Technical Analysts expects continued weakness for Suzlon as the stock has been under the weather recently.

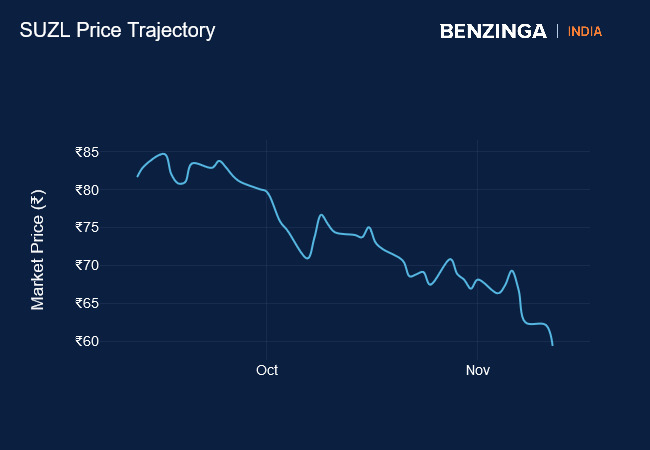

What Happened: Suzlon is now down 35% from its highs in September. The stock has fallen in each of the last five trading sessions.

Recently the company’s CEO of new business, Ishwar Chand Mangal resigned, and the strong Q2 results have helped little to stem the bleeding in the stock. The stock has fallen 18% since its results.

Technical Views: Jigar S Patel, senior manager – technical research analyst, Anand Rathi Shares and Stock Brokers, said technical indicators show that investors lost confidence in the stock, and it is likely to continue its decline.

“Suzlon has shown continued weakness after reversing from a significant resistance near the Ichimoku cloud, indicating a bearish sentiment in the stock. Adding to this concern, Suzlon has also breached the 200-day exponential moving average (DEMA) high-low band, which often serves as a critical support zone. This breakdown below the 200 DEMA high-low band suggests further downside potential, as it indicates a loss of confidence among traders in maintaining price levels around the moving average.” Patel said.

See Also: Battered Reliance Shares To Make A Comeback? This Analyst Sees 29% Upside Ahead

“Given these bearish signals, Suzlon is likely to continue its decline, with a potential target around the ₹50 mark. These ₹50 levels is especially important because it aligns with the previous breakout zone from June 2024, where the stock had gained upward momentum. Such prior breakout levels often act as strong support during pullbacks, as they represent historical points of accumulation. Therefore, given the weak technical outlook, a wait-and-watch approach is recommended to see if the stock can stabilize or reverse from this crucial support zone.”, the analyst added.

Anshul Jain, head of research at Lakshmi Shree said that the stock’s fall below ₹65 with high volumes has confirmed the bearish momentum for the company. “

“The next significant support level to watch is around ₹45 on the monthly timeframe. While minor bounces could occur given the oversold conditions, these are likely to be short-lived. Traders and investors should be cautious, as the stock appears to be heading toward the ₹45 support zone. Until a clear reversal pattern emerges, it’s advisable to stay on the sidelines or adopt a defensive strategy.” Jain added.

Price Action: Suzlon shares nosedived 6.87% to ₹55.31on Wednesday.

Read Next: Macquarie Sees 50% Downside For Zomato, Stock Rebounds After Falling Over 2%

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.