JM Financial sees the PSU bank index which includes State Bank of India, IndusInd Bank and Canara Bank outperforming the Nifty compared to recent underperformance after the election.

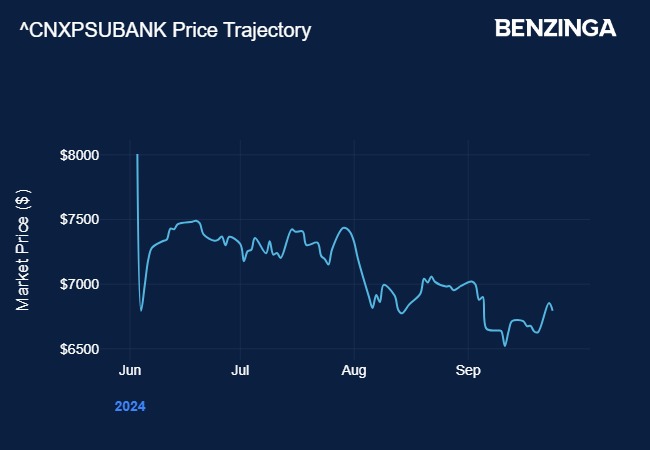

What Happened: The Nifty PSU Bank index fell from a high of 8,053 on June 3 to a low of 6,503 on September 11 a decline of 19% over three and a half months

Nifty PSU Bank index has generally shown strong positive price movement in October and November, JM Financial Technical and Alternative Research noted. “In the last 10 years, the index has closed in the positive territory on 7 and 8 occasions with an average return of 7% and 6% respectively,” the report said.

See Also: How Did Adani Enterprises, Tata Consumer Products Perform After Nifty 50 Entry?

The report further said the PSU Bank index declined from a high of 8,053 level and found support around its 200-day EMA levels in the previous week. In the current week, the index managed to surpass the previous week’s highs “suggesting further strength to prevail”.

JM Financial analysts said the previous instance of steep decline which was from December 2022 to March 2023, the index managed to find support around its 200-day EMA and witnessed a strong bounce up.

IndusInd Bank, Canara Bank and State Bank of India have declined by 12-15% each in the time period.

JM Financial said the cumulative open interest in futures in the banks has not risen significantly suggesting a lack of aggressive selling at current levels. Open interest in Punjab National Bank and Canara Bank have increased by 15% and 14% respectively while SBI shows a 6% increase.

Open interest is the total number of outstanding contracts in derivatives that are not settled. Meaning the derivative contract has not expired. Usually, an increase in open interest along with a price increase indicates a long position built up, indicating bullishness.

Read Next: RITES Bags ₹100 Cr Contract From Adani Ports & SEZ For Services At Dharma Port

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.