On Thursday, Nifty 50 fell 0.89% to 24,749.85. 10 stocks gained while 40 declined.

Infosys led the pack, registering a 2.50% increase to close at ₹1968.10, reflecting a robust uptrend from the previous session’s ₹1920.10.

Infosys gained ahead of its Q2 results announcement on Thursday. The company announced its results after the market close. Though the results missed the estimates, the company raised the revenue guidance for FY25.

Tech Mahindra followed suit, marking a 2.33% rise to end at ₹1699.00, up from ₹1660.30.

Top 5 Gainers

| Stock | Current Price | Last Close | % Change |

|---|---|---|---|

| Infosys | ₹1968.10 | ₹1920.10 | 2.50% |

| Tech Mahindra | ₹1699.00 | ₹1660.30 | 2.33% |

| Power Grid | ₹331.15 | ₹327.20 | 1.21% |

| Larsen & Toubro | ₹3570.30 | ₹3532.60 | 1.07% |

| State Bank of India | ₹811.05 | ₹805.45 | 0.70% |

Other notable gainers included Power Grid and Larsen & Toubro, witnessing a 1.21% and 1.07% increase respectively. State Bank of India also made it to the top five gainers, with a modest 0.70% rise in its stock price.

See Also: Indian Railways Introduces New Ticket Reservation Rules: All You Need To Know

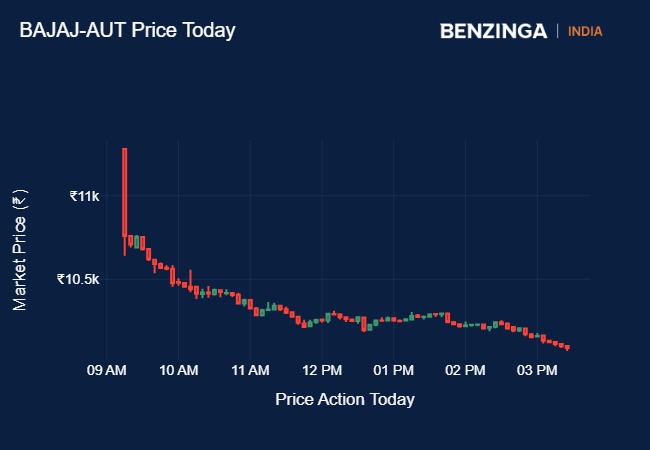

Conversely, Bajaj Auto experienced a drastic downturn, with its price tumbling 12.89% to ₹10,119.45 from ₹11,616.95, marking the day’s sharpest decline. Bajaj Auto declined after its Q2 results disappointed the markets.

Bottom 5 Losers

| Stock | Current Price | Last Close | % Change |

|---|---|---|---|

| Bajaj Auto | ₹10119.45 | ₹11616.95 | -12.89% |

| Shriram Finance | ₹3258.60 | ₹3390.40 | -3.89% |

| Nestlé India | ₹2378.70 | ₹2462.25 | -3.39% |

| Mahindra & Mahindra | ₹2964.60 | ₹3068.00 | -3.37% |

| Hero MotoCorp | ₹5217.45 | ₹5398.20 | -3.35% |

Other stocks that faced a downturn included Shriram Finance and Nestlé India with a 3.89% and 3.39% decrease respectively. Mahindra & Mahindra and Hero MotoCorp also experienced a slump, with a 3.37% decrease in their stock prices.

Vinod Nair, Head of Research, Geojit Financial Services said, “The domestic market experienced significant losses driven by widespread selloffs across various sectors, notably auto, realty, consumer durables and finance. This downturn was attributed to weaker sales forecasts for the festive season, high NPAs and slow credit growth. Weak Q2 result is affecting the market sentiment. Conversely, the IT sector outperformed as a contrary bet and in-line Q2 results.”

Read Next: Bharat Forge To Acquire AAM India Manufacturing Corporation

Engineered by Benzinga Neuro, Edited by Ananthu CU

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.