Saregama India Ltd., a renowned music and film production company, holds a significant place in Bollywood's history. With a rich library of music, Saregama has entertained generations of movie enthusiasts. It also released the very popular Saregama Caravan, which provides an evergreen library of top Bollywood songs.

The company generated a lot of buzz last year, as it demerged its e-commerce business. So with all the buzz around, we take a look at the company and bring you all the details you would need if you plan to invest in Saregama shares.

Saregama Company History

Saregama India Ltd., an RP Sanjiv Goenka Group company, holds the distinction of being India’s oldest music label, youngest film studio, and versatile multi-language TV content producer. Since its establishment in 1902, Saregama has played a pivotal role in shaping the music landscape, releasing India’s first-ever studio-recorded song. Over the years, the company has expanded its catalogue to become the largest global owner of both sound recording and publishing copyrights of Indian music in 14 languages.

Diversifying its portfolio, Saregama now holds intellectual property rights for over 4000 hours of TV content produced in Hindi, Tamil, Telugu, Kannada, Malayalam, and Bengali. The company has ventured into music retailing through various mediums, including physical and digital platforms such as CDs, iOS and Android apps, and USB-based thematic music cards. With its headquarters in Kolkata, Saregama also operates offices in Mumbai, Delhi, and Chennai.

A few years back, the company also announced Yoodlee Films, which has produced some thought-provoking cinema in Chaman Bahar and Bahut Hua Samman. The company has adapted well to the digital era by partnering with leading music streaming platforms.

See Also: Tata Technologies Share Price: How It’s Going Since Bumper IPO

How To Buy Saregama Shares

Saregama is a publicly listed company, allowing investors to easily purchase Saregama shares and monitor Saregama share prices. Interested individuals can acquire Saregama shares through their preferred brokerages. Here are the steps you would need to follow to buy Saregama shares:

- Open a Demat Account: Initiate the process by opening a Demat account with a depository participant, such as a bank, brokerage firm, or online trading platform. This account will serve as the repository for your Saregama shares.

- Open a Trading Account: Simultaneously, establish a trading account with the same institution where you hold your Demat account. This trading account will be used for executing orders on the stock exchange.

- Deposit Funds: Fund your trading account by depositing money through various channels, including Internet banking, UPI, or by issuing a check.

- Place an Order: Log into your trading account and search for Saregama’s stock symbol. Identify it using the ticker symbol “SAREGAMA”. Proceed to place an order to purchase Saregama shares.

- Settlement: Once your order is executed, the acquired Saregama shares will be automatically transferred to your Demat account. This settlement process typically takes two days after the trading day (T+2).

- Monitor Saregama Share Price: Stay informed about the Saregama share price by regularly checking the stock exchange or utilizing financial data platforms. This monitoring will assist you in making informed decisions about when to sell your Saregama shares based on your investment objectives.

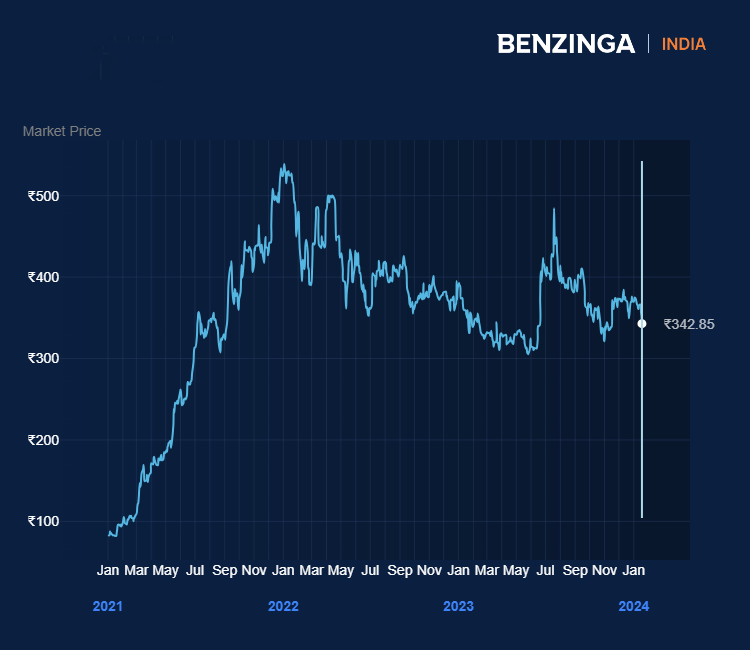

Saregama Share Price History

With a market capitalisation of over ₹6,000 crore is one of the biggest entertainment companies in the country. The stock has also seen a similar rise in recent years, giving multi-bagger returns to investors. From ₹30-₹40 levels in May 2020 to ₹340-₹400 levels in Jan 2024 – an over 1,000% return.

Saregama Financials

In the July-September period, Saregama reported a 6.82% decrease in revenue from operations, amounting to ₹172.35 crore compared to ₹184.98 crore during the same period last year. Despite the decline in revenue, the company witnessed a 2.96% growth in net profit, reaching ₹47.99 crore in the September quarter up from ₹46.61 crore in the corresponding period of the previous year.

Here is a financial snapshot of the company’s performance over the last four years.

| Year Ending | Net Sales (crore) | EBITDA (crore) | Net Profit (crore) | EPS |

|---|---|---|---|---|

| March 2020 | 521.5 | 60.5 | 43.9 | 2.5 |

| March 2021 | 442.0 | 130.1 | 112.6 | 6.5 |

| March 2022 | 580.6 | 187.1 | 152.6 | 7.9 |

| March 2023 | 751.3 | 219.7 | 189.3 | 9.8 |

Factors Affecting Saregama Share Price

The Saregama share price, like any other publicly traded company, is influenced by a variety of factors, both internal and external. Here are some key factors that can affect the share price of Saregama:

- Company Performance: The financial health and operational performance of Saregama are fundamental factors. This includes revenue, profit margins, growth trajectory, and return on investments. Quarterly and annual reports often provide insights into the company’s performance.

- Industry Trends: Being in the music and entertainment industry, Saregama’s share price can be affected by broader industry trends. This includes shifts in consumer preferences, technological advancements, and changes in content consumption patterns (like the shift to streaming services).

- Regulatory Environment: Changes in regulations related to copyright laws, digital streaming, and media content can impact Saregama’s business operations and, consequently, its share price.

- Competition: The competitive landscape in the music and entertainment industry, including the strategies and performance of competitors, can influence Saregama’s market position and share price.

- Technological Advancements: Innovations in technology, particularly in music streaming, digital distribution, and media consumption devices, can have a substantial impact on Saregama’s business model and its stock value.

Saregama Competitors: Alternative Investment Ideas

In the vibrant landscape of Bollywood’s entertainment industry, Saregama India Ltd. stands out as a prominent player, particularly known for its extensive music library and film production. However, the sector is bustling with other noteworthy companies that offer diverse investment opportunities for those interested in the entertainment sector.

One such competitor is Tips Industries Ltd., a major production house with a history of blockbuster movies. Tips Industries has demonstrated its prowess in creating high-quality content, appealing to a broad audience base. Another notable entity is Bodhi Tree Multimedia Ltd., which has carved a niche in television and digital content production. Known for its compelling storytelling, Bodhi Tree has produced popular shows and has shown impressive stock performance.

Prime Focus Ltd. brings a different flavour to the table, specializing in visual entertainment services. Their expertise in post-production and visual effects for both Bollywood and Hollywood films marks them as a key player in the industry. Lastly, Balaji Telefilms Ltd., steered by Ekta Kapoor, has been a dominant force in Indian television and film production, with a rich portfolio of popular TV shows and films.

These companies, each with their unique strengths and market positions, present a dynamic and varied landscape in the Bollywood stock market.

Read Next: Is RVNL A Good Buy?

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.