Throughout the last three months, 4 analysts have evaluated US Energy USEG, offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

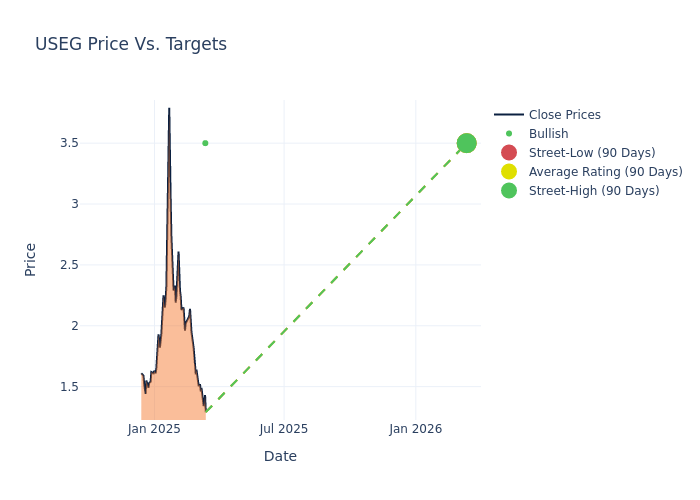

Analysts have set 12-month price targets for US Energy, revealing an average target of $2.75, a high estimate of $3.50, and a low estimate of $2.00. The current average, unchanged from the previous average price target, holds steady.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of US Energy by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jesse Sobelson | D. Boral Capital | Maintains | Buy | $3.50 | $3.50 |

| Jesse Sobelson | D. Boral Capital | Maintains | Buy | $3.50 | $3.50 |

| Jesse Sobelson | D. Boral Capital | Maintains | Buy | $2.00 | $2.00 |

| Jesse Sobelson | D. Boral Capital | Maintains | Buy | $2.00 | $2.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to US Energy. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of US Energy compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of US Energy's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of US Energy's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on US Energy analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering US Energy: A Closer Look

US Energy Corp is an independent energy company. It is focused on the acquisition and development of oil and natural gas-producing properties in the continental United States. It has business activities in South Texas and the Williston Basin in North Dakota. The company generates revenue from its interest in the sales of oil and natural gas production.

Financial Insights: US Energy

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: US Energy's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -43.29%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: US Energy's net margin excels beyond industry benchmarks, reaching -45.33%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): US Energy's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -6.12% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): US Energy's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -3.26% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: US Energy's debt-to-equity ratio is below the industry average. With a ratio of 0.02, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|