This year, the group of stocks that garnered the most attention and generated significant buzz were railway stocks. Both public and private railway companies saw a surge in their stock prices, driven by the government’s increased focus on Infrastructure.

Indian Railway Finance Corporation (IRFC) has been a subject of keen interest among investors, especially since it emerged as one of the top gainers among railway stocks this year. In this comprehensive guide, we delve deep into the nuances of IRFC stock, offering insights into its history, financial health, share price trends, and all the other details you need to make sure whether you want to jump on its bandwagon.

IRFC Company History

Established in 1986, the Indian Railway Finance Corporation is a dedicated market borrowing arm of the Indian Railways. Its primary role is to finance the acquisition of rolling stock assets and project assets of the Indian Railways and lend to other entities under the Ministry of Railways, Government of India.

The company went public in 2021, in fact, it was the first IPO to be floated that year. The ₹4,633 crore received a strong response from investors. The retail segment was oversubscribed 3.66 times, the Qualified Institutional Buyer (QIB) category was oversubscribed 3.78 times, and non-institutional investors subscribed 2.67 times. The IRFC IPO price band was ₹25-₹26.

How To Buy IRFC Shares

IRFC is a publicly listed company, allowing investors to easily purchase IRFC shares and monitor IRFC share prices. Interested individuals can acquire IRFC shares through their preferred brokerages. Here are the steps you would need to follow to buy IRFC shares:

- Open a Demat Account: Start by opening a Demat account with a depository participant, which can be a bank, a brokerage firm, or an online trading platform. This account will hold your IRFC shares.

- Open a Trading Account: Simultaneously, open a trading account with the same organization where you have your Demat account. This trading account will be used to place orders on the stock exchange.

- Deposit Funds: Fund your trading account by depositing money through Internet banking, UPI, or by issuing a check.

- Place an Order: Log into your trading account and search for IRFC’s stock symbol. You can identify it as “IRFC” or another symbol specific to the company. Place an order to buy IRFC shares.

- Settlement: After your order is executed, the purchased IRFC shares will be automatically transferred to your Demat account. This process typically takes two days after the trade (T+2).

- Monitor IRFC Share Price: Keep a close eye on the IRFC share price by checking the stock exchange or financial data platforms. This will help you decide when to sell your IRFC shares according to your investment goals.

See Also: Is Suzlon A Good Buy?

Factors Affecting IRFC Share Price

The following factors can affect the IRFC share price:

Economic Conditions: IRFC’s share price is influenced by the broader economic environment, including economic growth, inflation, and monetary policies.

Government Policies: As a part of the Indian Railways, IRFC is impacted by regulatory changes, budget allocations, and railway infrastructure enhancement initiatives.

Infrastructure Development: Major projects like the India-Middle East-European corridor can boost IRFC's growth and stock value.

IRFC Financials

During the April-June period, the company’s revenue from operations amounted to ₹6,679.2 crore, marking an 18% increase compared to the ₹5,627.5 crore in revenue it generated in the same period the previous year. However, the company’s profits for the quarter were reported at ₹1,556.6 crore, representing a decrease of approximately 6% from the figures in the year-ago period.

Past Two Years

Here is a financial snapshot of the company’s performance in FY22 and FY23:

| Financial Metrics | FY22 | FY23 | Percentage Change |

|---|---|---|---|

| Revenue from Operations | 20,298.27 | 23,891.28 | +17.68% |

| EBITDA | 20,179.42 | 23,795.37 | +17.89% |

| EBITDA Margin | 99.38% | 99.27% | -0.11% |

| Profit After Tax (PAT) | 6,089.84 | 6,337.01 | +4.05% |

IRFC Share Price History

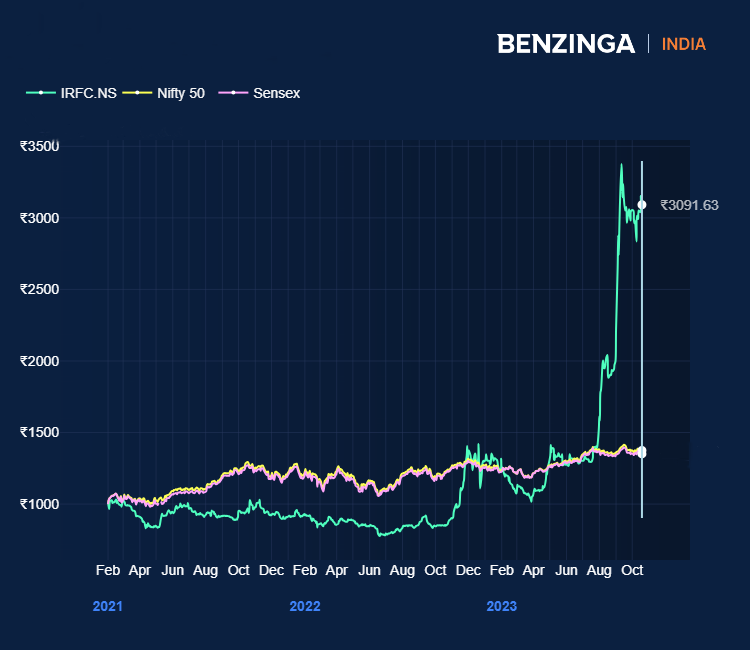

The stock remained relatively mute for almost two years after its listing but has recently embarked on an incredible bull run. Factors such as strategic initiatives, increased investment in the railway sector, and positive market sentiment have contributed to the stock's impressive performance.

As the chart shows the stock has really skyrocketed this year. In the past six months, the stock has surged up over 170%. Now if you are wondering what would have happened if you had invested in the stock two years back

IRFC Shareholding Pattern

As of September 2023, the government still holds the majority share in the stock at around 86%. Mutual funds own about 0.5% stake in the company, whereas FPIs own around 1.11%. The public shareholding in the stock is around 11%.

IRFC Dividend Policy

IRFC has also been consistent with dividend payments. Indian Railway Finance Corporation Ltd. has declared 5 dividends since listing amounting to a total of ₹3.95/share. The latest dividend of ₹0.70/share was handed out in October.

Read Next: Is Olectra Greentech Share A Good Buy?

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.