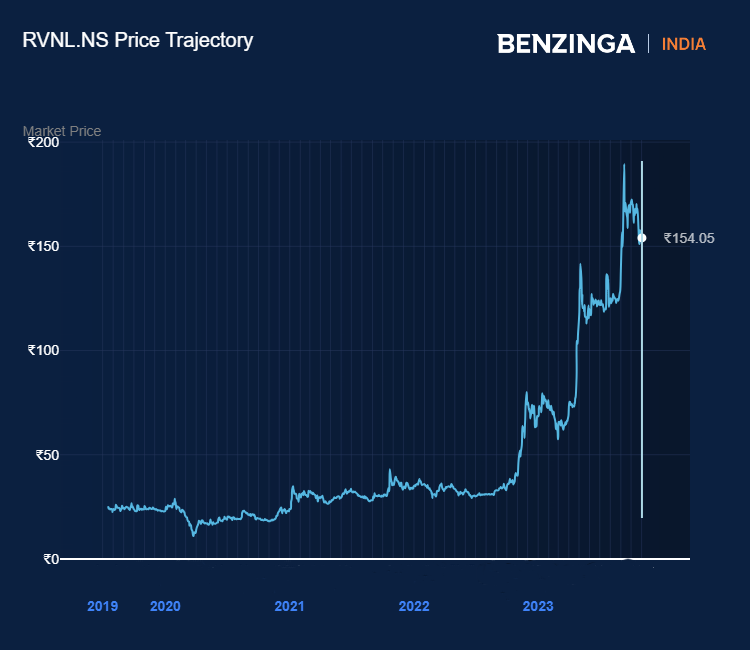

Railway stocks have stolen the spotlight this year. Railway stocks have been on a remarkable bullish run in the stock market this year. Rail Vikas Nigam Ltd (RVNL) has been one of the prominent players in this rally, particularly over the past six months, during which the RVNL share price has surged by nearly 180%. This impressive performance has increased the appeal towards the railway stock.

So with this spike in interest, in this article, we delve deep into RVNL, its history, financials, and the factors that could influence its share price.

RVNL Company History

RVNL was established as a Public Sector Undertaking (PSU) on January 24, 2003, based on the vision set forth by former Prime Minister Atal Bihari Vajpayee. His idea was to address the infrastructure deficit in the Indian Railways, and this vision led to the announcement of the National Rail Vikas Yojana (NRVY) on August 15, 2002, during his address from the Red Fort. The NRVY was officially launched by the Hon’ble Prime Minister on December 26, 2002.

RVNL commenced its operations in 2005, the company specializes in the development, financing, and implementation of rail infrastructure projects. The company earned “Miniratna” status in September 2013. Earlier in the year it was given the “Navratana” status. The title of “Navratna” is an esteemed designation granted by the Government of India to a select group of Central Public Sector Enterprises (CPSEs). Navratna CPSEs represent well-established and profitable companies that wield substantial influence over the Indian economy.

How To Buy RVNL Shares

RVNL is a publicly listed company, so you can easily buy RVNL shares and check the RVNL share price. Here’s a step-by-step guide:

- Open a Demat Account: This account will hold your RVNL shares.

- Open a Trading Account: Used to place orders on the stock exchange.

- Deposit Funds: Fund your trading account through various means.

- Place an Order: Search for RVNL's stock symbol and place an order.

- Settlement: Post-execution, the RVNL shares are transferred to your Demat account.

- Monitor RVNL Share Price: Regularly check the RVNL share price and make decisions accordingly.

See Also: Is IRFC A Good Buy?

RVNL Financials

For the June quarter, Rail Vikas Nigam Limited achieved a 15% year-on-year increase in its consolidated net profits, reaching ₹343 crore compared to ₹297.6 crore booked in the corresponding quarter of the previous year.

Revenue from operations surged by 20% year-on-year, rising to ₹5,571 crore crore from ₹4,640 crore. The earnings per share (EPS) of the increasing from ₹1.43 in the same quarter last year to ₹1.65 during the period under review.

Here’s the financial snapshot of the company over the past three years.

| Year Ending | Revenue | EBITD | EBITD Margin | PAT |

|---|---|---|---|---|

| March 2023 | 20,281.6 | 2,243.2 | 10.54% | 1,420.5 |

| March 2022 | 19,381.7 | 1,983.3 | 9.83% | 1,182.7 |

| March 2021 | 15,403.8 | 1,189.2 | 7.57% | 922.4 |

RVNL Share Price History

Post its listing, RVNL’s share price has remained relatively muted for almost three years. However, in the past year, the stock has really picked up some serious pace.

Factors Affecting RVNL Share Price

- Economic Conditions: RVNL’s performance is significantly impacted by broader economic factors such as economic growth, inflation rates, and the monetary policies adopted by central banks. A robust economic environment with steady growth can lead to increased investment in railway infrastructure, positively affecting RVNL’s project pipeline and revenue. Conversely, high inflation or unfavourable monetary policies may lead to budget constraints and affect the financing of infrastructure projects.

- Government Policies: The regulatory landscape and government policies play a pivotal role in RVNL’s operations. Changes in regulations, budget allocations, and government initiatives for railway infrastructure development can have a profound impact on the company. Government support and funding are essential for the successful execution of RVNL’s projects, making it crucial for the company to align with evolving government policies.

- Infrastructure Development: The progress of major infrastructure projects can significantly influence RVNL’s growth prospects. Initiatives like the India-Middle East-European corridor, which aims to enhance international connectivity, trade, and transportation, can create substantial opportunities for RVNL. By participating in and contributing to such large-scale projects, RVNL can further expand its presence and revenue streams in the infrastructure development sector.

RVNL Outlook

The company’s prospects are flourishing as the railway industry experiences a resurgence in government attention and investment. The company boasts an impressive Return on Equity (ROE) of around 20%, coupled with a sustainable operating margin ranging from 6% to 7%. Over the last five years, RVNL has displayed robust financial performance, with profits compounding at an annual rate exceeding 20% and revenues growing at a steady rate of approximately 22%.

RVNL has a robust order book, which exceeds ₹65,000 crore, reflecting a book-to-bill ratio of approximately 3x. The company’s target is to expand the order book to a range of ₹75,000 crores to ₹1 lakh crore.

Read Next: Is Suzlon A Good Buy?

Disclaimer: Benzinga India doesn’t give financial advice. The above article is for educational purposes alone.

Editor’s Note: AI was used as a secondary aid in the writing of this article.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.