Defence companies such as Hindustan Aeronautics, Mazagon Dock Shipbuilders and Bharat Dynamics were down more than 3% to 5% on Monday.

What Happened: Defence companies fell along with the rest of the markets as bears took control of the market after fears of recession took over the U.S. markets. Benchmark indexes Sensex and Nifty were down 2.7%.

Defence stocks had fallen on Budget day after the sector was left disappointed, finding little mention in the budget.

The government has allocated ₹6.22 lakh crore to the defence ministry in the Budget, an increase of 4.79% from the previous year. With ₹1.72 lakh crore allocated for capital acquisition.

See Also: Why RVNL, IRCON, IRFC, Other Railway Stocks Are Bleeding At The Bourses Today

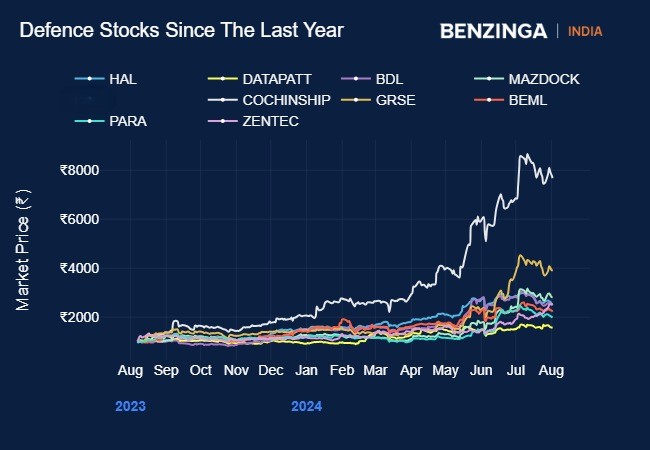

Defence stocks have been beneficiaries of the government’s focus on indigenisation of defence products and increased capex allocation in the budget. Defence stocks have risen above 100% since the last year with Cochin Shipyard rising above 600% since the last year.

Price Action: Shares of Hindustan Aeronautics fell 3.35% to ₹4,538.40.

Shares of Bharat Dynamics fell 5.37% to ₹1,342.95.

Shares of Cochin Shipyard fell 5% to ₹2,411.

Shares of Mazagon Dock Shipbuilders fell 5.95% to ₹4,792.50.

Shares of Garden Reach Shipbuilders fell 5% to ₹2,210.30.

Shares of Bharat Earth Movers fell 5.61% to ₹4,190.

Shares of Paras Defence fell 5% to ₹1,187.70.

Shares of Zen Technologies were down 4.17% to ₹1,638.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.