Tata Motors is expected to report another month of sales decline in October, as per a preview note from Motilal Oswal. Declining sales have resulted in the stock underperforming in the past few months.

What Happened: Motilal Oswal highlighted that passenger vehicle (PV) demand showed signs of recovery towards the end of October 2024, with inquiries and bookings picking up for leading original equipment manufacturers (OEMs) like Maruti Suzuki India and Tata Motors.

The recent launch of the Nexon CNG variant by Tata Motors saw a positive response from consumers at the outset.

See Also: Godavari Refineries Surges 3% After Madhuri Madhusudan Kela Buys Stake

| Sales | Oct 24 | Oct 23 | Change | Sept 24 | Change |

|---|---|---|---|---|---|

| CVs | 32,200 | 34,300 | -6.1% | 30,000 | 7.3% |

| PVs | 46,200 | 48,600 | -5.0% | 41,300 | 11.8% |

| Total | 78,400 | 83,000 | -5.4% | 71,300 | 9.9% |

In the commercial vehicle (CV) segment, demand remained weak, with anticipated declines of around 5% in volumes year on year, though improvements in fleet utilisation rates were noted in several regions.

A fleet operator in Madhya Pradesh reported over 75% utilisation, driven by demand from metals, fast-moving consumer goods and consumer durables, while demand in autos and agriculture sectors lagged. Motilal Oswal expects dispatch declines of about 6% for Tata Motors CV, 3% for Ashok Leyland and 1% for VE Commercial Vehicles (VECV).

Analysts at Anand Rathi expect the company to post total sales of 79,500 compared to 82,954 units in the previous year.

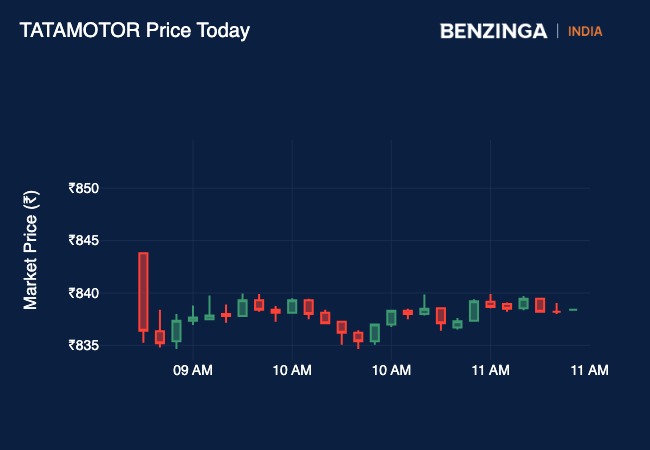

Price Action: Tata Motors’ share price was down 0.24% to trade at ₹838.20 in early trade on Thursday.

Read Next: Why Tata Power Shares Are In The Green Even Though Q2-Print Missed Estimates

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.