Shares of Vodafone Idea were tanking on Friday after global brokerage Goldman Sachs said the debt-ridden telco was likely to lose even more market share going forward.

What Happened: Goldman Sachs said it has major concerns about the future of telecom operator Vodafone Idea, highlighting challenges in achieving free cash flow break-even and regaining market share.

The brokerage maintained its “sell” rating on the stock, though it slightly raised its target price to ₹2.5 from ₹2.2, still representing a significant 83% downside from the current market price of ₹15 per share.

Goldman Sachs anticipates Vodafone Idea losing 300 basis points in market share over the next three to four years. Even under an optimistic scenario — where adjusted gross revenue (AGR) dues are slashed by 65%, tariffs continue to rise and no immediate government repayments are required — the best-case implied value per share would only reach ₹19.

Rising Star: Meanwhile, Goldman Sachs is more upbeat about Bharti Airtel, raising its target price to ₹1,700 from ₹900, reflecting a 10% upside from its current price. Goldman also reiterated its “buy” rating on the stock, citing strong growth and improvements in free cash flow and returns, which justify the stock's premium valuation.

Bharti Airtel's growth is expected to continue, driven by market share gains, organic growth, and potential tariff hikes. Goldman Sachs projects Bharti Airtel’s India revenue to grow at 16% annually and EBITDA to tick up at 21% every year between FY24 and FY27. The firm also foresees Bharti reducing its net debt to near zero by FY28, further improving its balance sheet.

Roll-On Effects: On the other hand, Goldman Sachs downgraded Indus Towers to a “sell” from its previous “neutral” rating, though it increased the target price to ₹350 from ₹220. The firm expressed concerns over the disconnect between Indus Towers’ current valuation and its fundamentals.

Despite a 75% surge in Indus Towers’ stock price over the past six months, the brokerage sees limited growth potential in the medium to long term, especially if Vodafone Idea, one of its key clients, struggles to stabilise its finances.

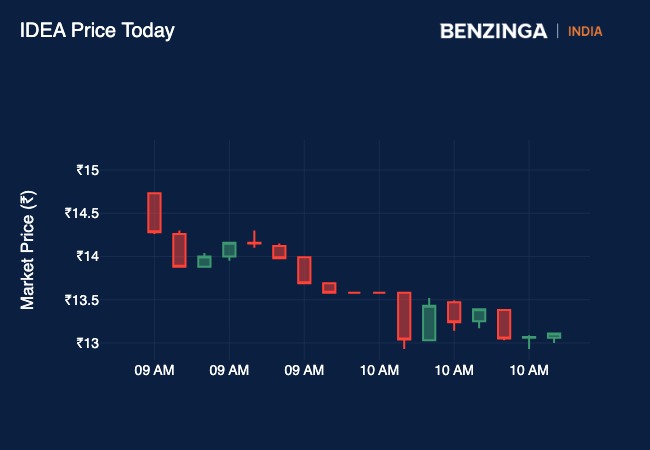

Price Action: Vodafone Idea’s share price was down 10% at ₹13.58, while Airtel’s stock edged 0.31% lower to ₹1,542.40 and Indus Tower’s shares sank 4.8% to ₹421.85 in early trade on Friday.

Read Next: Ather Energy Set To File Rs 4,000-Crore IPO, Targets ₹16,800 Cr Valuation: Report

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.