After Block Inc. XYZ became the first U.S. firm to use Nvidia Corp.’s NVDA new artificial intelligence clusters, its CEO and founder, Jack Dorsey said that he expects it to be 30 times more powerful as compared to current implementations.

What Happened: Leveraging tens of thousands of GB200 Superchips, Nvidia’s DGX SuperPOD with GB200 systems delivers the computational power needed to train and run state-of-the-art AI models with trillions of parameters.

Dorsey's Block became the first North American company to deploy this cluster for AI research. Following its “codename goose” AI framework launch, this move reinforces Block’s commitment to AI innovation.

Thanking the Jensen Huang-led chipmaker, Dorsey in an X post said that he expects the training and research on these new systems to be 30 times more powerful than any existing system.

To advance open-source generative AI research and training, particularly in underexplored areas, Block will deploy resources in an Equinix Inc. EQIX data center.

Why It Matters: CTO Dhanji R. Prasanna highlighted the company’s focus on groundbreaking AI solutions, aiming to level the playing field for customers through novel approaches.

The Grace Blackwell-powered DGX SuperPOD, known for its ability to accelerate AI innovation, will enable Block’s engineering teams to train larger, more advanced models.

This move builds upon Block’s prior AI initiatives, which have included deepfake detection and hyper-realistic generated audio, further solidifying its dedication to pushing the boundaries of AI technology.

Price Action: Shares of Block were 35.56% on a year-to-date basis and rose 1.1% to $55.90 on Wednesday. It also fell 34.79% over the last year.

In premarket on Thursday, the stock dropped 0.54%.

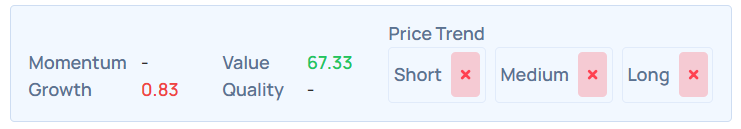

According to Benzinga Edge Rankings, XYZ's value remains healthy with a poor price trend in the short, medium and long term. Its growth rankings, measuring historical expansion in earnings and revenue, were also low.

Its consensus price target was $91.22 based on the 44 analysts tracked by Benzinga with a ‘buy' rating. The price targets ranged from a low of $46 to a high of $120. The three latest ratings from Macquarie, Seaport Global, and Piper Sandler averaged at $98.67, implying a 77.33% upside.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.