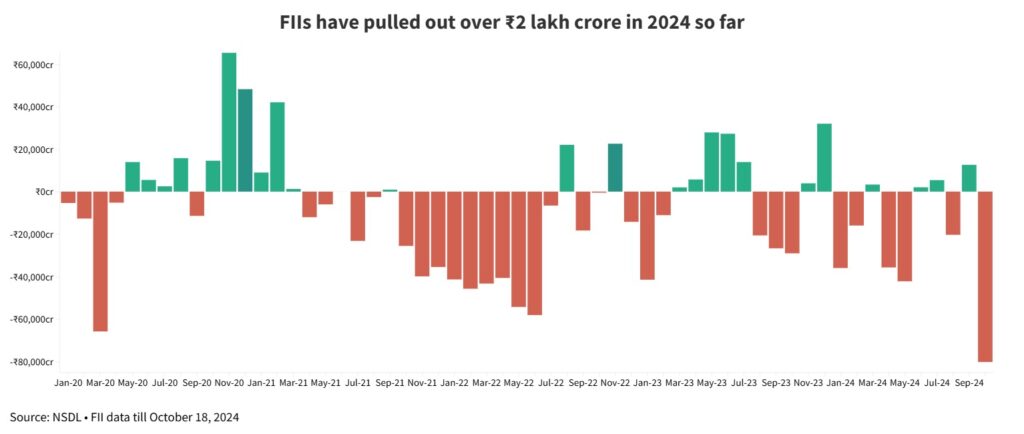

Foreign institutional investors (FII) have pulled out over ₹80,000 crore from the Indian equity markets in October so far, making it the worst monthly outflow since the outbreak of the COVID-19 pandemic.

What Happened: FIIs have sold Indian equities worth ₹80,218 crore in October so far, coinciding with a rally in Chinese stocks as well as growing tensions in the Middle East.

According to data from NSDL, FIIs sold Indian equities worth ₹65,817 crore in March 2020, when the COVID-19 pandemic was at its peak during the first wave.

The second worst month since then was June 2022, when FIIs offloaded equities worth ₹58,112 crore amid growing fears of recession and rising inflation.

However, October has eclipsed March 2020 as the worst month for Indian equities in terms of FII flows since the pandemic broke out in 2020.

For context, the benchmark Nifty50 index has fallen by 3.7% in October so far.

Overall, in the calendar year 2024, FIIs have sold Indian equities worth over ₹2 lakh crore. During this period, the Nifty50 index has gained 14.36%.

DIIs To The Rescue: While FII flows have been volatile in 2024 so far – they were positive for four months, and negative in the other six – domestic institutional investors (DII) have strongly backed Indian equities.

According to NSDL data, DIIs have plowed in ₹4,15,681 crore in Indian equities this year to date. DIIs have also been net buyers every month this year, in stark contrast to the volatile FII flows.

However, Deepak Jasani, Head of Retail Research at HDFC Securities, says that Nifty50 has slipped into a weak zone. "This could be a precursor to a sharp fall in Nifty. A breach of 24694 could take the Nifty down to 24367, while 24920 could be a resistance on the up move," he said.

Read Next: Infosys Shares Slump 4% As Q2 Profit Misses Estimates, But Brokerages Remain Bullish

Photo courtesy: Unsplash

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.