The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Target Corp TGT

- On March 20, Stifel analyst Mark Astrachan maintained Target with a Hold and lowered the price target from $130 to $120. The company's stock fell around 17% over the past month and has a 52-week low of $101.76.

- RSI Value: 25.5

- TGT Price Action: Shares of Target fell 0.1% to close at $104.06 on Friday.

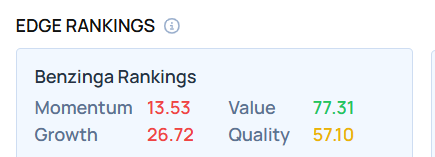

- Edge Stock Ratings: 13.53 Momentum score with Value at 77.31.

TreeHouse Foods Inc THS

- On Feb. 14, the company reported fourth-quarter adjusted earnings per share of 95 cents, missing the street view of 97 cents. Quarterly revenues of $905.70 million (down 0.6% year over year), missed the analyst consensus estimate of 907.716 million. "We closed a challenging 2024 with sequentially improved net sales trends, gross profit margin, and Adjusted EBITDA margin, all of which were in-line with our updated expectations," said Steve Oakland, Chairman, Chief Executive Officer, and President. The company's stock fell around 16% over the past month and has a 52-week low of $26.14.

- RSI Value: 23.6

- THS Price Action: Shares of TreeHouse Foods fell 0.1% to close at $26.35 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in THS stock.

Spectrum Brands Holdings Inc SPB

- On Feb. 6, Spectrum Brands reported quarterly earnings of $1.02 per share, up from 78 cents per share from the same period last year. “We are pleased with the start of the year. The brand-focused investments we started making in 2024, and are continuing to make in 2025, are driving innovation in our products and consumer demand. Our investments in e-commerce are helping us win in what is the fastest growing channel for most of our products,” said David Maura, Chairman and Chief Executive Officer of Spectrum Brands. The company's stock fell around 11% over the past month and has a 52-week low of $68.74.

- RSI Value: 29.3

- SPB Price Action: Shares of Spectrum Brands fell 0.6% to close at $69.67 on Friday.

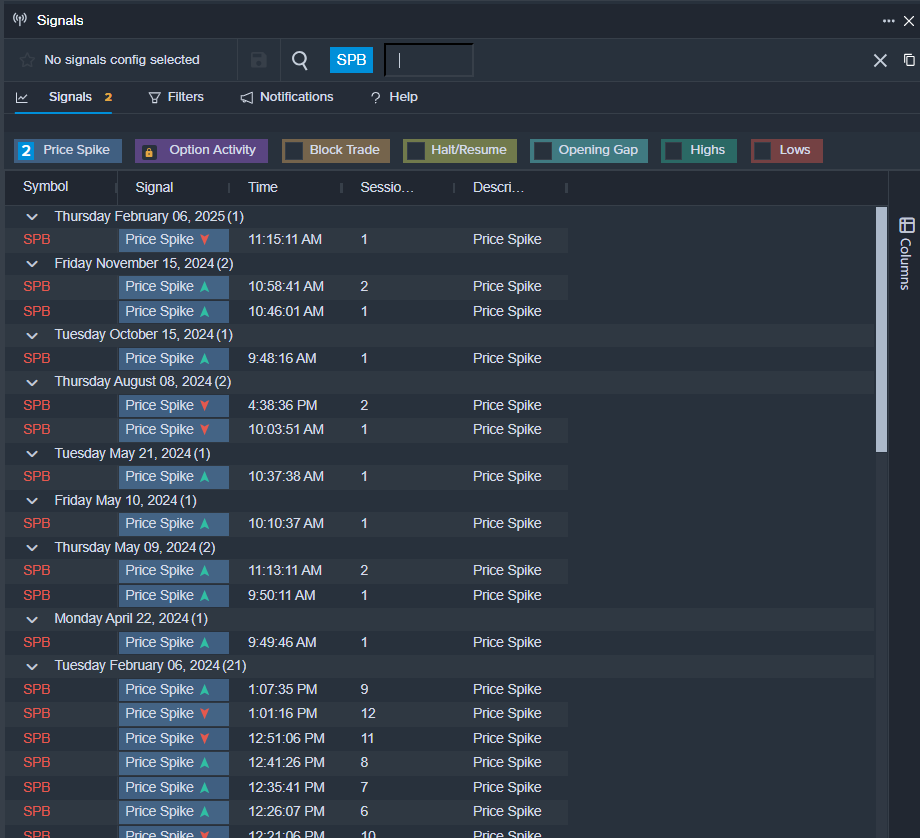

- Benzinga Pro’s signals feature notified of a potential breakout in SPB shares.

Want Edge Stock Rankings on this stock? Become an Edge subscriber here

Read This Next:

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.