Technical analysts have mixed opinions on shares of Bombay Stock Exchange (BSE) after its recent rally.

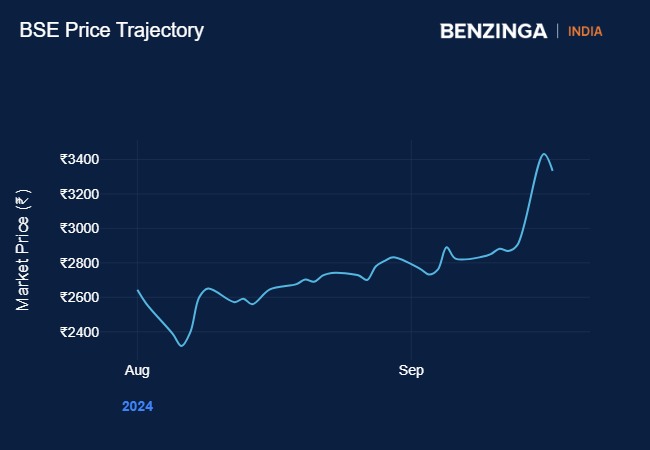

What Happened: BSE shares have risen 15% on Wednesday. The shares have surged over 40% in the last month. Analysts attribute the rise to buzz around the National Stock Exchange’s possible IPO.

Securities and Exchange Board of India recently dismissed the co-location facility case against NSE, reasoning lack of solid evidence. The market regulator also dismissed the case against seven former NSE employees including Chitra Ramkrishna and Ravi Narain. NSE had also applied for a no objection certificate (NOC) from SEBI to go forward with its IPO.

See Also: TCS Partners With McDonald’s Philippines To Digitise Over 760 Outlets

Technical Views: Anshul Jain, head of research at Lakshmishree attributed BSE’s recent rise to NSE’s possible listing, citing market excitement for stocks such as MCX. “BSE has witnessed a strong bullish breakout from a 90-day-long cup and handle pattern on the daily chart, crossing the 3050 mark. This technical surge propelled the stock to an impressive 3600, with momentum showing no signs of slowing down. Investors are advised to buy fresh and consider adding on dips around 3300 levels, targeting an upside of 4200.” Jain said.

Jigar S Patel, senior manager – technical research analyst, Anand Rathi Shares and Stock Brokers shared a more cautious note on BSE. “At the current point, BSE has shown a breakout on the weekly chart, signalling a strong upward move. However, the current market price (CMP) of 3658 is significantly higher than the breakout level of 3300. This creates a situation where the market becomes vulnerable to a pullback, potentially down to the 3350 or 3300 level.” Patel said.

Patel also advised traders should have a wait-and-watch approach before taking positions in the stock. “Additionally, from a technical analysis perspective, the weekly RSI (Relative Strength Index) is in an extremely overbought zone, which further increases the likelihood of a pullback in the coming sessions. Overbought conditions typically indicate that BSE may be due for a correction or pause in its upward trend, making it important to be cautious before entering new positions.” He added.

Price Action: Shares of BSE rose 15.94% to ₹3,865 on Wednesday.

Read Next: Ola Electric’s Daily Complaints Climb Up To 7,000, EV Maker Revamps Service Team: Report

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.