Providing a diverse range of perspectives from bullish to bearish, 14 analysts have published ratings on Eaton Corp ETN in the last three months.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 5 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 2 | 2 | 0 | 0 |

| 2M Ago | 0 | 1 | 3 | 0 | 0 |

| 3M Ago | 1 | 2 | 1 | 0 | 0 |

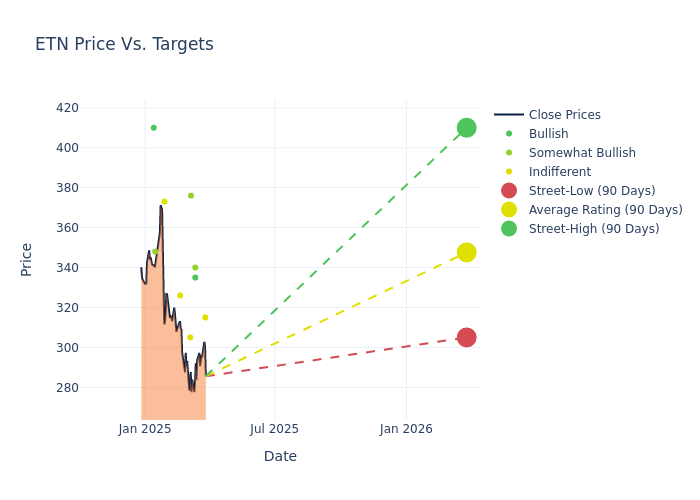

The 12-month price targets, analyzed by analysts, offer insights with an average target of $352.5, a high estimate of $410.00, and a low estimate of $305.00. A 5.5% drop is evident in the current average compared to the previous average price target of $373.00.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Eaton Corp by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Lowers | Equal-Weight | $315.00 | $325.00 |

| Jeffrey Hammond | Keybanc | Announces | Overweight | $340.00 | - |

| Stephen Volkmann | Jefferies | Lowers | Buy | $335.00 | $390.00 |

| Deane Dray | RBC Capital | Lowers | Outperform | $376.00 | $405.00 |

| Joseph O'Dea | Wells Fargo | Lowers | Equal-Weight | $305.00 | $335.00 |

| Julian Mitchell | Barclays | Lowers | Equal-Weight | $325.00 | $353.00 |

| David Raso | Evercore ISI Group | Lowers | In-Line | $326.00 | $382.00 |

| Deane Dray | RBC Capital | Lowers | Outperform | $405.00 | $407.00 |

| Joseph O'Dea | Wells Fargo | Lowers | Equal-Weight | $335.00 | $350.00 |

| Scott Davis | Melius Research | Announces | Hold | $373.00 | - |

| Stephen Tusa | JP Morgan | Lowers | Overweight | $348.00 | $350.00 |

| Andrew Kaplowitz | Citigroup | Lowers | Buy | $410.00 | $440.00 |

| Joseph O'Dea | Wells Fargo | Lowers | Equal-Weight | $350.00 | $365.00 |

| Deane Dray | RBC Capital | Raises | Outperform | $392.00 | $374.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Eaton Corp. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Eaton Corp compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Eaton Corp's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Eaton Corp's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Eaton Corp analyst ratings.

All You Need to Know About Eaton Corp

Founded in 1911 by Joseph Eaton, the eponymous company began by selling truck axles in New Jersey. Eaton has since become an industrial powerhouse largely through acquisitions in various end markets. Eaton's portfolio can broadly be divided into two parts: its electrical and industrial businesses. Its electrical portfolio (representing around 70% of company revenue) sells components within data centers, utilities, and commercial and residential buildings, while its industrial business (30% of revenue) sells components within commercial and passenger vehicles and aircraft. Eaton receives favorable tax treatment as a domiciliary of Ireland, but it generates over half of its revenue within the US.

Key Indicators: Eaton Corp's Financial Health

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Eaton Corp displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 4.58%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Eaton Corp's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 15.56%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Eaton Corp's ROE stands out, surpassing industry averages. With an impressive ROE of 5.16%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Eaton Corp's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.5% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Eaton Corp's debt-to-equity ratio is below the industry average. With a ratio of 0.53, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|