Good Morning Everyone!

Especially Mark Zuckerberg who stopped hanging out in the metaverse. Cut costs and returned to cash flow positive. Stock up 20% pre-market set to gain $200 billion.

Next catalyst, AI?

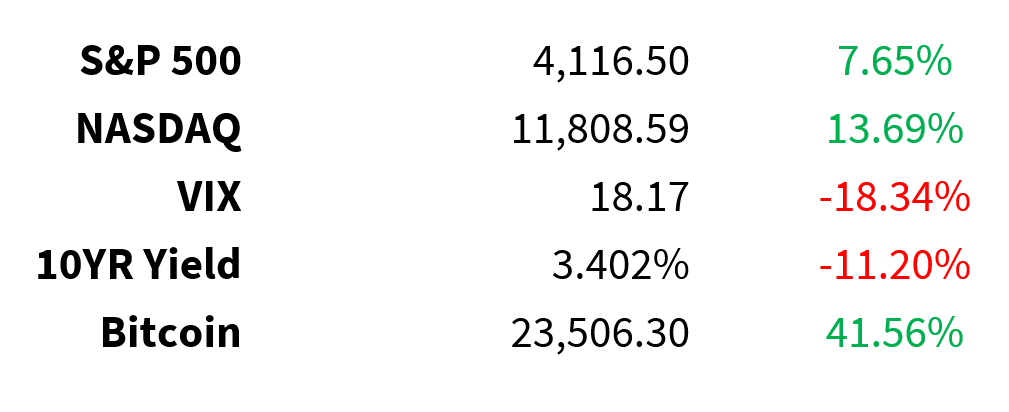

Prices as of 4 pm EST, 2/1/23; % YTD

MARKET UPDATE

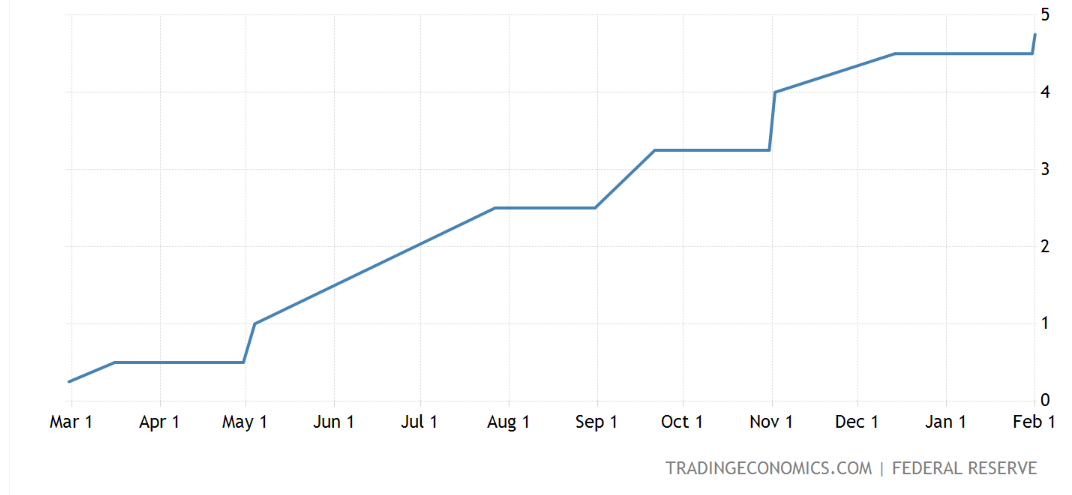

The U.S. Federal Reserve delivered an expected 25 basis point hike

-

Signals a “couple” more hikes before a pause

ECB

-

Delivers 50 basis point hike

-

Signals more hikes ahead

Bank of England

-

Raised by 50 basis points to 4%

-

10th consecutive increase

-

Like the Fed, close to a pause

Crude 76 -0.5%

Meta META +19%

-

Q4 revenue 32.2 billion at high end of guide $30-32.5

-

Ad revenues up 2% y/y

-

Q1 revenue guide $26-$28.5 Billion vs $27B consensus

-

2023 operating expenses comes down to $89-95B from $94-100B

-

After repurchasing $7 billion of stock in Q4, buyback increased by $40 billion

-

How big is $40 billion. It’s 10% of the market cap.

-

Don’t bet against Zuck

-

Solid revenue, Solid guide, larger than expected capex cut, big share buyback

-

Chart: Average Revenue per user (ARPU)

-

People are using Meta products. Ad impressions up 23% y/y. Reels is having an impact.

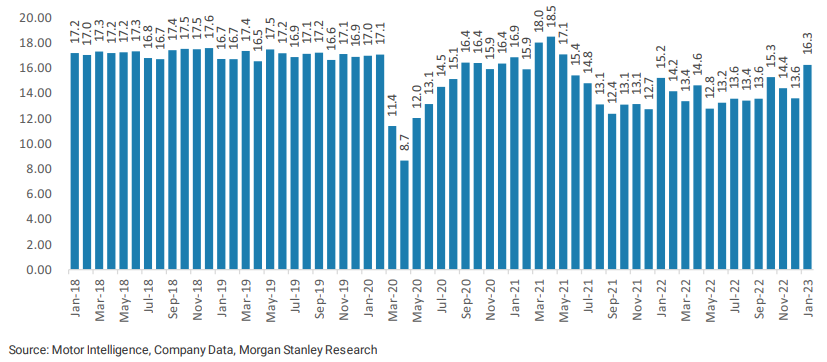

Auto

-

U.S. January SAAR 16.2 million units vs. street 15.3

-

Incentives down 22.9% at $1,400 per car

-

Days supply is 37 vs. 33 last month

Earnings

-

MetLife MET flat EPS $1.55 vs street $1.65

-

McKesson MCK -2% raised 2023 EPS guide

-

Alfac AFL flat EPS $1.29 vs street $1.21

-

Corteva CTVA -2% guide lower than street

-

Allstate ALL flat Auto loss ratio worse than street

-

Align ALGN +17% revenues down but better than street, $1 cash reserves

-

Eli Lilly LLY -2% top line miss, bottom line beat

-

Merck MRK -1% EPS $6.90 beat street $6.35, raised guide

-

Shell SHEL +2% record profits of $42.3 billion, increased dividend and share buyback

-

Bristol-Myers BMY +1% Q4 revenues +2%, earnings +5%, 2% increase to guide

-

ConocoPhillips COP -1% 4% cash flow beat, capex modestly higher

-

Honeywell HON -3% EPS in line, guide light

-

Sony SONY +2% in-line, boosts guide

-

Estee Lauder EL -3% guide is light

-

Ferrari RACE +5% revenue and EBITDA beat

Tonight

-

Apple AAPL

-

Google GOOGL

-

Amazon AMZN

-

Starbucks SBUX

CRYPTO UPDATE

99-year old Charlie Munger on crypto

-

“Instead, it’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity”

-

“The U.S. should now enact a new federal law that prevents this from happening”

Alameda Research

-

Alameda wallet received over $10 million in crypto overnight

-

$6 million in tether from Bitfinex

-

$4.5 million in USDC from unknown entity

-

Reasons unclear

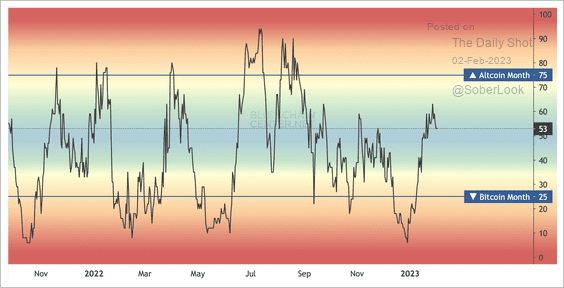

Risk appetite

-

More than half of altcoins outperforming Bitcoin BTC/USD over last 30 days

-

Suggest higher risk appetite

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.