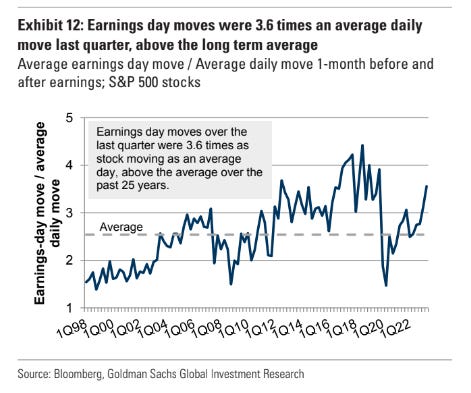

Last quarter's earnings day moves were 3.6x the average daily move. Will we see more of the same this season?

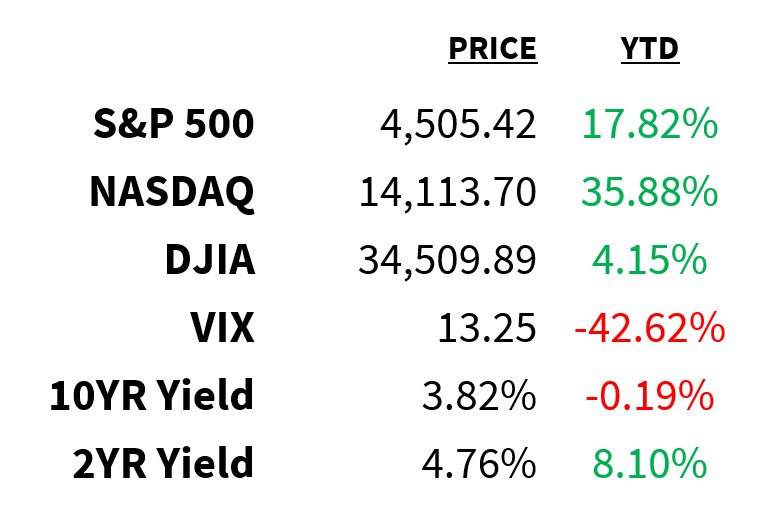

Market

Prices as of 4 pm EST, 7/14/23

Macro

The economic rebound in China has failed to meet lofty expectations.

-

In fact, it’s largely disappointed and the latest data isn’t helping.

-

GDP expanded by just 0.8% in Q2 thanks to soft retail sales and a drop in private-sector

-

That pushed annual economic growth to 6.3%, well below forecasts of 7.3%.

-

Driving the slowdown are deflation, a +20% youth unemployment rate, and—above all else—a large drop in property investment.

Stop me if you’ve heard this before: economists are pushing out recession expectations.

-

A new WSJ poll shows economists’ probability of a recession within the next year fell to 54% from 61%.

-

That’s the largest drop since August 2020.

-

The main reason for optimism: declining inflation and an increasingly clearer path to a soft landing.

-

Is it just me, or have we seen this headline a thousand times over the last year?

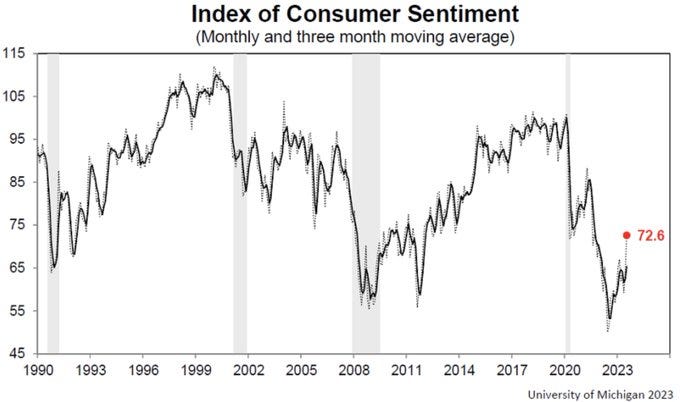

Economists aren’t the only ones holding brighter outlooks.

-

The University of Michigan’s Consumer Sentiment Index reached its highest level since September 2021 in July.

-

The monthly swing in sentiment was the largest since 2006.

-

Lower prices and a healthy jobs market were behind the renewed optimism.

-

On the other hand, inflation expectations edged up to 3.4% from 3.3%.

University of Michigan

Stocks

America’s biggest bank posted its biggest quarterly profits ever in Q2.

-

JPMorgan reported $14.5 billion in net income on a 34% YoY increase in revenue.

-

Solid loan growth and higher interest rates led to a 44% rise in net interest income.

-

The bank upped its 2023 net interest guidance for the third time to $87 billion.

-

Jamie Dimon: “Consumer balance sheets remain healthy, and consumers are spending, albeit a little more slowly.”

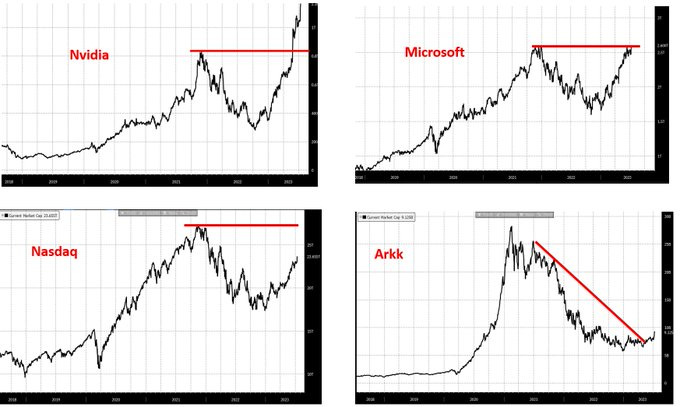

After becoming a household name following its historic post-Covid rally, ARK Innovation ETF (ARKK 2.14%↑) has been struggling to hold onto investors.

-

The fund has seen $717 million in net redemptions over the last year.

-

Once at close to $30 billion—making it the largest actively managed ETF—AUM has been cut by roughly 2/3 to ~$9 billion.

-

While ARKK has outperformed the indices YTD, there’s a clear lag in its recovery back to all-time highs:

@HayekAndKeynes

Energy

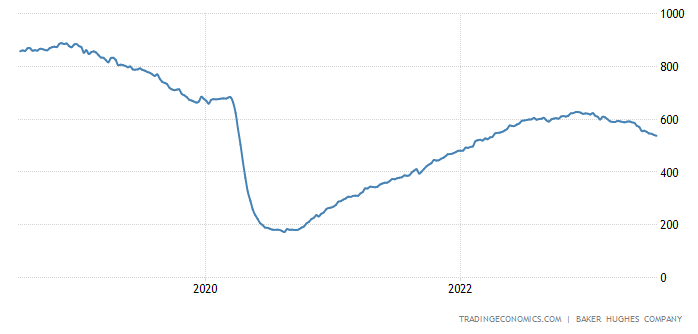

The Baker Hughes oil & gas rig count is a leading indicator for future output.

-

Last week, the total number of rigs dropped to 675 from 680.

-

That marked the 10th decline in 11 weeks.

-

Total oil rigs, meanwhile, are at their lowest since April 2022 (chart).

-

Driving the decline in rigs: declining oil prices.

Baker Hughes/Trading Economics

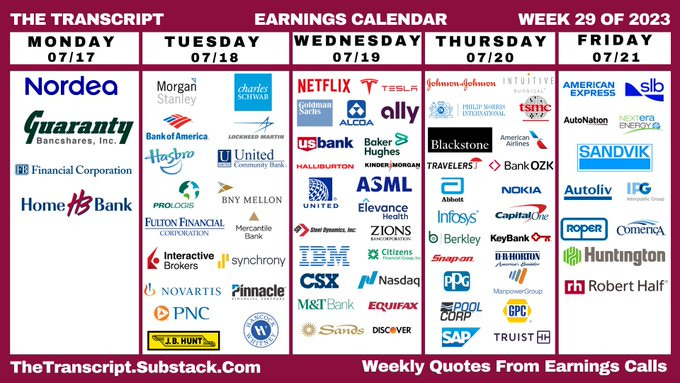

Earnings

Yesterday’s highlights:

Wells Fargo WFC: $1.25 EPS (vs. $1.16 expected), $20.53 billion in sales (vs. $20.17B expected).

-

Profits jumped 57% in Q2 thanks to a 29% rise in net interest income.

-

The bank expects a 14% annual increase in net interest income for 2023.

Citigroup C: $1.33 (vs. $1.30 expected), $19.44 billion (vs. $19.29B expected).

-

A 1% decline in revenue led to a 36% drop in net income.

-

The bank cited challenging economic conditions that led to higher expenses, credit costs, and weak sales.

What we’re watching today:

-

Equity Lifestyle Properties ELS

-

FB Financial FBK

Top Headlines

-

G20 meetings: Central bank officials and financial ministers from the Group of 20 are meeting in India for 2 days.

-

No grain pact: Russia suspended a humanitarian corridor to transport Ukranian grains to global markets in the final hour.

-

Teams antitrust: The EU Commission is launching a formal antitrust investigation against Microsoft over Teams.

-

Dollar decline: Many believe the dollar’s recent weakness is foreshadowing its demise.

-

Pilots deal: United Airlines reached a preliminary deal with its pilots which includes 40% raises.

-

Hollywood strike: The ongoing strike in Hollywood is threatening to seriously impact 2024’s release calendar.

-

Cybertruck: Four years after unveiling the concept, Tesla has finally begun producing Cybertrucks.

-

HELOCs: Interest in home equity lines of credit has risen along with mortgage rates.

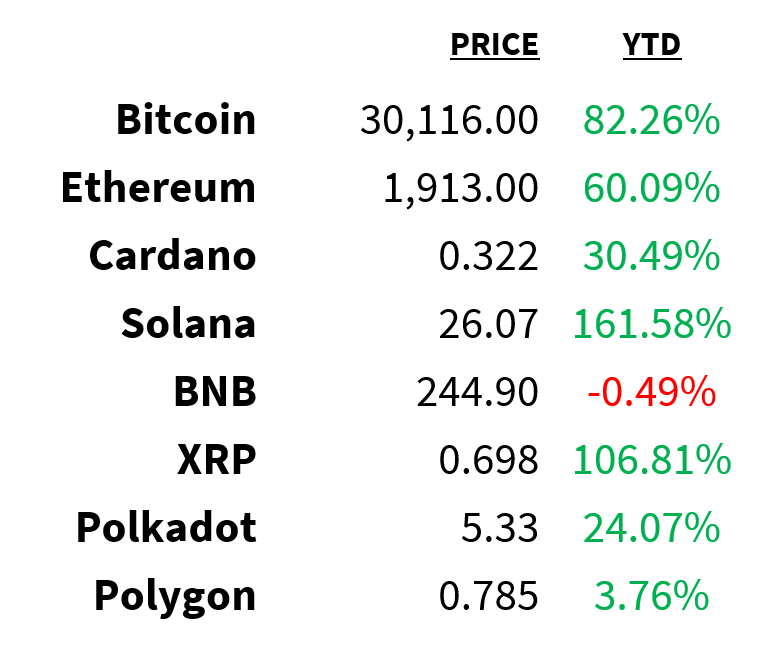

Crypto

Prices as of 4 pm EST, 7/14/23

-

Miner headwind: JPMorgan predicts Bitcoin’s upcoming halving will hit miners’ revenues and increase their production costs.

-

Crackdown cost-cutting: Binance has laid off more than 1,000 employees in recent weeks.

-

BNB shorts: Futures activity reveals investors are increasingly short Binance’s BNB token.

-

Crypto vs. real estate: The NBER says home prices in wealthy countries got a boost from crypto after the 2017 crypto rally.

-

Everyday crypto: A new Visa-integrated, crypto-based debit card lets holders make everyday purchases with stablecoins.

Deals

-

CoD deal: Sony and Microsoft have signed a 10-year deal to ensure Call of Duty remains available on PlayStation.

-

Aluminum buyout: A group of Wall Street banks is launching a $1.9 billion debt sale to support Apollo’s acquisition of Arconic Corp.

-

Drug M&A: Eli Lilly will acquire obesity drug maker Versanis for up to $1.93 billion.

-

Edu takeout: Goldman Sachs and General Atlantic will take education technology company Kahoot private in a ~$2 billion deal.

-

Growth mode: Recently valued at $7.35 billion, Fenway Sports Group is looking to expand its sports portfolio.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.