Dover DOV underwent analysis by 10 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 4 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

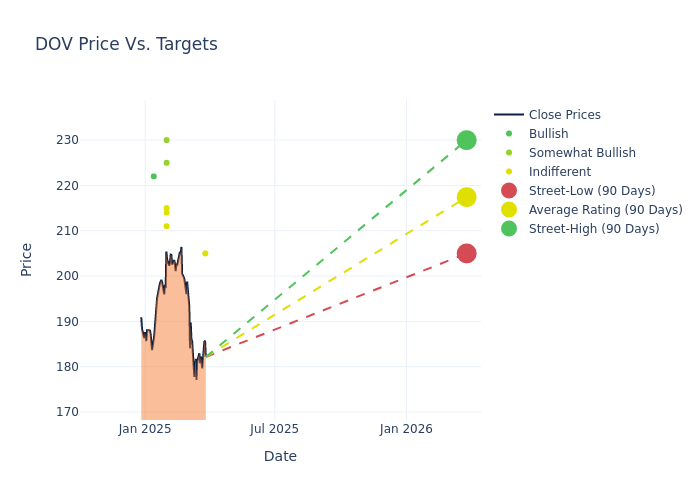

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $214.3, a high estimate of $230.00, and a low estimate of $200.00. Surpassing the previous average price target of $211.20, the current average has increased by 1.47%.

Interpreting Analyst Ratings: A Closer Look

A clear picture of Dover's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Lowers | Equal-Weight | $205.00 | $213.00 |

| Amit Mehrotra | UBS | Lowers | Neutral | $211.00 | $217.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $214.00 | $196.00 |

| Stephen Tusa | JP Morgan | Raises | Overweight | $230.00 | $208.00 |

| Bryan Blair | Oppenheimer | Raises | Outperform | $225.00 | $220.00 |

| Joseph O'Dea | Wells Fargo | Raises | Equal-Weight | $215.00 | $200.00 |

| Julian Mitchell | Barclays | Raises | Equal-Weight | $213.00 | $205.00 |

| Stephen Tusa | JP Morgan | Lowers | Overweight | $208.00 | $212.00 |

| Andrew Kaplowitz | Citigroup | Lowers | Buy | $222.00 | $236.00 |

| Joseph O'Dea | Wells Fargo | Lowers | Equal-Weight | $200.00 | $205.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Dover. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Dover compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Dover's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Dover's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Dover analyst ratings.

Delving into Dover's Background

Founded in 1955 by George Ohrstrom, Dover has become an industrial behemoth through the acquisition of dozens of esteemed brands. The company is organized into five segments through which it designs and manufactures highly engineered components, such as vehicle repair, factory automation, welding, aerospace, fuel dispensing, printing, liquid handling, refrigeration, and can-making equipment. It has operations around the globe but generates over half of its revenue in the United States.

Financial Insights: Dover

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Dover's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.32% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 74.41%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 22.7%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 11.76%, the company showcases effective utilization of assets.

Debt Management: Dover's debt-to-equity ratio is below the industry average. With a ratio of 0.45, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|