There is no bigger investor on Dalal Street than India’s biggest insurer, Life Insurance Corporation. The insurance behemoth manages a whopping ₹50 lakh crore, a nice chunk of which is invested in some of India’s biggest companies. As per the public data available with the bourses, the investment giant holds over 250 stocks with a market value exceeding ₹11 lakh crore. In this article, we take a look at some of the company’s biggest bets and how they’ve performed in the past year.

Reliance

The company’s biggest bet on the street is the biggest conglomerate in India. As of March 2024, LIC owns around 6.29% or 41.54 crore shares of the company. The massive stake is worth over ₹1.23 lakh crore.

ITC

Next in line, we have the cigarette-to-hotel conglomerate ITC. As of March 2024, the insurer owns a massive 15.21% stake in the company. LIC’s holding is currently valued at around ₹80,000 crore. The hotels-to-tobacco giant has had a tough start to the year. On a year-to-date basis, the stock has gone down around 9%.

State of Bank of India

LIC owns around 8.93% stake in India’s largest lender. The stake is currently worth around ₹65,250 crore. SBI has been one of the better-performing stocks in LIC’s portfolio especially among the big guns. In the past year, SBI’s share price has gone up over 40%.

Tata Consultancy Services

LIC’s portfolio also houses India’s biggest IT giant. As of March 2024, LIC owns around 4.86% or 17.59 crore shares of the company. Those shares are currently worth around ₹65,130 crore. In the past year, the stock has gone up around 12%.

Larsen and Toubro

The LIC portfolio also includes one of India’s biggest construction companies. As of March 2024, LIC owns 11.19% or 15.17 crore shares of the company. The holding is currently worth around ₹56,070 crore. Among LIC’s biggest bets, L&T has been one of the overachievers at the bourses in the past year. The stock has gone up around 67% in the past year.

Infosys

LIC’s shareholding in Infosys is at 10.41% equivalent to 38.59 crore shares. The value of that stake is around ₹55,000 crore. Infosys shares have had a tough time at the bourses this year. Since the start of the year, the stock has gone down close to 8%.

HDFC Bank

Next up is India’s largest private bank. As of March 2024, LIC owns around 5.26% stake in the private lender. The value of these 34.51 crore shares comes up to around ₹52,700 crore. The insurer earlier this year, also got the RBI’s nod to increase its shareholding in the lender up to 9.99%.

IDBI Bank

Next up we have another public-sector bank, which is co-owned by the LIC and the government of India. As of March 2024, LIC owns a 49.24% stake in the company. The stake is worth around ₹44,655 crore. After an incredible run, the bank stock has had a quiet few weeks. In the last 30 days, the stock has gone down around 6%.

ICICI Bank

Following up is India’s second-largest private lender ICICI Bank. As of March 2024, LIC owns a 7.01% stake in the bank. The 39.58 crore shares of the bank are currently worth around ₹44,480 crore. The bank has had a decent run at the bourses — in the past year the stock has gone up around 17%.

Coal India

To conclude this list we have the mining giant Coal India. LIC holds a 10.18% stake in the company. The holding is currently worth around ₹30,430 crore. The stock, same as several other PSU stocks, has had an incredible year at the bourses. In just the past year, the stock has surged up over 100%.

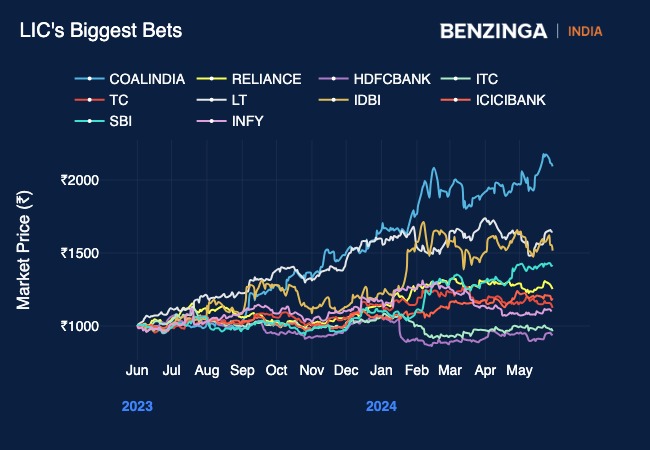

And now here’s a comparison of how a hypothetical ₹1,000 investment in all these LIC portfolio stocks would have performed over the last year.

As you can see from the chart above, returns from Coal India, Larsen & Toubro and IDBI outperform all other stocks. However, all the stocks have given positive returns except for HDFC Bank, which has had a rough start to 2024.

Read Next: IREDA Share Price History, Financials, Company History: All You Need To Know

Image generated using Dall-E.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.