Ace investor Ashish Kacholia stands out as one of the most distinguished and successful investors on India’s Dalal Street. According to Trendlyne data, Kacholia publicly holds 45 stocks, totaling approximately ₹2,900 crore in combined value. Here’s an overview of five stocks in his portfolio that have delivered multi-bagger returns since the beginning of the year.

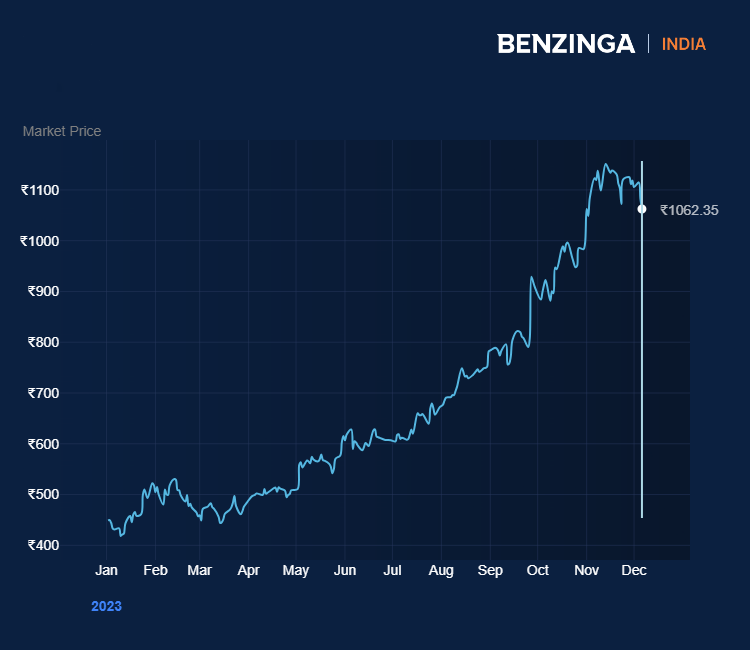

Gravita India

Shares of Gravita India have surged up close to 140% this year. The stock that trades at around ₹450 levels is currently at around ₹1,050 levels. Just last month, the stock hit an all-time high of ₹1,166. Kacholia owns a 2.2% stake in the company that is worth around ₹160 crore.

PCBL

The next on the list is PCBL. The RP-Sanjiv Goenka Group company is one of the largest carbon black manufacturers in India. This year the stock has seen a tremendous rally growing from ₹130 levels to ₹260 levels. Kacholia owns a 1.9% stake in the company that is worth around ₹190 crore.

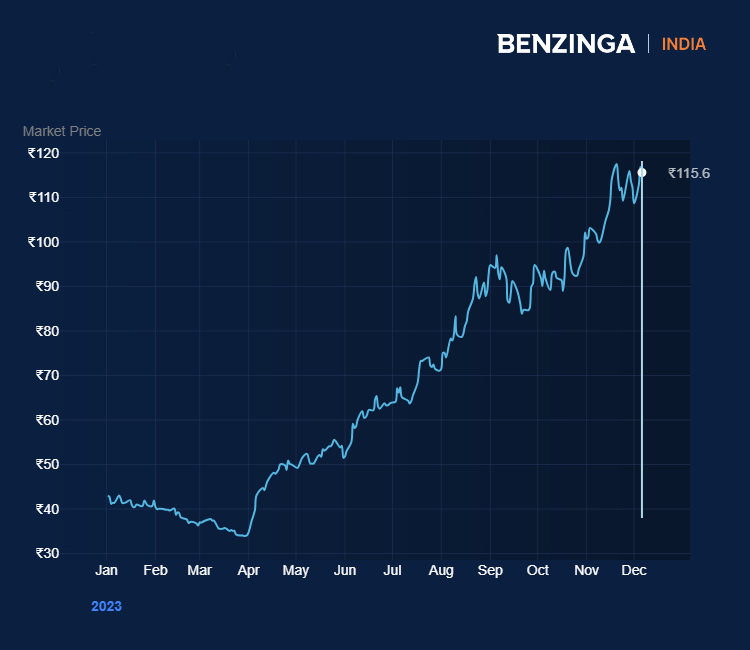

TARC

This small-cap stock has gone up over 170% on a year-to-date basis. Just this month, the stock has surged up close to 18%. Kacholia owns a 2.2% stake in the real estate company that is worth around ₹76 crore.

Garware Hi-Tech Films

Shares of the small-cap company have risen over 100% since the start of the year. One of the leading manufacturers of speciality performance polyester film products, Garware, has seen its stock surge from ₹650 levels to ₹1,500 levels. Kacholia owns a 4.2% stake in the company worth around ₹140 crore.

Aditya Vision

The electronics retailer has had a great couple of years at the bourses. This year, the stock has surged up over 110%. Kacholia who picked up a stake in the small-cap stock during the March quarter owns a 2% stake in the company that is worth around ₹80 crore.

Read Next: 5 Mukul Agrawal Portfolio Stocks That Gave Multibagger Returns This Year

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.