Investors with significant funds have taken a bearish position in Stryker SYK, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in SYK usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 11 options transactions for Stryker. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 36% being bullish and 54% bearish. Of all the options we discovered, 10 are puts, valued at $366,700, and there was a single call, worth $36,890.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $360.0 and $380.0 for Stryker, spanning the last three months.

Analyzing Volume & Open Interest

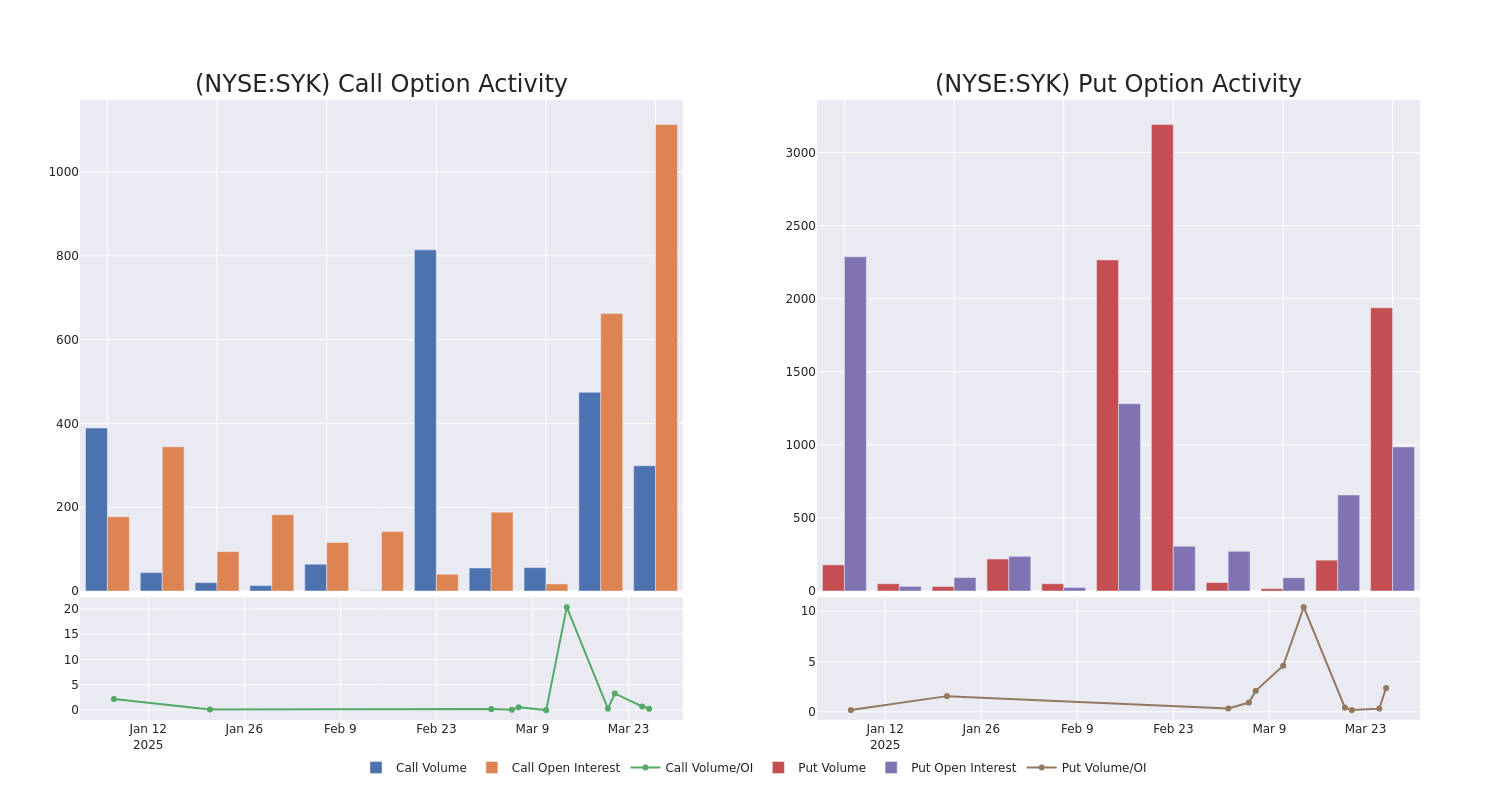

In today's trading context, the average open interest for options of Stryker stands at 699.67, with a total volume reaching 2,237.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Stryker, situated within the strike price corridor from $360.0 to $380.0, throughout the last 30 days.

Stryker Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SYK | PUT | TRADE | BEARISH | 04/17/25 | $9.8 | $9.6 | $9.8 | $370.00 | $44.1K | 888 | 87 |

| SYK | PUT | TRADE | BEARISH | 04/17/25 | $10.5 | $8.6 | $9.8 | $370.00 | $44.1K | 888 | 47 |

| SYK | PUT | TRADE | BEARISH | 04/17/25 | $10.4 | $8.7 | $9.8 | $370.00 | $39.2K | 888 | 87 |

| SYK | PUT | TRADE | BULLISH | 04/17/25 | $11.4 | $7.0 | $8.7 | $370.00 | $37.4K | 888 | 193 |

| SYK | CALL | TRADE | BULLISH | 04/17/25 | $3.1 | $3.0 | $3.1 | $380.00 | $36.8K | 1.1K | 299 |

About Stryker

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, extremities, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and orthopedic robotics. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Roughly one fourth of Stryker's total revenue currently comes from outside the United States.

In light of the recent options history for Stryker, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Stryker's Current Market Status

- Currently trading with a volume of 1,657,485, the SYK's price is down by -1.37%, now at $367.77.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 34 days.

Professional Analyst Ratings for Stryker

2 market experts have recently issued ratings for this stock, with a consensus target price of $446.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $442. * In a cautious move, an analyst from Citigroup downgraded its rating to Buy, setting a price target of $450.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Stryker with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.