The Nifty 50 companies weightage is key to understanding how much impact a company could have on the broader market as well as instruments such as mutual funds.

The Nifty 50 is one of India’s most recognised stock market indices, representing the performance of 50 of the largest and most liquid companies listed on the National Stock Exchange (NSE).

The weightage of each stock in the Nifty 50 index is a crucial factor that reflects the stock’s influence on the overall index performance.

This article delves into the intricacies of how weightage is calculated, and why it matters and provides a detailed breakdown of the Nifty 50 companies weightage as of the latest data.

What Is the Nifty 50 Index?

The Nifty 50 index, managed by NSE Indices Limited (formerly India Index Services & Products Limited), is a free-float market capitalisation-weighted index.

It includes 50 companies from 13 sectors of the Indian economy, making it a barometer for the overall stock market performance in India. The index covers various sectors such as financial services, IT, automobiles, consumer goods and energy, among others.

Understanding the Nifty 50 companies weightage is key for investors looking to make informed decisions.

How Is Weightage Determined in the NIFTY 50?

Weightage in the Nifty 50 is determined by a company’s free-float market capitalisation. The free-float market capitalisation is the portion of a company’s total market capitalisation that is available for trading by the general public.

It excludes shares held by promoters, governments or other entities that are not meant for public trading. The NIFTY 50 companies weightage directly relates to how this calculation impacts the index.

Why Is Weightage Important?

The weightage of a company in the Nifty 50 index is critical because it determines how much influence the stock has on the index’s movements.

To calculate the Nifty 50 companies weightage, we first need to figure out the total free float capitalisation of all the stocks in the index and divide each company’s free float by the sum.

Stocks with higher weightage have a more significant impact on the index. Investors and fund managers closely watch these weightages to understand market dynamics and make informed investment decisions.

Monitoring the Nifty 50 companies weightage helps investors align their portfolios with market trends.

See Also: Namma Yatri Planning To Enter U.S. Market: Report

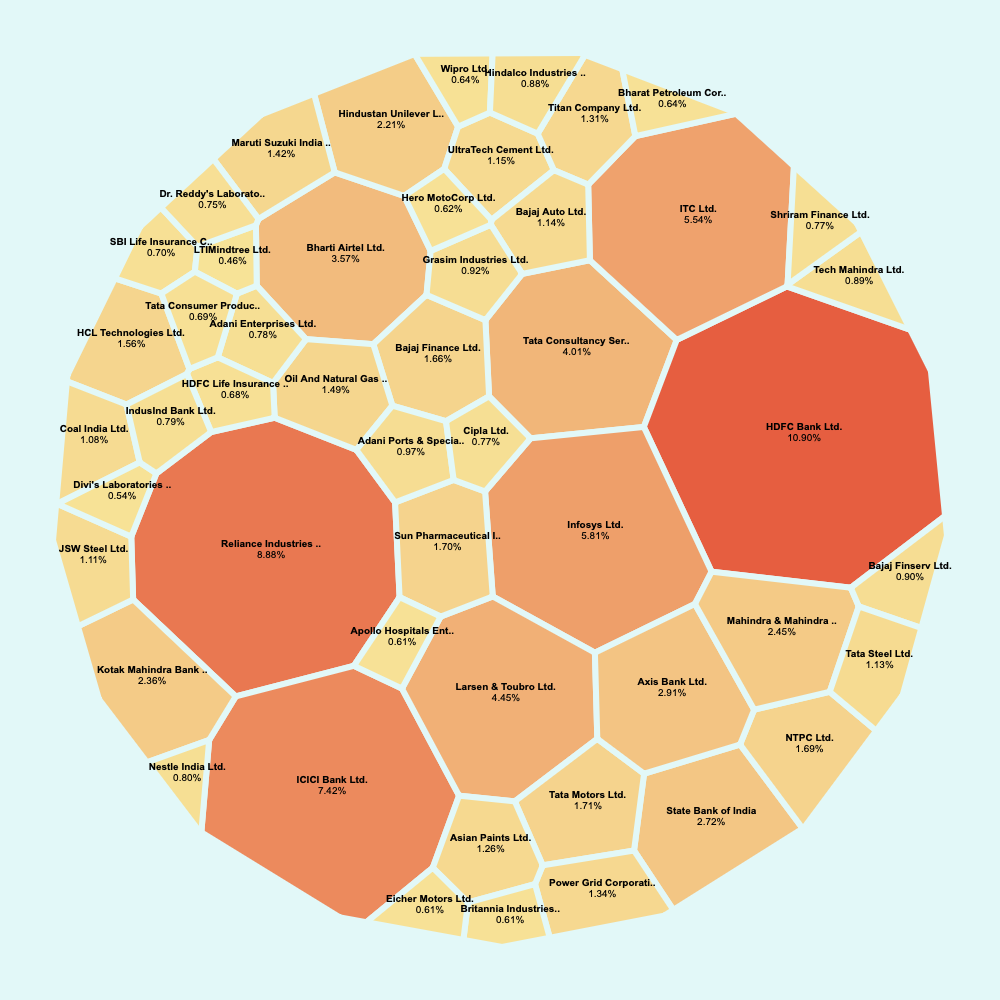

Detailed Breakdown of Nifty 50 Companies Weightage

Here is a detailed breakdown of the weightage of all companies in the Nifty 50 index based on the latest free-float market capitalisation data. This table is based on the latest available data as of Friday, August 23:

| Stock Name | Free Float Market Cap (INR Crores) | Weightage (%) |

|---|---|---|

| HDFC Bank Ltd. | 12,41,082.48 | 10.90% |

| Reliance Industries Ltd. | 10,11,061.27 | 8.88% |

| ICICI Bank Ltd. | 8,44,154.05 | 7.42% |

| Infosys Ltd. | 6,61,819.08 | 5.81% |

| ITC Ltd. | 6,30,276.44 | 5.54% |

| Tata Consultancy Services Ltd. | 4,56,008.04 | 4.01% |

| Larsen & Toubro Ltd. | 5,06,206.80 | 4.45% |

| Bharti Airtel Ltd. | 4,06,711.55 | 3.57% |

| Axis Bank Ltd. | 3,31,667.48 | 2.91% |

| State Bank of India | 3,09,650.04 | 2.72% |

| Kotak Mahindra Bank Ltd. | 2,68,526.37 | 2.36% |

| Mahindra & Mahindra Ltd. | 2,79,002.01 | 2.45% |

| Hindustan Unilever Ltd. | 2,51,097.52 | 2.21% |

| Maruti Suzuki India Ltd. | 1,62,112.84 | 1.42% |

| Tata Motors Ltd. | 1,94,527.47 | 1.71% |

| Sun Pharmaceutical Industries Ltd. | 1,93,064.18 | 1.70% |

| NTPC Ltd. | 1,92,156.17 | 1.69% |

| Bajaj Finance Ltd. | 1,89,133.39 | 1.66% |

| Oil And Natural Gas Corp. Ltd. | 1,69,219.46 | 1.49% |

| Titan Company Ltd. | 1,49,485.57 | 1.31% |

| Power Grid Corporation of India Ltd. | 1,52,017.38 | 1.34% |

| Asian Paints Ltd. | 1,43,842.82 | 1.26% |

| Tata Steel Ltd. | 1,28,331.39 | 1.13% |

| JSW Steel Ltd. | 1,26,441.59 | 1.11% |

| Coal India Ltd. | 1,22,426.02 | 1.08% |

| UltraTech Cement Ltd. | 1,30,650.86 | 1.15% |

| HCL Technologies Ltd. | 1,77,495.71 | 1.56% |

| Bajaj Auto Ltd. | 1,29,837.68 | 1.14% |

| Hindalco Industries Ltd. | 1,00,347.10 | 0.88% |

| Tech Mahindra Ltd. | 1,01,357.22 | 0.89% |

| Grasim Industries Ltd. | 1,04,670.82 | 0.92% |

| Bajaj Finserv Ltd. | 1,02,584.42 | 0.90% |

| IndusInd Bank Ltd. | 89,834.33 | 0.79% |

| Adani Enterprises Ltd. | 88,717.11 | 0.78% |

| Cipla Ltd. | 87,979.26 | 0.77% |

| Shriram Finance Ltd. | 87,805.27 | 0.77% |

| Dr. Reddy’s Laboratories Ltd. | 85,131.20 | 0.75% |

| Nestle India Ltd. | 91,267.46 | 0.80% |

| HDFC Life Insurance Company Ltd. | 77,830.70 | 0.68% |

| Tata Consumer Products Ltd. | 78,983.51 | 0.69% |

| SBI Life Insurance Company Ltd. | 80,226.88 | 0.70% |

| Adani Ports & Special Economic Zone Ltd. | 1,09,867.73 | 0.97% |

| Hero MotoCorp Ltd. | 70,662.24 | 0.62% |

| Bharat Petroleum Corporation Ltd. | 72,826.76 | 0.64% |

| Wipro Ltd. | 73,240.63 | 0.64% |

| Britannia Industries Ltd. | 69,425.88 | 0.61% |

| Eicher Motors Ltd. | 68,896.02 | 0.61% |

| Apollo Hospitals Enterprise Ltd. | 69,950.15 | 0.61% |

| Divi’s Laboratories Ltd. | 61,929.84 | 0.54% |

| LTIMindtree Ltd. | 52,436.19 | 0.46% |

Top Influencers in Nifty 50 Companies Weightage

1. HDFC Bank Ltd. (10.90% Weightage)

HDFC Bank holds the highest weightage in the Nifty 50 index by far at 10.90%. As one of India’s leading private sector banks, HDFC Bank’s performance significantly impacts the index.

The bank’s extensive network, consistent financial performance, and strong asset quality make it a dominant player in the market, contributing significantly to the Nifty 50 companies weightage.

2. Reliance Industries Ltd. (8.88% Weightage)

Reliance Industries is another major player in the Nifty 50, with a weightage of 8.88%. Despite being one of the largest companies in India by market capitalisation, its weightage is slightly lower than HDFC Bank due to the free-float market cap calculation.

Reliance’s diverse business portfolio, ranging from energy to telecommunications, plays a crucial role in its influence on the NIFTY 50.

3. ICICI Bank Ltd. (7.42% Weightage)

ICICI Bank, another leading private sector bank, holds a weightage of 7.42% in the Nifty 50. The bank’s strong presence in retail and corporate banking, along with its robust financial metrics, makes it a key component of the NIFTY 50 companies weightage.

4. Infosys Ltd. (5.81% Weightage)

Infosys, one of India’s largest IT services companies, has a weightage of 5.81%. The company’s global presence and leadership in the IT sector contribute to its position on the Nifty 50.

5. ITC Ltd. (5.54% Weightage)

ITC Ltd., a conglomerate with interests in fast-moving consumer goods, hotels, paperboards and more, holds a weightage of 5.54%. ITC’s diversified business model and strong brand presence in the consumer goods sector make it a critical stock in the Indian market.

The Impact of Sectoral Representation

The Nifty 50 index includes companies from various sectors, ensuring a broad representation of the Indian economy. The financial services sector typically has the highest representation, followed by IT, consumer goods, and energy.

This sectoral diversity helps in mitigating risks associated with specific industries and provides a more balanced view of the market, impacting the overall Nifty 50 companies weightage.

Capping Mechanism in Nifty 50

To ensure that the index is not overly dominated by a few large companies, a capping mechanism is applied. This means that no single stock can have a weightage exceeding a certain percentage, typically around 33%.

This capping helps in maintaining the index’s balance and prevents excessive concentration in a few stocks, ensuring that the Nifty 50 companies weightage remains representative of the broader market.

Changes in Nifty 50 Weightage Over Time

The weightage of Nifty 50 companies is not static; it changes over time based on the performance of the stocks, changes in free-float market capitalization, and other factors.

The index is reviewed semi-annually, and adjustments are made to ensure it remains representative of the market. Monitoring these changes in the Nifty 50 companies weightage can provide insights into evolving market trends.

For investors, keeping an eye on the Nifty 50 companies weightage is crucial for understanding market dynamics and making informed investment decisions. Companies with higher weightage have a more significant impact on the index, and their performance can influence overall market sentiment.

As the market evolves, so too will the weightage of these companies, reflecting the ever-changing landscape of the Indian stock market. Investors should regularly monitor these weightages to stay ahead in the game and make strategic investment decisions.

Read Next: SEBI Slaps 5-Year Securities Market Ban On Anil Ambani And 24 Entities

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.