As Nvidia continues its dream run, Indian mutual funds that have invested in the stock are also set to see huge gains.

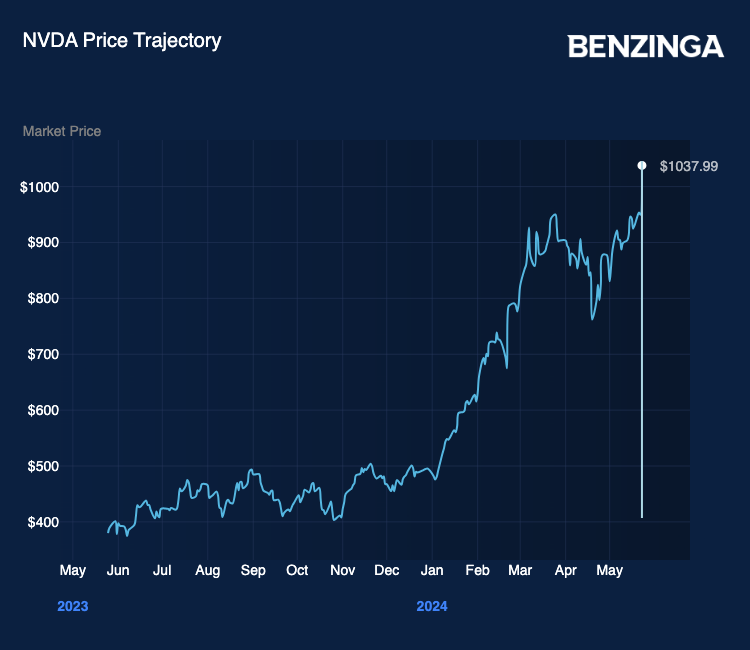

What Happened: Nvidia in its April quarter recorded a revenue of $26.04 billion, growing 18% from the previous quarter and 262% from the previous year. The company also announced a 10-for-1 stock split and hiked its quarterly dividend by 150%. The stock has delivered returns of approximately 490% over the past 18 months and approximately 240% over the last 12 months.

According to data from Fisdom Research, the total exposure of Indian AMCs (asset management companies) in Nvidia increased to ₹1,951 crore in April 2024, up 14.83% from the January quarter when they had exposure of ₹1,699 crore.

Motilal Oswal had the highest exposure with an investment of ₹463 crore followed by Franklin Templeton (₹284 crore), Mirae (₹217 crore), Kotak (₹188 crore) and Axis Mutual Funds (₹181 crore).

| AMC Name | Exposure to NVIDIA (In ₹ Cr) |

|---|---|

| Motilal Oswal MF | 463 |

| Franklin Templeton MF | 284 |

| Mirae MF | 217 |

| Kotak MF | 188 |

| Axis MF | 181 |

| Edelweiss MF | 139 |

| Navi MF | 101 |

| PGIM India MF | 93 |

| ICICI Pru MF | 73 |

| SBI MF | 49 |

| HDFC MF | 42 |

| Aditya Birla SL MF | 41 |

| DSP MF | 32 |

| Invesco MF | 25 |

| Bandhan MF | 23 |

| Total | 1,951 |

See Also: Small Cap Stock Soars 5% After Winning Orders From Adani Group, L&T

Among Active Funds, Axis Growth Opportunities Fund had ₹115.8 crore investments in the stock. Edelweiss Technology Fund has invested ₹18.5 crore. Axis Special Situations Fund has invested ₹10.3 crore.

| Fund Name | Exposure to NVIDIA (In ₹ Cr) | % of AUM |

|---|---|---|

| Axis Special Situations Fund | 10.3 | 0.8% |

| Axis Growth Opp Fund | 115.8 | 1.0% |

| Edelweiss Technology Fund | 18.5 | 4.1% |

In Non-Broadbased Passive funds, Motilal Oswal Nasdaq 100 FoF invested ₹299 crore, Kotak Nasdaq 100 FoF invested ₹188 crore and Motilal Oswal S&P 500 Index Fund has ₹164 crore investments.

| Fund Name | Exposure to NVIDIA (In ₹ Cr) | % Portfolio Holdings |

|---|---|---|

| Motilal Oswal Nasdaq 100 FOF | 299 | 6.5% |

| Kotak NASDAQ 100 FoF | 188 | 6.5% |

| Motilal Oswal S&P 500 Index Fund | 164 | 5.2% |

| Mirae Asset NYSE FANG+ETF FoF | 153 | 9.8% |

| ICICI Prudential NASDAQ 100 Index Fund | 73 | 6.3% |

| Navi NASDAQ 100 FoF | 58 | 6.5% |

| Mirae Asset S&P 500 Top 50 ETF FoF | 47 | 8.9% |

| Invesco India – Invesco EQQQ NASDAQ-100 ETF FoF | 24 | 6.5% |

| Aditya Birla SL NASDAQ 100 FOF | 24 | 6.5% |

| Axis NASDAQ 100 FoF | 10 | 6.5% |

In Broad-based mutual funds, Franklin India Feeder – Franklin U.S. Opportunities Fund has invested ₹282.3 crore, Edelweiss US Technology Equity FoF has ₹120.4 crore and PGIM India Global Equity Opportunity Fund has ₹93.2 crore investments.

| Fund Name | Underlying | Exposure to NVIDIA (In ₹ Cr) | % of AUM |

|---|---|---|---|

| Franklin India Feeder – Franklin U.S. Opportunities Fund | Franklin U.S. Opportunities Fund, Class I (ACC) | 282.3 | 8.4% |

| Edelweiss US Technology Equity FOF | JPMORGAN F-US TECHNOLOGY-I A | 120.4 | 5.6% |

| PGIM India Global Equity Opp Fund | PGIM JENNSN GLEQ OP-USD AC I | 93.2 | 7.0% |

| SBI International Access-US Equity FoF | Amundi Funds US Pioneer Fund -I15 USD | 48.6 | 5.7% |

| Navi US Total Stock Market FoF | VANGUARD ETF | 43.3 | 5.1% |

| HDFC Developed World Indexes FoF | CSIF (IE) MSCI USA Blue UCITS ETF | 42.1 | 4.9% |

| Axis Global Equity Alpha FoF | Schroder ISF Global Equity Alpha Class X1 Acc | 31.1 | 3.6% |

Price Action: Nvidia's stock closed 9% higher at $1,037.99 on May 23 in the US markets.

Read Next: Meet Krish And Bhoomi, Doordarshan’s First AI Anchors

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.