Ecovyst ECVT has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

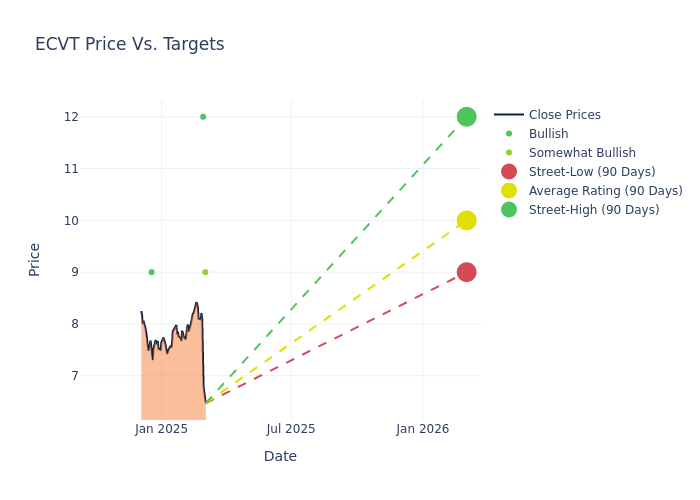

Insights from analysts' 12-month price targets are revealed, presenting an average target of $10.5, a high estimate of $12.00, and a low estimate of $9.00. Highlighting a 2.33% decrease, the current average has fallen from the previous average price target of $10.75.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Ecovyst is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John McNulty | BMO Capital | Lowers | Outperform | $9.00 | $11.00 |

| Hamed Khorsand | BWS Financial | Maintains | Buy | $12.00 | $12.00 |

| Patrick Cunningham | Citigroup | Raises | Buy | $9.00 | $8.00 |

| Hamed Khorsand | BWS Financial | Maintains | Buy | $12.00 | $12.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ecovyst. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Ecovyst compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Ecovyst's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Ecovyst's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Ecovyst analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Ecovyst's Background

Ecovyst Inc is a integrated and global provider of materials, specialty catalysts and services. Its products contribute to lower emissions and cleaner air, higher fuel efficiency and cleaner fuels, and key enablers to advance transition to clean energy. The company has two reporting segments: (1) Ecoservices and (2) Advanced Materials & Catalysts. Ecoservices provides sulfuric acid recycling to the North American refining industry for the production of alkylate and provides on-purpose virgin sulfuric acid for water treatment, mining, and industrial applications. Maximum revenue is generated from Ecoservices segment.

Ecovyst: Delving into Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Ecovyst's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 5.3%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Ecovyst's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -16.72%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ecovyst's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -4.25%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Ecovyst's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -1.67%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Ecovyst's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.28, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|