions, the stock has gone down around 20%.

Suzlon’s share price is now down over 35% from its highs in September and technical analysts see further decline ahead.

Read Next: Tata Power Commissions 126 MW Floating Solar Project In Madhya Pradesh

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.