Robinhood Markets Inc. HOOD is transforming its business model by launching an integrated suite of financial services designed to attract retail investors seeking more sophisticated private banking and investment solutions.

What Happened: The company introduced Robinhood Banking, a comprehensive offering that provides checking and savings accounts with a competitive 4% annual percentage yield and Federal Deposit Insurance Corporation insurance coverage up to $2.5 million through Coastal Community Bank, a subsidiary of Coastal Financial Corp. CCB.

The new service initially targets Robinhood Gold subscribers on early access request, with plans to expand access to all customers. A unique feature includes on-demand cash delivery, allowing customers to receive cash directly at their doorsteps, subject to geographic limitations.

Beyond traditional banking, Robinhood is expanding its investment ecosystem with two groundbreaking platforms. Robinhood Strategies offers personalized investment portfolios combining exchange-traded funds and individual stocks, while Robinhood Cortex leverages artificial intelligence to provide real-time market analysis and insights.

Why It Matters: Steph Guild, Senior Director, Investment Strategy, Robinhood Financial, emphasized the company’s strategic positioning. “We’re addressing a critical gap in wealth management,” Guild said, positioning the service between expensive traditional advisors and generic robo-advisors.

The AI-powered platform will deliver personalized portfolio displays and tailored investment recommendations through written and audio messages.

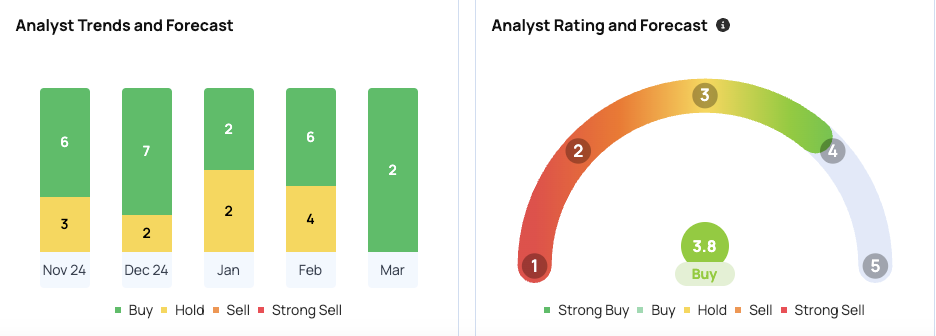

Analyst sentiment remains cautiously optimistic. The company’s consensus price target stands at $59.53, with Morgan Stanley’s high estimate of $90 and Barclays’ low at $11. Recent analyst ratings from Compass Point, Deutsche Bank, and Keefe, Bruyette & Woods suggest a potential 39.59% upside for Robinhood.

Price Action: Robinhood closed at $44.73 on Wednesday, down 7.10%, and fell 2.84% after hours to $43.46. The stock is up 13.41% year-to-date and 123.54% over the past year.

According to the Benzinga Edge ranking, Robinhood has high growth and momentum and is expected to continue on an upward trajectory in the medium and long term. For deeper insights, sign up for Benzinga Edge.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.