Ratings for Pfizer PFE were provided by 6 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

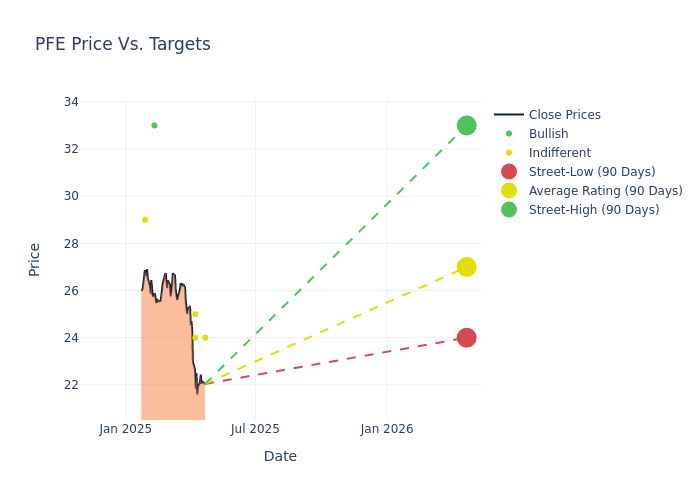

The 12-month price targets, analyzed by analysts, offer insights with an average target of $27.17, a high estimate of $33.00, and a low estimate of $24.00. Observing a downward trend, the current average is 10.62% lower than the prior average price target of $30.40.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Pfizer by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Carter Gould |Cantor Fitzgerald |Announces |Neutral | $24.00|- | |Trung Huynh |UBS |Lowers |Neutral | $24.00|$28.00 | |Asad Haider |Goldman Sachs |Lowers |Neutral | $25.00|$32.00 | |Vamil Divan |Guggenheim |Maintains |Buy | $33.00|$33.00 | |Colin Bristow |UBS |Lowers |Neutral | $28.00|$29.00 | |Andrew Baum |Citigroup |Lowers |Neutral | $29.00|$30.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Pfizer. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Pfizer compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Pfizer's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Pfizer's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Pfizer analyst ratings.

Discovering Pfizer: A Closer Look

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding covid-19-related product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Pfizer: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Over the 3M period, Pfizer showcased positive performance, achieving a revenue growth rate of 21.93% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Pfizer's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 2.31%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Pfizer's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.45%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Pfizer's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.19%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.72, Pfizer adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|