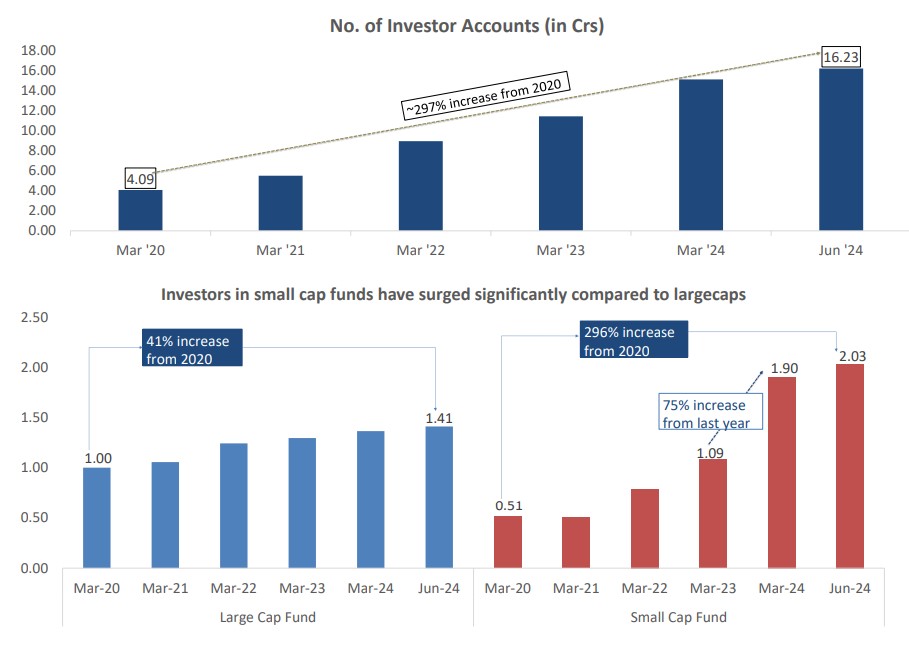

DSP Mutual fund points out that the number of investors in small-cap funds has surpassed the number in large-cap funds.

What Happened: DSP Mutual fund in its Netra report said that the number of investor accounts has grown significantly since Covid. "Loose fiscal policies, liquidity inflows and historically low interest rates fueled the credit binge in 2020 to 2022", the report said.

The bull market has created triple-digit returns in small and midcap stocks which attracted a growing number of investors driven by fear of missing out (FOMO) and the trend has created new investor demat accounts and a high number of investors in small-cap funds, the report added.

See Also: Suzlon Shares Extend Losses To 8th Day: What’s Going On?

The number of investor accounts increased from 4.09 crore in March 2020 to 16.23 crore in June 2024, resulting in a 297% increase from 2020. Among these number of investors in small-cap funds from 0.51 crore in March 2020 to 2.03 crore in June 2024, clocking higher than large-cap investors which grew from 1 crore in March to 1.41 crore in June 2024.

DSP report said that for the first time in history, the number of small-cap fund investors surpassed the large-cap fund investors. " However, 75% of these new small-cap investors have never experienced a bear market. The critical question remains: how many will survive the next bear market ?", the report added.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.