Lockheed Martin Corp LMT stock reacted as the company reported its fourth-quarter earnings.

The Bethesda, Maryland-based company delivered an 8.82% surprise in earnings and a 5.03% surprise in revenue. Lockheed’s 2023 backlog reached a record $160.6 billion, and sales increased 2% to $67.6 billion.

F-35 Jets Delay Causes Turbulence In Lockheed Martin Stock

In terms of guidance, Lockheed sees net sales of $68.5 billion-$70 billion and diluted EPS of $25.65-$26.35 for fiscal year 2024. The company also revealed that software issues might cause a delay in the delivery of an upgraded version of its F-35 fighter jets.

This led to a significant drop in the company's stock. Lockheed Martin stock declined by 3.9%, recording the most significant decline in over four months.

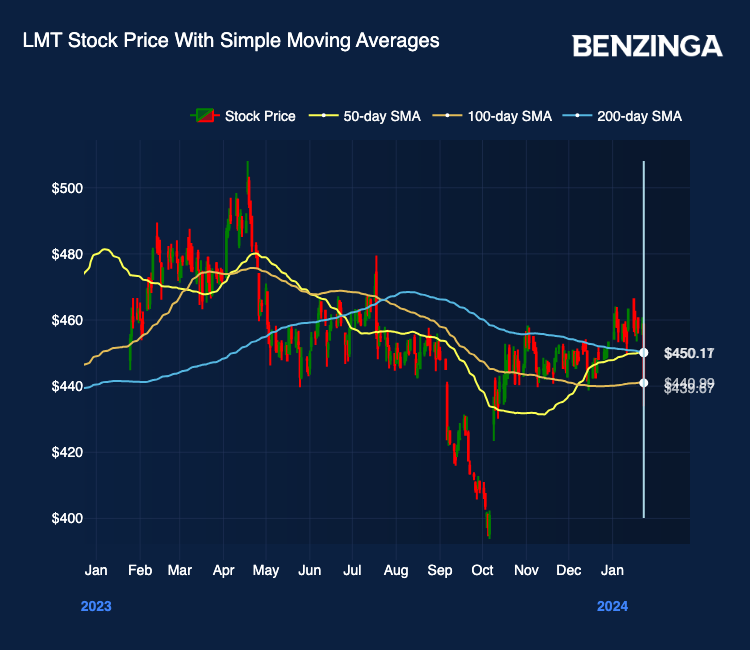

However, while the stock may have hit some turbulence, a technical signal indicates a take-off from here.

Golden Cross Signals Potential Take-Off

The Golden Cross is a technical signal on the chart above. The 50-day SMA for Lockheed Martin stock has crossed above the 200-day SMA indicating a bullishness overriding investor sentiment.

The Golden Cross suggests a potential shift in momentum and indicating that the stock or market may be entering a period of upward trend or positive momentum. Traders and investors may see it as a signal to buy or hold onto a security.

Analysts’ ratings also support this view. Morgan Stanley, JPMorgan and Citigroup have a target price of $510, $481 and $540, respectively on the stock.

Now Read: Lockheed Martin Vs. Raytheon Technologies: Which Is The Better Buy Post Q4 Earnings?

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.