On Friday, Nifty 50 fell 1.17% to 24,852.15. 7 stocks gained while 43 stocks declined.

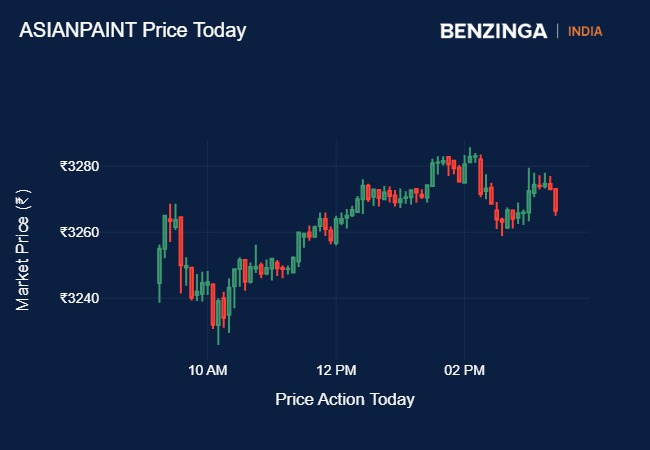

Leading the pack of gainers, Asian Paints saw an increase of 1.09% from its last close, with the current price standing at ₹3273.70.

Following closely, Bajaj Finance registered a gain of 0.99% to trade at ₹7317.15.

Gainers:

| Stock | Current Price | Last Close | % Change |

|---|---|---|---|

| Asian Paints | ₹3273.7 | ₹3238.25 | 1.09% |

| Bajaj Finance | ₹7317.15 | ₹7244.9 | 1.0% |

| JSW Steel | ₹932.8 | ₹925.45 | 0.79% |

| Divi’s Laboratories | ₹5137.8 | ₹5120.9 | 0.33% |

| LTIMindtree | ₹6165.4 | ₹6149.3 | 0.26% |

The steel and energy conglomerate, JSW Steel, also witnessed a positive shift of 0.79% in its stock price, bringing it to ₹932.80. The pharmaceutical giant, Divi’s Laboratories, saw a moderate increase of 0.33% to ₹5,137.80, while LTIMindtree experienced a slight uptick of 0.26% to ₹6,165.40.

See Also: Reliance Infra Reportedly Considers Entering Electric Vehicle Market, Shares Jump

Losers:

| Stock | Current Price | Last Close | % Change |

|---|---|---|---|

| SBI | ₹782.5 | ₹818.75 | -4.43% |

| BPCL | ₹352.15 | ₹360.7 | -2.37% |

| ICICI Bank | ₹1208.15 | ₹1235.95 | -2.25% |

| NTPC | ₹394.8 | ₹403.25 | -2.1% |

| HCLTech | ₹1756.1 | ₹1790.55 | -1.92% |

On the flip side, the banking sector faced a tough day on the market. SBI led the list of losers with a significant drop of 4.42%, bringing its current price down to ₹782.50. SBI fell after Goldman Sachs downgraded the stock.

This was followed by BPCL, which saw a decrease of 2.37% to ₹352.15.

Another banking heavyweight, ICICIBANK, also faced a setback with a decline of 2.24%, bringing its stock price to ₹1208.15. The power and energy sector wasn’t spared either, with NTPC experiencing a fall of 2.09% to ₹394.80.

Lastly, HCLTech, one of the leading IT firms, saw a decrease of 1.92% in its stock price, bringing it to ₹1756.10.

Vinod Nair, Head of Research, Geojit Financial Services said, “The domestic market was in panic today due to the SEBI’s deadline over FIIs disclosure norm, however this is not expected to impact India's lucrativeness to FIIs in the long-term. Coupled with lack of new market catalysts and elevated valuations, a muted trend is expected to continue in the short-term. Global markets are also adopting a cautious stance ahead of the release of the US non-farm payroll data. Additionally, the continuous decline in oil prices to a 14-month low and weak job openings data are heightening fears of a slowdown in the US in the near term.”

Engineered by Benzinga Neuro, Edited by Ananthu CU

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.