MakeMyTrip Limited is one of the if not the most popular online travel platforms in India. The online travel company provides a comprehensive range of travel services, including flight bookings, hotel reservations, holiday packages and car rentals.

Established in 2000, MakeMyTrip launched its India website back in 2005. It was listed on the NASDAQ in 2010. Deep Kalra is the founder of the company and currently serves as the chairman. In this article, we look at the stock and how can you invest in the company from India.

MakeMyTrip Fundamentals

Before investing in MMYT stock, one of the most important things you should take note of is the company’s financial performance. MakeMyTrip reported a 12.9% year-on-year (YoY) increase in net profit, reaching $21.0 million (around ₹174 crore) for the quarter that ended on June 30, 2024.

The company’s revenue grew by 31.4% YoY in constant currency, rising to $254.5 million (around ₹2,108 crore) in Q1FY25 from $196.7 million (around ₹1626.8 crore) in Q1FY24.

Past Three Years

| Metric | FY24 | FY23 | FY22 |

|---|---|---|---|

| Revenue | ₹ 6054.85 | ₹ 4651.32 | ₹ 2372.97 |

| Profit | ₹ 1799.44 | ₹ -93.79 | ₹ -376.82 |

From FY22 to FY24, the company’s financial performance has shown significant improvement across key metrics. Revenue increased steadily from ₹2,372.97 crore in FY22 to ₹4,651.32 crore in FY23 and further surged to ₹6,054.85 crore in FY24, reflecting strong top-line growth. The company achieved a compound annual growth rate of around 69%.

Profitability also improved dramatically, transitioning from a loss of ₹376.82 crore in FY22 and ₹93.79 crore in FY23 to a substantial profit of ₹1,799.44 crore in FY24.

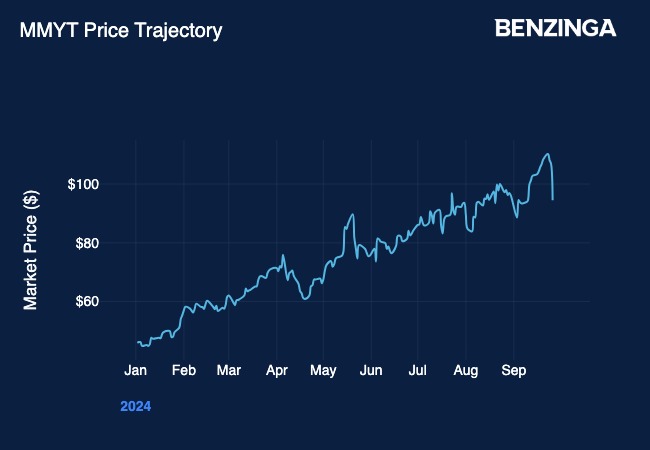

MMYT Stock Price Performance

The MMYT stock price has been on a strong bull run at the bourses. Since the start of the year, the MMYT stock price has surged up over 100%.

Factors Affecting MMYT Stock Price

The MMYT stock price is influenced by various factors, both internal to the company and external market forces. Understanding these factors can help investors make informed decisions when buying or selling MakeMyTrip shares.

1. Company Performance

One of the most direct influences on the MMYT stock price is the company’s financial performance. This includes quarterly earnings reports, revenue growth, profitability, and guidance for future performance. Strong earnings results or upward revisions in growth forecasts often lead to an increase in stock price, while disappointing results can cause a decline.

2. Travel Industry Trends

MakeMyTrip operates in the travel and tourism sector, so the MMYT stock price is sensitive to industry trends. Factors such as changes in consumer travel behaviour, seasonal fluctuations in bookings, and the overall health of the tourism industry directly impact the MMYT stock price. For example, during periods of high travel demand, such as holiday seasons or post-pandemic travel recovery, the company may see an increase in bookings, boosting investor confidence.

3. Global and Economic Conditions

Broader economic conditions, both in India and globally, can affect the MMYT stock price. Economic slowdowns, inflation, currency exchange rates, and fuel prices (which affect airline costs) can influence consumer spending on travel. In times of economic uncertainty, people may reduce discretionary spending, including travel, which can negatively affect MakeMyTrip’s revenues and, consequently, its stock price.

4. Regulatory Changes and Government Policies

Changes in regulations, such as new tax laws, visa restrictions, or government policies related to tourism, can significantly impact MMYT’s stock price. For example, stricter travel restrictions or new taxes on travel-related services could reduce bookings, negatively affecting the stock price.

5. Competitor Activity

Competition within the online travel industry can also influence MMYT’s stock price. The emergence of new competitors, price wars, or mergers and acquisitions in the industry can shift market dynamics. If competitors gain market share or introduce innovative offerings, it could impact MakeMyTrip’s revenue and market position, thus affecting its stock price.

6. Foreign Exchange Rates

Since MakeMyTrip is listed on NASDAQ and earns a significant portion of its revenue in Indian Rupees (INR), fluctuations in the INR to USD exchange rate can impact the company's profitability and stock price. A stronger dollar can make foreign earnings appear lower, negatively affecting investor sentiment.

By keeping an eye on these factors and their impact on the MMYT stock price, investors can better predict market movements and make more strategic investment decisions.

Investing in MMYT Shares from India

Setting Up a Foreign Trading Account

The first step to investing in MMYT shares from India is to open an overseas trading account. Some well-regarded brokerage firms in India that offer access to international markets include:

- HDFC Securities: A leading brokerage firm in India that provides trading access to global stock exchanges, including MMYT.

- Kotak Securities: A reputable brokerage firm that enables investors to trade in international stocks, including MMYT.

- ICICI Direct: ICICI Direct offers a variety of investment options, including services for international stock trading, making it easy to invest in MMYT.

Select a brokerage firm that meets your needs, offers competitive fees, and provides an intuitive trading platform. Follow the brokerage firm's instructions and provide the necessary documentation to open your demat account.

Understanding the Tax and Fee Structure for Investing in MMYT Shares

Investing in foreign stocks like MMYT involves various fees and taxes beyond just the cost of the actual MMYT stock price. Here are the charges and taxes you will need to account for:

- Tax Collected at Source (TCS): Under the RBI’s Liberalised Remittance Scheme (LRS), a 5% TCS is imposed on all remittances exceeding ₹7 lakh. This tax is applicable only to the amount exceeding ₹7 lakh. However, under the Finance Act 2023, changes have been made to increase this tax. From July 1, 2023, a 20% TCS will apply to the entire investment amount, as the ₹7 lakh threshold has been removed. For instance, if you invest ₹12 lakh after June 30, TCS will be charged on the entire ₹12 lakh, not just the amount exceeding ₹7 lakh.

- Capital Gains & Dividend Tax: Dividends from U.S. stocks, including MMYT, are subject to a 25% tax rate for Indian citizens. However, the Double Tax Avoidance Agreement (DTAA) allows investors to receive a tax credit for taxes paid abroad, ensuring they are not taxed twice on the same income. You will also need to pay taxes on capital gains in India based on the holding period.

- Brokerage Fees: Brokerage firms impose fees for buying and selling foreign shares, including MMYT. These fees vary by broker and are typically higher for international stock transactions than for domestic stocks.

- Bank Charges: Banks charge fees for foreign exchange conversion and fund transfers. Additionally, there may be one-time account setup fees. Banking charges usually range between 4% and 5% of the total investment amount, including commission and GST.

- Foreign Exchange Rate: The foreign exchange rate at the time of purchase or withdrawal can impact the cost and the number of shares allocated.

Given these factors, investing in MMYT stock from India involves several costs. It's essential to conduct thorough research and consider all fees and taxes before proceeding. Additionally, under the LRS, Indian citizens can remit up to $250,000 (approximately ₹2 crore) per financial year for investments abroad.

Once you've purchased the MMYT stock, it’s vital to monitor your investment regularly. Stay updated on financial performance, news, and market trends that could affect the MMYT stock price. You can check the MMYT stock price any time using your trading platform or even a simple Google search for MMYT stock price will get you the desired result.

Read Next: How To Compare Mutual Funds?

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.