As Trent and BEL gear up to join the Nifty 50 on September 27, we take a look at how the most recent previous entrants have performed after they entered the benchmark index.

What Happened: Shriram Finance, LTIMindtree, Adani Enterprises, Apollo Hospitals and Tata Consumer Products have been recent entrants to Nifty 50. We only look at the performance of these stocks six months following their inclusion as Shriram Finance, the latest addition, was added six months ago.

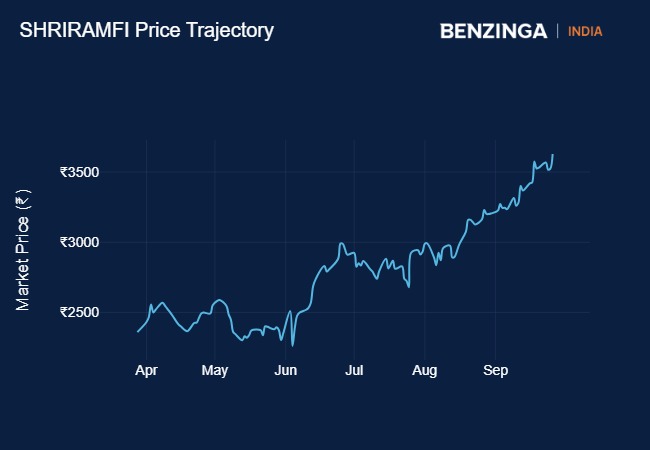

Shriram Finance

Shriram Finance entered the benchmark index on March 28. The stock replaced UPL from the index. Since then, Shriram Finance has gained 52.96% over the last six months. This comfortably beat Nifty 50 returns of 17.51% in the same period.

LTIMindtree

LTIMindtree, which is now about to exit the Nifty 50 in the latest rejig, was added to the benchmark on July 12, 2023, when HDFC was merged with HDFC Bank. LTIMindtree delivered a return of 24% in the first six months following its inclusion, beating Nifty’s 12% return.

LTIMindtree, along with Divi’s Laboratories, is about to be removed from the index as the six-month average free-float market capitalisation of Trent and BEL was 1.5 times of Divi’s and LTIMindtree.

Since its inclusion in the Nifty 50, LTIMindtree has returned 24.71% to date, underperforming the benchmark’s 35.12% return in the same period.

See Also: India Now Ranked 3rd-Most Powerful Nation In Asia Power Index

Adani Enterprises

Adani group’s flagship company Adani Enterprises was included in Nifty 50 on September 29, 2022. It replaced Shree Cements in the index. In the six months after its inclusion, the stock fell over 12%, underperforming the Nifty’s 1.56% gain in the same period.

The stock underperformed as its inclusion coincided with Hindenburg’s first short seller report in January 2023, accusing the conglomerate of “pulling the largest con in corporate history.”

Even though the stock has clawed back some of the gains, it is still trading 12.29% lower than when it was included in the benchmark, underperforming Nifty 50 returns of 55.71% till September 24.

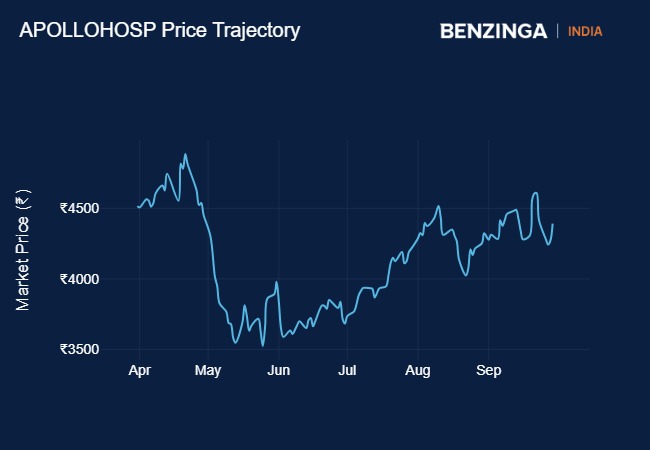

Apollo Hospitals

Apollo Hospitals was included in the benchmark index since March 31, 2022, replacing Indian Oil Corporation. The stock fell 5.22% over the next six months, underperforming the benchmark’s 2.12% decline in the same period.

The stock has given a return of 54.31% since its inclusion to date, slightly above Nifty’s 49.95% return.

Tata Consumer Products

Tata Consumer Products entered the benchmark index on March 30, 2021, replacing GAIL (India). Over the next six months, the stock returned 28.97%, beating the Nifty’s 18.68% return in the same period.

The stock has grown 93.69% since its addition to the Nifty and outperformed the Nifty’s 76% return in the same period.

Read Next: Ola Electric’s S1 X 2Kwh Scooter Receives PLI Certification, 5 Products Now Under Scheme

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.