Ola Electric‘s share price has had a rollercoaster ride at the bourses ever since it listed in August. The stock still trades around 46% higher than its IPO issue price of ₹76.

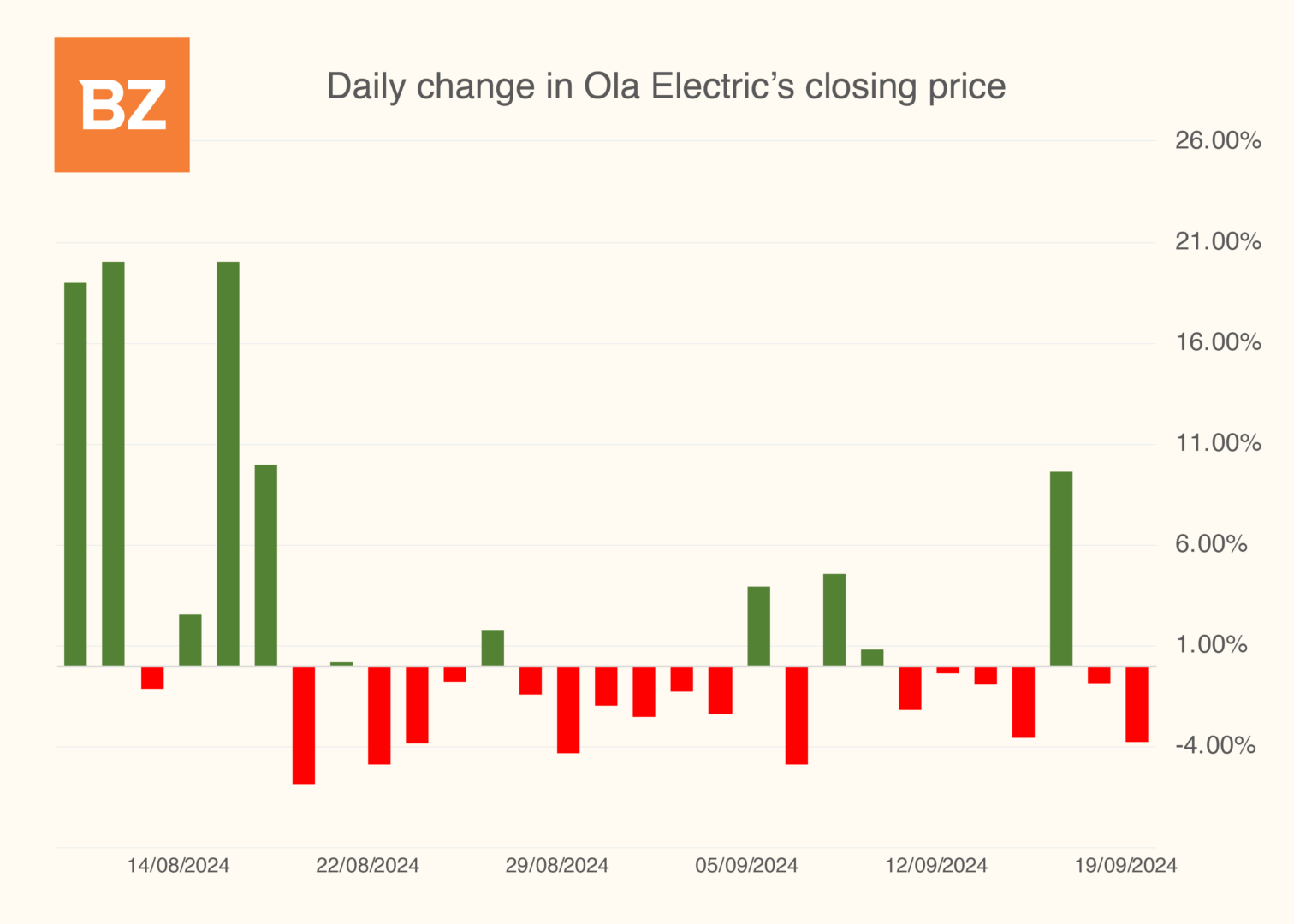

What Happened: An analysis of the stock’s daily trading data shows that the stock has closed in the red on most occasions since it was listed on August 9. In total, the stock has been listed for a total of 28 trading days, out of which it has closed in the red on 17 occasions.

The electric vehicle maker has been getting glowing recommendations from brokerages.

HSBC, Goldman Sachs and BofA Securities all are bullish on the electric two-wheeler market leader. BofA initiated coverage with a "buy" call and a target price of ₹145, while Goldman Sachs initiated coverage on the stock with a "buy" call and a target price of ₹160.

Goldman Sachs’ bull case target price is ₹230. HSBC initiated coverage of the stock with a “buy” recommendation and a target price of ₹140.

On the other hand, analysts at Ambit Capital, began their coverage of the stock with a “sell” call and a price target of ₹99.60.

Price Action: Ola Electric’s share price was down 5.94% to trade at ₹110 in the afternoon hours of trading on Thursday.

Read Next: Bajaj Housing Finance Slumps 10% Giving Up Gains From Blockbuster Listing

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.