On Sunday evening, Benzinga asked its followers on Twitter what stock they’re buying at the open on Monday. From the replies, Benzinga selected one ticker for technical analysis.

@kukovisuals, @JasonWe80277557, @FlatTrading and @pvvardhanreddy are buying Tilray, Inc TLRY.

On Friday, President Joe Biden announced he intends to nominate Robert Califf as the new Food and Drug Administration (FDA) commissioner. Califf, who briefly headed the FDA under the Obama administration, has previously said he prescribed a cannabinoid drug as a doctor and has acknowledged the potential medical benefits of cannabis.

The announcement coincided with a typically bullish season in the cannabis sector and last week many individual names such as the cannabis space leader Canopy Growth Corporation CGC reversed into an uptrend and broke through a key resistance level near the $15 mark.

Tilray, a Canadian-based cannabis giant, also broke up bullishly from a pattern and bust through a resistance area at the $12.54 level, which indicates a larger run north may be in the cards.

See Also: Some Cannabis Companies Are Prepping for a Possible Next Wave of Legislative Change

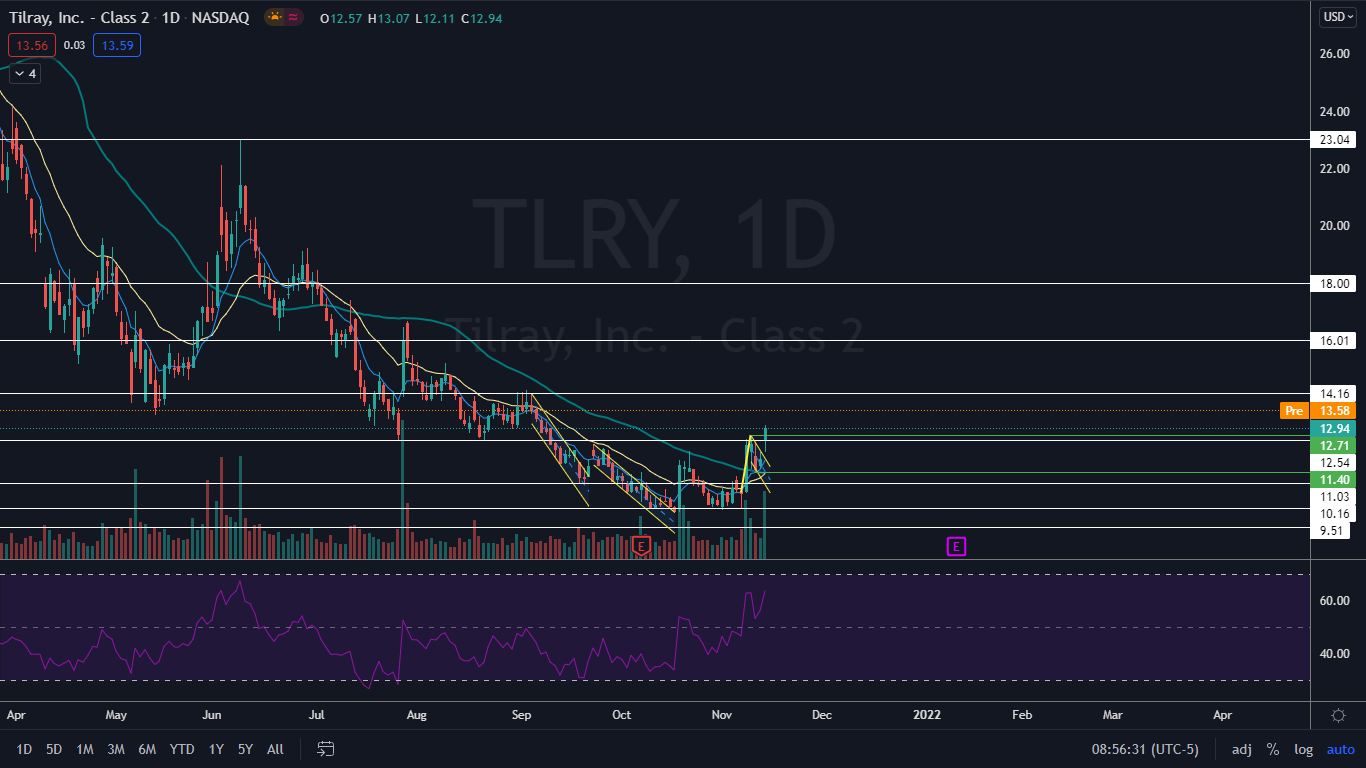

The Tilray Chart: On Friday, Tilray broke up bullishly from a bull flag pattern on the daily chart. The stock had created the pole of the pattern on Nov. 8 and consolidated into the flag formation between Nov. 9 and Nov. 11. For technical traders, the bull flag was confirmed when Tilray broke up from the flag on massive volume where 56.2 million shares exchanged hands over the course of the day compared to the 10-day average of 2.28 million.

Tilray also confirmed it had reversed into an uptrend on Friday by creating a higher high above the Nov. 9 high of $12.71. The most recent higher low is at the $11.40 mark and although Tilray will need to eventually print another higher low it must remain above the level to continue in the trend.

In the premarket on Monday, it appeared Tilray would gap up about 5% higher at the market open. Traders will want to watch to see if the gap is filled immediately or whether sustained big bullish volume drives it up higher. Gaps are filled about 90% of the time so it's likely Tilray will fall down to fill the gap at some point in the future.

Tilray is trading above the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending above the 21-day, both of which are bullish indicators. The stock is also trading above the 50-day simple moving average, which indicates longer-term sentiment is bullish.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial

- Bulls want to see big bullish volume come in and push Tilray firmly up over a resistance level at $14.16, while keeping in mind the lower gap may cause selling pressure. Above the level, there is further resistance at $16 and $18.

- Bears want to see big bearish volume come in and drop Tilray down below the $11.40 level to negate the uptrend. The stock has support at $12.54, $11.03 and $10.16.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!