Peloton Interactive, Inc. PTON reported better-than-expected second-quarter financial results on Thursday.

The company's quarterly losses dropped to $30.5 million from $241.1 million compared to the same period last year while its sales rose to $643.6 million, up from $642.1 million a year earlier and exceeding analyst expectations of $630.48 million, according to data from Benzinga Pro

Peloton Interactive shares climbed 35.4% to close at $4.55 on Thursday.

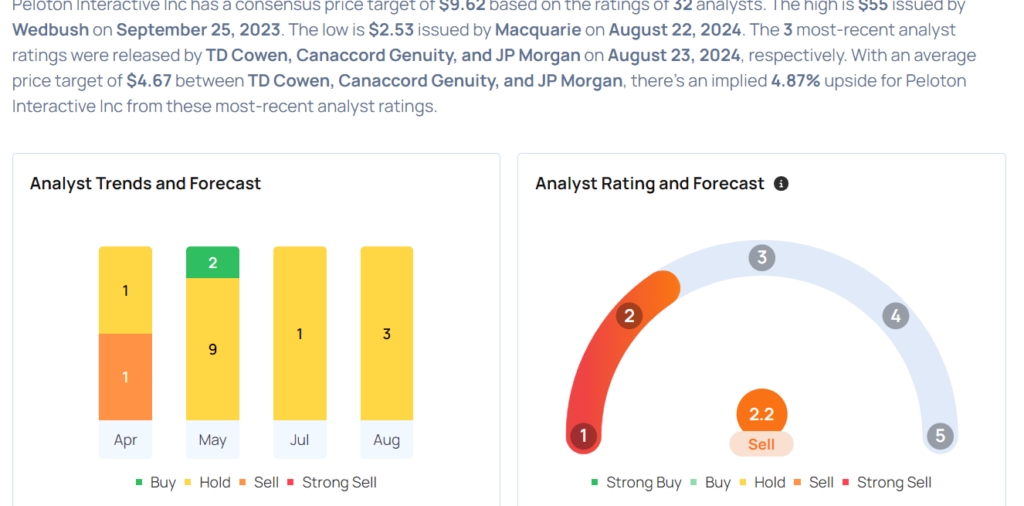

These analysts made changes to their price targets on Peloton Interactive following earnings announcement.

- JP Morgan analyst Doug Anmuth downgraded Peloton Interactive from Overweight to Neutral and lowered the price target from $7 to $5.

- Canaccord Genuity analyst Michael Graham maintained Peloton Interactive with a Hold and raised the price target from $4 to $5.

- TD Cowen analyst John Blackledge maintained Peloton Interactive with a Hold and raised the price target from $3 to $4.

Considering buying PTON stock? Here’s what analysts think:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.