FuboTV Inc FUBO shares are trading higher after the company reported fourth-quarter fiscal 2023 results. Sales grew 28.5% Y/Y to $410.18 million, beating the consensus of $397.8 million.

Adjusted EPS loss of $(0.17) beat the consensus loss of $(0.31).

The company’s gross margin stood at 10%, an 888 bps Y/Y improvement. Also, it witnessed a 662 bps reduction in subscriber-related expenses (SRE) as a percentage of revenue to 86.5% on continued progress in optimizing content costs.

North America Streaming: Revenue grew 29% Y/Y to $401.8 million as paid subscribers grew 12% Y/Y to 1.618 million. Average revenue per user (ARPU) rose 15% Y/Y to $86.65.

Rest of the World Streaming: Revenue was $8.4 million, an 18% Y/Y jump, with a paid subscriber decline of 3% Y/Y.

FuboTV ended the quarter with $251 million in cash, cash equivalents, and restricted cash.

Outlook: FuboTV expects first-quarter revenue of $371.6 million – $383.6 million (versus consensus of $393.6 million) and fiscal 2024 revenue of $1.536 billion – $1.560 billion (versus consensus of $1.624 billion).

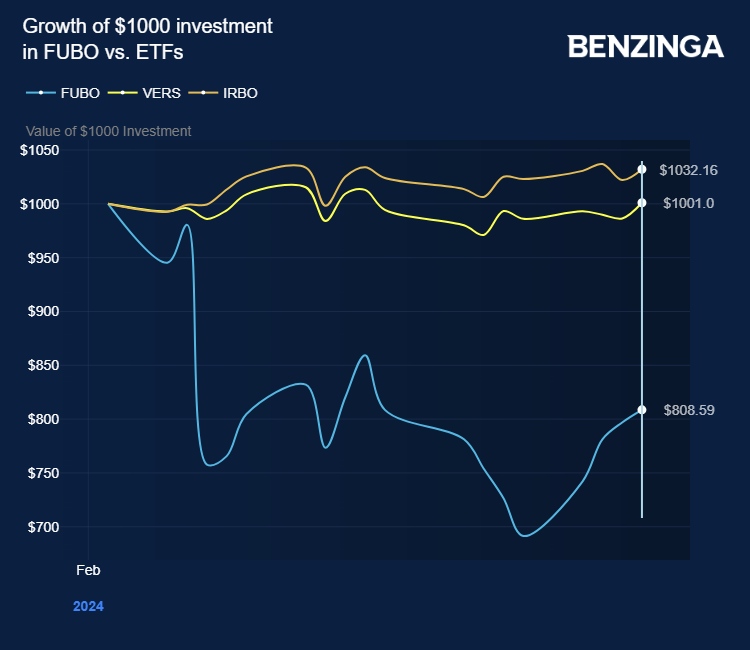

Investors can gain exposure to the stock with ProShares Trust ProShares Metaverse ETF VERS and IShares Robotics And Artificial Intelligence Multisector ETF IRBO, which gained 2.4-3.7% last month.

Price Action: FUBO shares are down 5.6% at $1.95 on the last check Friday.

Photo: courtesy of FuboTv.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.