The Indian Renewable Energy Development Agency (IREDA) is arguably one of the most performing IPOs of 2023. While the PSU received a relatively lukewarm response with its IPO being oversubscribed 38 times, and the retail portion getting a subscription of 7x, its journey on the bonuses has been incredible.

In just a few months of listing, the stock has surged up over 500% from its IPO issue price of ₹32. So, with all this buzz around the stock, we delve into the history, financial health, and everything else that you might need to make a decision about the PSU stock.

IREDA Company History

IREDA is a Mini Ratna (Category – I) Government of India Enterprise under the administrative control of the Ministry of New and Renewable Energy (MNRE). IREDA is a Non-Banking Financial Institution established in 1987 engaged in promoting, developing and extending financial assistance for setting up projects relating to new and renewable sources of energy and energy efficiency/conservation.

REDA has been at the forefront of financing renewable energy projects across the country. Its mission to promote, develop, and extend financial assistance for renewable energy and energy efficiency projects aligns with global sustainability goals. As of March 31st, 2022, IREDA had sanctioned loans totalling approximately ₹1,20,522 crores to projects in the Renewable Energy & Energy Efficiency sector. Out of this, around ₹77,946 crores have been disbursed, supporting the development of more than 19,453 MW of renewable energy capacity across the country. One of the customers of the company is the popular cab company BluSmart.

How to Buy IREDA Shares

IREDA is a publicly listed company, making it convenient for investors to purchase IREDA shares and track IREDA share prices. Interested individuals can acquire IREDA shares through their preferred brokerages. Here’s a step-by-step guide to buying IREDA shares:

- Open a Demat Account: Start by opening a Demat account with a depository participant, such as a bank, brokerage firm, or online trading platform. This account will serve as the repository for your IREDA shares.

- Open a Trading Account: Concurrently, establish a trading account with the same institution where you hold your Demat account. This trading account will be used for executing orders on the stock exchange.

- Deposit Funds: Fund your trading account by depositing money through various channels, including Internet banking, UPI, or by issuing a check.

- Place an Order: Log into your trading account and search for IREDA's stock symbol. Identify it using the ticker symbol "IREDA". Proceed to place an order to purchase IREDA shares.

- Settlement: Once your order is executed, the acquired IREDA shares will be automatically transferred to your Demat account. This settlement process typically takes two days after the trading day (T+2).

- Monitor IREDA Share Price: Stay informed about the IREDA share price by regularly checking the stock exchange or utilizing financial data platforms. This monitoring will assist you in making informed decisions about when to sell your IREDA shares based on your investment objectives.

IREDA Financial Performance

IREDA reported a significant 67.15% year-on-year increase in net profit for the December quarter, reaching ₹335.54 crore compared to ₹200.75 crore in the same period last year. Revenue from operations also surged by 44.21% to ₹1,253.20 crore, up from ₹868.98 crore in the corresponding quarter last year. IREDA’s loan book grew to ₹50,579.67 crore, marking a notable 33.50% increase from ₹37,887.69 crore year-on-year.

Past Three Years

Here is a snapshot of the company’s performance over the last three financial years.

| Particulars | Year Ending March 23 | Year Ending March 22 | Year Ending March 21 |

|---|---|---|---|

| Interest Income | 3374 | 2713 | 2564 |

| Interest Expense (Finance Cost) | 2088 | 1587 | 1570 |

| Net Interest Income (NII) | 1285 | 1126 | 994 |

| Expenses | 255 | 453 | 518 |

| PAT | 865 | 634 | 346 |

See Also: Tata Technologies Share Price: How It's Going Since Bumper IPO

Factors Influencing IREDA Share Price

Several factors can impact IREDA’s share price and overall valuation:

- Government Policies: Supportive policies and incentives for renewable energy can significantly benefit IREDA.

- Global Energy Trends: A shift towards renewable energy sources worldwide increases the demand for IREDA’s financing services.

- Technological Advancements: Innovations in green technology can open new opportunities for IREDA-funded projects.

- Market Sentiment: Investors’ growing interest in sustainable and ESG (Environmental, Social, and Governance) investments can boost IREDA’s appeal.

IREDA Share Price History

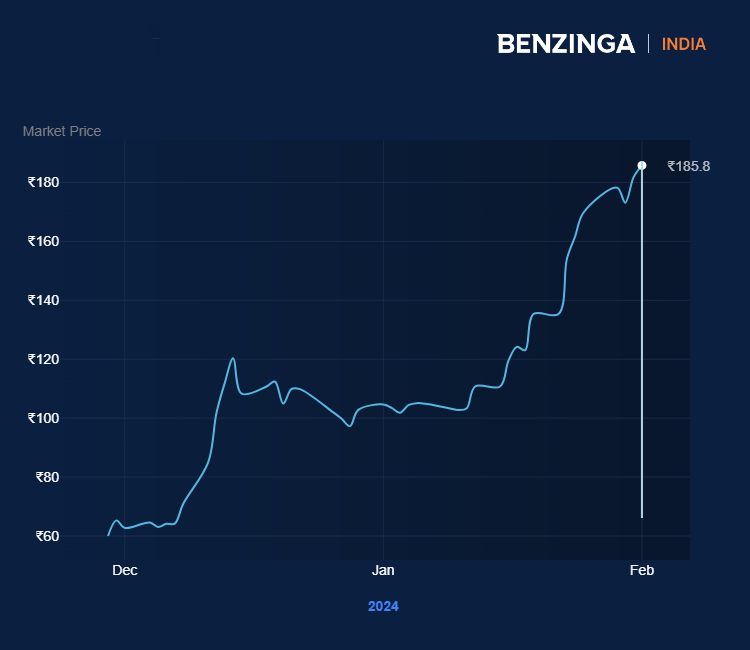

IREDA shares debuted on Indian exchanges on November 29, 2023, with shares opening at ₹60, a 87.5% premium over the issue price of ₹32. Since then, the stock has been going up. The stock is up over 500% from the IPO issue price and over 225% from the listing price.

In just the last 30 days the stock has surged up over 80%.

IREDA Competitors: Alternative Investment Ideas

As the largest pure-play green financing non-banking financial company (NBFC) in India, the company specializes in lending to and investing in activities/projects that contribute to climate risk mitigation, climate adaptation and resilience, and other climate-related or environmental objectives, including biodiversity management and nature-based solutions. So, as such it does not have any direct competition but other power financing NBFCs can be counted as peers of the company.

Compared to other power financing NBFCs, the company stands out due to its exclusive focus on the renewable energy (RE) sector. While competitors like Power Finance Corporation Limited (PFC), REC Limited, India Infradebt Limited, Tata Cleantech Capital Limited, and PTC India Financial Services Limited are engaged in financing power generation, transmission, distribution, and other related activities across various sectors, the company’s sole focus is on supporting the RE sector.

The company has the largest share of credit towards the RE sector among power financing NBFCs, aside from PFC. By concentrating solely on the RE sector, the company aligns itself closely with the growing demand for sustainable and environmentally friendly energy solutions.

Read Next: Is RVNL A Good Buy?

Editor's Note: Artificial intelligence was used as a secondary aid in the writing of this story.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.