The exchanges on Tuesday evening announced the revision in price bands for several stocks including RVNL.

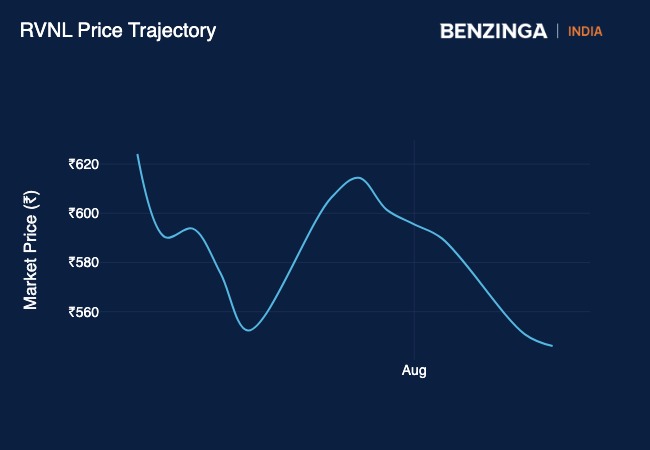

What Happened: The RVNL share price band has been revised upward to 20%. This means that the RVNL share price could not go over 20% down or up. The exchanges had last month, revised downward the price band for the popular railway stock. Such revisions are made when a stock is experiencing more than usual volatility. Prior to that downward revision that stock had gone up over 45% in five sessions.

Stock exchanges revise the price bands of listed securities as part of their surveillance measures to control excessive volatility. BSE implements a circuit filter mechanism to limit the maximum fluctuation allowed in a stock’s price within a single day. Price bands set by these filters determine the upper and lower limits for the price movements of a stock.

See Also: Suzlon To Buy 76% Stake In Renom Energy For ₹660 Cr

According to the Securities and Exchange Board of India (SEBI), all individual scrips are subject to price bands up to 20% on either side, except for those that have derivative products associated with them. This measure is aimed at mitigating excessive price swings and ensuring market stability.

Shares of the rail infra company have remained volatile ever since the budget failed to meet the expectations of investors. The company will post its earnings for the June quarter tomorrow, on August 8.

Read Next: IRFC To Post Q1 Financial Results On August 12: What Investors Can Expect

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.