On Wednesday, Nifty 50 rose 1.27% to 24,297.50, reversing the previous three day’s slide. 42 stocks ended in the green while 8 ones declined.

Oil and Natural Gas Corporation was the star of the day, with its stock price surging by 7.51% to ₹329.10, up from its last close at ₹306.10. ONGC gained after the brokerages shared positive calls on company’s guidance to increase oil production.

| Company | Current Price | Last Close | % Change |

| Oil and Natural Gas Corporation | ₹329.10 | ₹306.10 | 7.51% |

| Coal India | ₹531.50 | ₹499.60 | 6.39% |

| Adani Enterprises | ₹3185.95 | ₹3072.73 | 3.69% |

| Adani Ports | ₹1543.80 | ₹1494.10 | 3.33% |

| Power Grid Corporation of India | ₹352.05 | ₹340.75 | 3.32% |

Following closely was Coal India, which saw a robust increase of 6.38% in its stock price. The stock closed at ₹531.50, a substantial rise from its previous close of ₹499.60.

See Also: Cochin Shipyard’s Share Price Band Revised Upwards By Exchanges

Other notable gainers included Adani Enterprises and Adani Ports, both part of the Adani Group, with their stock prices increasing by 3.68% and 3.33% respectively. Power Grid Corporation of India also made it to the top five gainers with a 3.32% rise in its stock price.

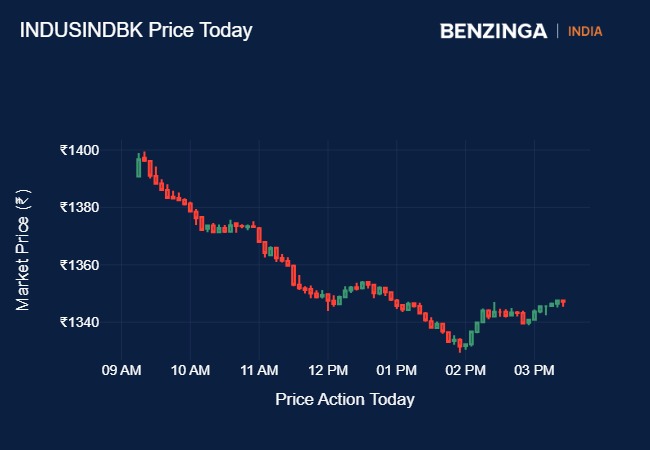

On the flip side, IndusInd Bank emerged as the biggest loser of the day, with its stock price dipping by 2.60% to ₹1345.15 from its last close of ₹1381.00.

| Company | Current Price | Last Close | % Change |

| IndusInd Bank | ₹1345.15 | ₹1381.00 | -2.60% |

| Tech Mahindra | ₹1473.65 | ₹1483.40 | -0.66% |

| Britannia Industries | ₹5836.80 | ₹5854.50 | -0.30% |

| Titan Company | ₹3326.25 | ₹3335.10 | -0.27% |

| Hindustan Unilever | ₹2744.05 | ₹2750.00 | -0.22% |

Other underperformers included Tech Mahindra and Britannia Industries, with their stock prices falling by 0.66% and 0.30% respectively. Titan Company and Hindustan Unilever also featured in the bottom five performers, with minor dips in their stock prices.

Vinod Nair, Head of Research, Geojit Financial Services said, “Global markets experienced a notable rebound after the BoJ’s Deputy Governor reassured that the central bank would not raise interest rates during a period of financial instability. The Indian market also witnessed broad-based buying across sectors, with the Realty sector seeing a relief rally due to the reinstatement of indexation benefits. The carry trade issue appears to have been eased for now and the focus is on the ongoing RBI policy, which is likely to hold the rate and positive economic outlook.”

Read Next: ONGC Surges 7% As Brokerage Cheers Increased Production Guidance

Engineered by Benzinga Neuro, Edited by Ananthu CU

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.