Ace investor Mukul Agrawal is one of the most renowned and successful investors of India’s Dalal Street. As per Trendlyne data, Agrawal publicly holds 53 stocks, amounting to a total combined value of around ₹4,500 crore. Over the years, his investments have gone on to generate incredible returns for investors. Here’s a look at five of his portfolio that gave multibagger returns since the start of the year.

Zen Tech

Shares of Zen Technologies have been on a bull run since the start of the year. From ₹200 levels to the current ₹700, the stock has surged up over 250%. The defence stock also hit a new all-time high of ₹911.40 in August earlier this year. Agrawal owns a 1.3% stake in the company that is worth around ₹83 crore.

De Nora India

Shares of De Nora India have surged over 150% since the start of the year. The stock also hit a new all-time high of ₹2,236.95 in July earlier this year. De Nora India Limited is related to Industrie De Nora, an Italian multinational company. The company has a portfolio of products and systems to optimize the production of chlorine, caustic soda, and derivatives for the Chlor-alkali industry. Agrawal owns a 1.9% stake in the company that is worth around ₹17 crore.

See Also: Tata Tech’s GMP Falling Because Of This Key Factor: Details Here

MPS Ltd

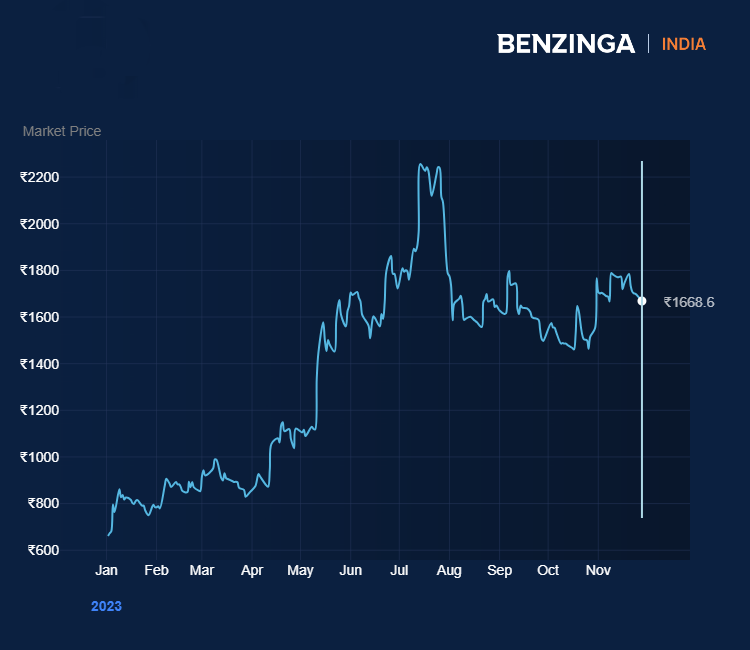

The next multi-bagger on the list is MPS Ltd. The small-cap stock has seen its shares surge from ₹800 levels to ₹1,800 levels this year. Just last week, the stock hit a new all-time high of ₹1,885 on Nov. 21. Agrawal owns a 4.5% stake in the company that is worth around ₹135 crore.

Pearl Global Industries

Shares of Pearl Global have been on a tremendous bull run. Just this year, the stock has surged up over 200%. Started in 1987, Pearl Global is an end-to-end clothing vendor and supplier with a presence across the globe. Agrawal owns a 3.5% stake in the company that is worth around ₹95 crore.

Neuland Laboratories

Neuland Laboratories shares have been on a roll this year. The small-cap stock has surged up over 200% since the start of the year. Just last week, the stock went on to hit a new 52-week high of ₹5,524.30. Agrawal owns a 3.01% stake in the company that is worth around ₹207 crore.

Read Next: Ashish Kacholia-Backed Small Cap Stock Jumps 6% After Announcing ₹3,800 Cr Acquisition

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.