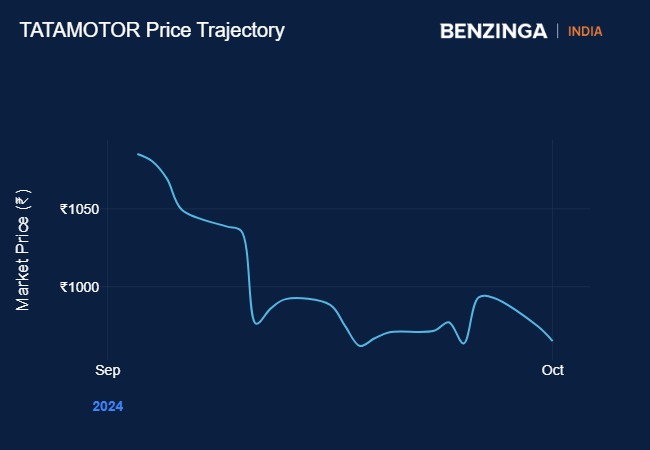

Technical analysts sees further weakness for Tata Motors on the charts.

What Happened: Tata Motors have fallen over 4% on Thursday and have sunk 14% over the last month. Recently Tata Motors lost the second position in domestic car sales as Mahindra and Mahindra surpassed the company’s numbers in September.

Total sales of Tata Motors fell 15% to 71,345 vehicles.

What The Analysts Said: Analysts see further weakness for the stock as they see small chance of bounceback. Anshul Jain, head of research at Lakshmishree said, “Tata Motors is poised for a crucial test as it approaches key support at ₹921, after two unsuccessful attempts to break out past ₹1065. With strong selling pressure evident around the ₹1065 mark, indicated by high volumes during down moves, the stock appears to be in a distribution phase.

“The likelihood of a bounce from current levels is slim, and a breakdown below ₹920 seems imminent. We anticipate the stock will decline further to test ₹880 in the near term, where a more significant rebound could materialize. Market participants should keep an eye on price action around these levels, as failure to hold the support zone at ₹880 may signal further downside. For now, the trend points downward.”

See Also: This Small Cap Stock Flies 5% After Winning ₹565 Cr Order From Power Grid

Jigar S Patel, senior manager – technical research analyst, Anand Rathi Shares and Stock Brokers also shared concerns in the stock’s technical position after its recent downfall. “From an indicator perspective, the Directional Movement Index (DMI) on the monthly chart is signalling caution. The ADX line, which measures trend strength, is notably higher than both the positive and negative DMI lines, suggesting a potential shift in momentum. Additionally, a bearish divergence has appeared, further confirming a potential downward trend.

“More critically, a long-standing four-year bull trendline has been violated on the monthly chart, indicating the possibility of further weakness. As we move forward, it is advisable to book profits on any decent bounce from here on, with support anticipated around ₹850 and resistance near ₹1,030. Given the technical indicators pointing towards a potential top formation, a correction could be expected in the next one to two months. Caution is warranted when dealing with Tata Motors in the near term.”

Price Action: Shares of Tata Motors were trading down 4.15% at ₹925.10.

Read Next: RITES And DMRC Sign MoU To Venture Into Metro Projects

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.