Shares of defence stocks like Hindustan Aeronautics, Mazagon Dock Shipbuilders, Cochin Shipyard and Bharat Electronics opened in positive territory but some eased into the red ahead of the Budget announcement on Tuesday.

What Happened: Finance Minister Nirmala Sitharaman is expected to present the Union Budget 2024 at 11 a.m., and there are hopes that she may announce higher allocations towards the sector.

Investors anticipate a 12%-15% year-on-year growth in defence capital outlay, as the government focuses on systems modernisation and infrastructure development, given its emphasis on indigenisation and exports ramp-up.

Nuvama Institutional Equities expects a 5%-8% increase in defence capex, with higher allocations toward unmanned aerial vehicles and drones, research and development and anti-drone systems, noting that some key large systems are already in the pipeline.

An announcement of this nature might bring slight pessimism in the market in the short term, but the long-term outlook for the defence sector is still positive as orders from the Ministry of Defence are expected to continue.

See Also: Suzlon Shares Rocket To Record High As Earnings Beat Estimates

In the interim budget, the finance minister had announced a budgetary allocation of ₹1.72 lakh crore towards FY25 defence capital expenditure, which was 20.33% higher than the actual expenditure of FY23 and 9.40% more than the revised allocation of FY24.

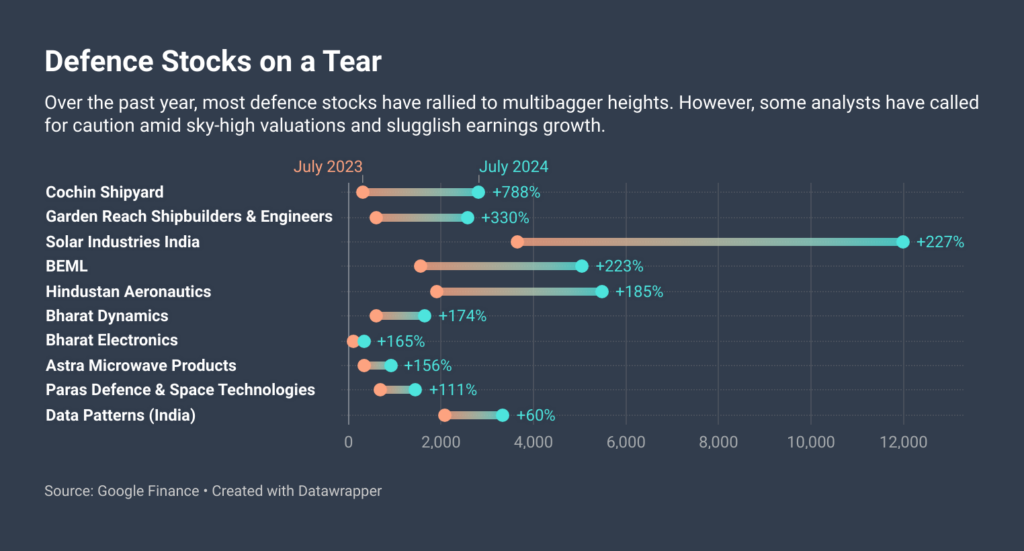

Most defence sector stocks have given mutlibagger resturns over the past year, with Cochin Shipyard going up 700%. Mazagon Dock Shipbuilders Ltd, BEML Ltd, HAL and Bharat Dynamics have delivered 150%-200% returns during the same period.

When compared to historical performance, the current price-to-earnings ratios of defence stocks appear elevated, raising concerns about whether these stocks are overpriced. While the defence sector's reliance on government contracts provides long-term revenue streams and stability, any adverse changes in government policy or budget allocations can significantly impact these stocks' performance.

In the run-up to the Budget, defence stocks have been under pressure, with many seeing sharp corrections amid reports of profit booking and concerns over divestments.

Sharekhan has HAL, BEL and Bharat Forge as its preferred defence picks ahead of the budget.

Despite having the world's fifth-largest defense budget, India sources 60% of its weapon systems from international markets. The Indian government is trying to strengthen the nation's defence prowess by reducing dependence on imports.

Large and sustainable opportunities for domestic players exist, particularly in engineering services and component sourcing, with the goal of reaching ₹50,000 crore in exports by 2029-2030.

Price Action: Shares of defence stocks were mixed on Tuesday morning even though most had opened in positive territory.

- Cochin Shipyard shares climbed 2.61%, trading at ₹2,740.

- Bharat Dynamics Ltd saw an increase of 1.33%, reaching ₹1,513.60.

- Garden Reach Shipbuilders & Engineers Ltd experienced a rise of 0.98%, now at ₹2,593.45.

- BEML Ltd’s stock went up by 0.89%, trading at ₹4,759.50.

- Mazagon Dock Shipbuilders Ltd shares edged up 0.37%, now priced at ₹5,345.00.

- Hindustan Aeronautics Ltd shares fell by 0.11%, trading at ₹4,991.65.

- Data Patterns (India) Ltd saw a slight decline of 0.15%, with shares at ₹3,188.00.

- Bharat Electronics Ltd dropped 0.24%, trading at ₹311.55.

- Paras Defence and Space Technologies Ltd fell by 0.29%, with the stock price at ₹1,375.10.

- Astra Microwave Products Ltd experienced a downturn of 0.90%, now at ₹899.75.

- Solar Industries India Ltd shares decreased by 1.18%, trading at ₹10,783.00..

Read Next: How Budget Affects Market: Nifty Returns Around Budget Time In Last 5 Years

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.