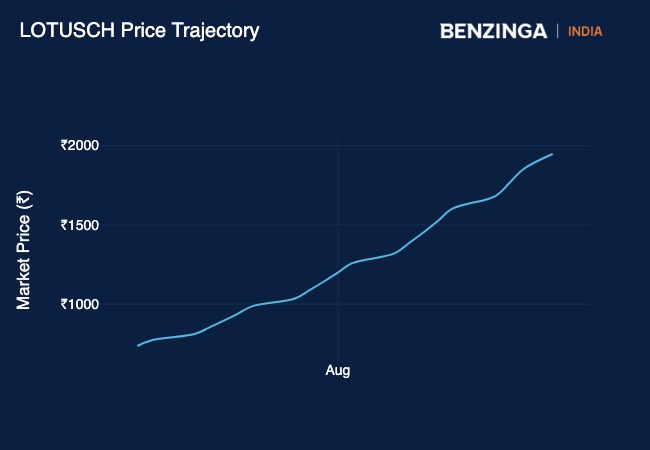

Shares of Lotus Chocolate Company were locked in the 5% upper circuit for the 22nd straight session on Monday morning, hitting a new 52-week high of ₹2,044.

What Happened: Shares of the company have been on this impressive bull run ever since it reported its earnings for the quarter ended June.

The company’s consolidated revenue from operations went up over 330% year-on-year to ₹141 crore. Net profit for the quarter came in at ₹9.4%, up multifold from the ₹19.60 lakh profit reported in the same quarter last year.

Shares of the company since then have been on a tear at the bourses. The BSE-listed small-cap stock has given returns of over 160% in the past 30 days.

Lotus Chocolates is a premier Indian manufacturer specialising in high-quality chocolates, cocoa products and cocoa derivatives. Since its incorporation in 1988 and the start of operations in 1992, the company has built a strong reputation as a dependable supplier to both local bakeries and multinational companies worldwide, as per the company’s website.

Reliance Consumer Products, the fast-moving consumer goods arm and a wholly-owned subsidiary of Reliance Retail Ventures owns a 51% stake in the company. The Reliance subsidiary acquired a controlling stake in the chocolate company in May 2023.

Price Action: Shares of Lotus Chocolate Company were locked in the 5% upper circuit at ₹2,044 on Monday.

Read Next: Zomato Up 3% After UBS Hikes Target Price To Reflect 19% Upside

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.