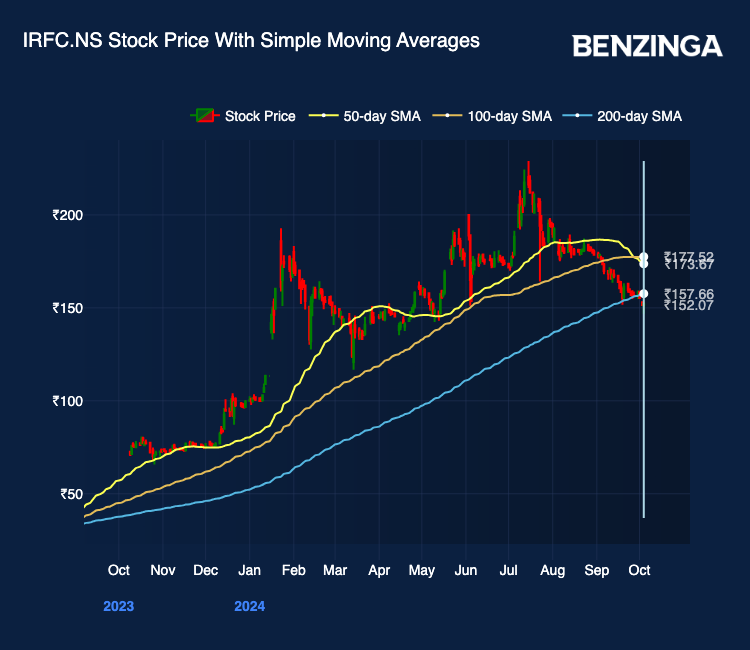

IRFC‘s share tanked on Monday, going down over 5% to hit an intraday low of ₹143.20. The stock has sunk around 14% in the last 30 days.

What Happened: While the reason behind the sharp fall today is not immediately clear, it comes as several other public sector stocks such as HAL, RVNL and IRCON are feeling pressure at the bourses. IRFC shares have remained under pressure for the past few months. In the last 10 sessions, the stock has closed in the red on eight occasions.

What Are Analysts Saying: “IRFC is currently trading near a major support level of ₹120 and minor support at ₹140, said Riyank Arora, technical analyst, Mehta Equities. He added that the stock shows potential for a rebound from these levels, with upside targets in the range of ₹160-₹165.

See Also: Reliance Extends Decline After Worst Ever Week Since 2021

“A successful bounce from support could signal renewed bullish momentum. However, a breakdown below Rs 120 may indicate further downside risk. Investors are advised to monitor these key levels closely,” the analyst added.

“Indian Railway Finance Corporation (IRFC) has shown a bearish flag breakdown, signalling further downside potential. Recently, it also breached the critical swing low of ₹150.6, reinforcing a bearish outlook. Since Budget Day, experts have consistently recommended a sell strategy for IRFC, said Anshul Jain head of research at Lakshmishree.

Jain thinks that even at current levels the stock still remains a strong sell opportunity. “Given the prevailing technical indicators, the stock is expected to decline further, with potential downside targets of ₹109 and ₹92 in the next two-three months. Investors are advised to act cautiously and review their positions, as the market appears unfavourable for IRFC in the near term,” Jain added.

Price Action: IRFC’s share price was down 4.92% to trade at ₹144.59 on Monday afternoon.

Read Next: Defence Q2 Preview: What To Expect From BEL, HAL, Mazdock And Cochin Shipyard’s Earnings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.