Are we inching closer to the elusive “soft landing”? An increasing share of global fund managers sees it as the most likely outcome over the next 12 months:

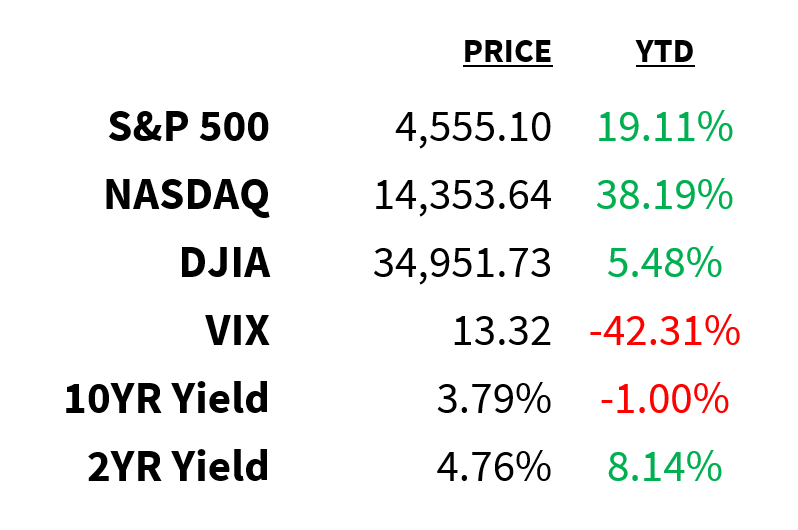

Market

Prices as of 4 pm EST, 7/18/23

Macro

Here are some highlights from BofA’s latest Global Fund Manager Survey:

-

Investors still expect global growth to weaken in the next 12 months.

-

But only 48% predict a recession by the end of Q1 2024.

-

In fact, most (68%) see a soft landing as the most likely outcome over the next year.

-

Sentiment, however, is still stubbornly low.

-

Investors expect the Fed’s first cut will come in Q2 2024.

June’s retail sales report revealed mixed signals about consumer strength.

-

Headline sales missed expectations, rising by 0.2% (vs. 0.5% expected) MoM to 1.5% YoY (vs. 1.6% expected).

-

On the other hand, spending on the core/control group–which excludes food, autos, gas, and building materials and is used to calculate GDP–jumped by 0.6%.

-

Overall, consumer spending softened but flashed resilience in June amid higher prices and borrowing costs.

Homebuilder confidence rose for the 7th consecutive month in July.

-

The NAHB Housing Market Index is at its highest since June 2022.

-

With record-low inventories boosting demand, why wouldn’t it be?

-

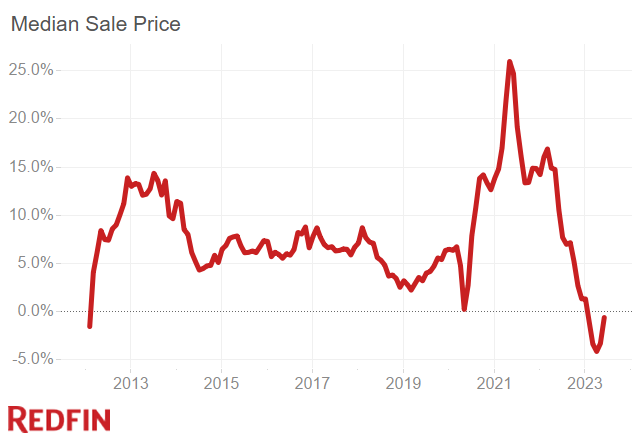

According to Redfin, the total number of homes for sale dropped 15% YoY in June to an all-time low (chart).

-

At the same time, home prices may have bottomed: June’s median sale price decline was the smallest of the past 5 months (chart) and homes are beginning to sell above their list prices.

Redfin

Stocks

Microsoft MSFT shares reached fresh all-time highs after the company announced new generative AI subscriptions for Microsoft 365.

-

The (not cheap) $30-a-month add-on includes AI tools that work with Teams, Word, and Excel.

-

Separately, Microsoft also announced a new partnership with Meta META.

-

As Meta’s preferred partner for Llama 2, Microsoft will make the AI language model software available (for a price) to its Azure customers.

Let’s turn back up on BofA’s Global Fund Manager Survey for some more insights:

-

There’s a massive divergence in sentiment between institutional and retail investors (chart).

-

Equity allocation increased in July but remains net 24% underweight.

-

Bond allocation has been overweight in 7 of the last 8 months and remained so in July despite ticking down.

-

Investors are the most underweight commodities since May 2020.

-

Over the last month, they rotated out of healthcare, Japan, bonds, and tech, and into the US, insurance, staples, EM, and equities.

-

Global profit expectations are the most optimistic since February 2022.

Bank of America

Energy

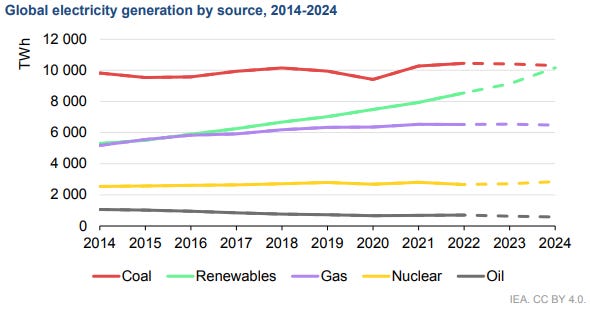

According to a new International Energy Agency (IEA) report, global power demand is poised to grow just under 2% this year.

-

That’s below the 5-year pre-pandemic average of 2.4%.

-

In 2024, however, growth is expected to jump to 3.3% as global economies rebound.

-

The agency predicts that next year—for the first time ever—renewable sources will account for more than 1/3 of the total global power supply:

IEA

Earnings

Yesterday’s highlights:

Bank of America BAC: $0.88 EPS (vs. $0.84 expected), $25.33 billion in sales (vs. $25.05B expected).

-

A 14% jump in net interest income (in-line) drove an 11% gain in total revenue.

-

The bank expects net interest income to expand by 8% for the year.

“We continue to see a healthy U.S. economy that is growing at a slower pace, with a resilient job market.”

- CEO Brian Moynihan

Morgan Stanley MS: $1.24 EPS (vs. $1.15 expected), $13.46 billion in sales (vs. $13.08B expected).

-

The bank’s wealth management business posted record revenue, beating estimates with 16% growth fueled by higher interest income.

-

As with others across the industry, its investment banking division disappointed.

“While we may not be quite at the end of rate increases, I believe we are very, very close to it.”

- CEO James Gorman

What we’re watching today:

-

Tesla TSLA

-

ASML Holding N.V. ASML

-

Netflix NFLX

-

International Business Machines IBM

-

Goldman Sachs GS

-

Elevance Health ELV

-

US Bancorp USB

-

Crown Castle CCI

-

Las Vegas Sands LVS

-

Kinder Morgan KMI

-

Baker Hughes BKR

-

Halliburton HAL

-

Discover Financial DFS

-

Equifax EFX

-

Nasdaq NDAQ

-

M&T Bank MTB

-

Steel Dynamics STLD

-

United Airlines UAL

-

Northern Trust NTRS

-

Citizens Financial CFG

-

Rexford Industrial Realty REXR

-

First Horizon FHN

Top Headlines

-

UK CPI: Inflation in the UK fell more than expected in June, dropping to 7.9%.

-

Stock ban: Two Senators will introduce legislation banning federal executive branch members and lawmakers from owning single stocks.

-

Regional banks: Slowing credit growth and deteriorating credit conditions are in the outlook for US regional banks, according to Apollo.

-

USD weakness: SocGen expects the USD will return to its December 2020 lows.

-

Slowing returns: Bernstein strategists predict US equities will show an annualized total return of 4% over the next decade.

-

Teamsters strike: The Teamsters union is threatening to strike against trucking company Yellow.

-

Pharma suit: Johnson & Johnson joins Merck, Bristol Meyers, and others in suing the US government over the new drug price controls law.

-

PSA: Jim Cramer does not see a recession on the horizon.

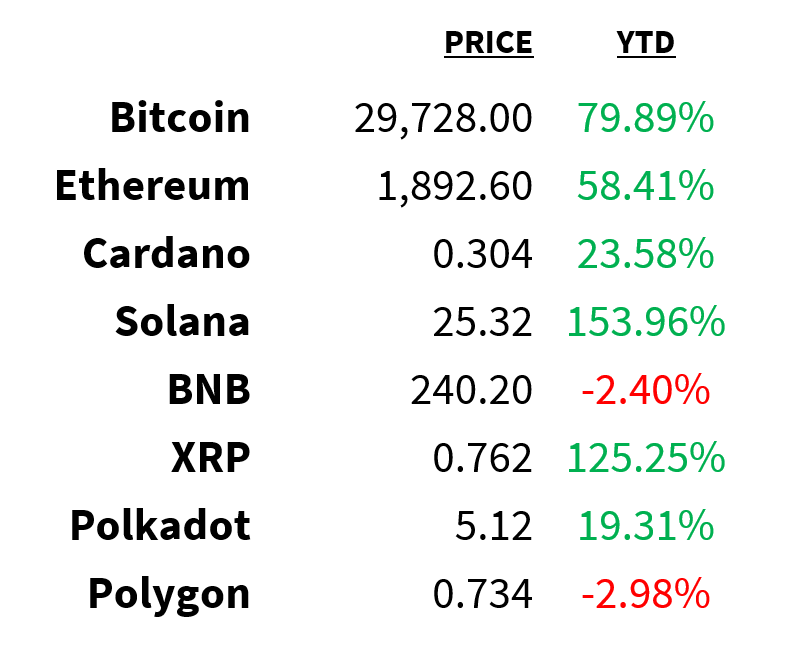

Crypto

Prices as of 4 pm EST, 7/18/23

-

XRP demand: Open interest in XRP futures hit a new YTD record high after climbing above $1.1 billion.

-

Polygon 2.0 roadmap: Polygon MATIC/USD will create a new governance framework aimed at decentralizing control.

-

Crypto flows: Inflows into digital asset investment products over the last 4 weeks were the highest since Q4 2021.

-

French license: SG Force, a Societe Generale division, is the first company to receive a crypto license in France.

-

Crypto nominee: Presidential hopeful RFK Jr. says he would exempt Bitcoin BTC/USD profits from capital gains tax.

Deals

-

Merger rules: The Biden administration is proposing tougher antitrust merger guidelines aimed at private equity and tech.

-

UK OK: Broadcom’s $69 billion acquisition of VMWare has received provisional clearance in the UK.

-

Crowdfunding nightmare: Investors who contributed $63 million for real estate deals through CrowdStreet have watched their funds disappear.

-

Beauty IPO: Oddity Tech raised $424 million in its IPO after pricing shares above the marketed range.

-

PE admin: Private equity firm THL will acquire a majority stake in Standish Management for ~$1.6 billion.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.