Shares of several defence stocks were in the red on Tuesday including HAL, BEL, BDL, Mazdock and Cochin Shipyard.

What Happened: While the reason for the drop is not immediately clear, market analysts think it could be due to profit booking.

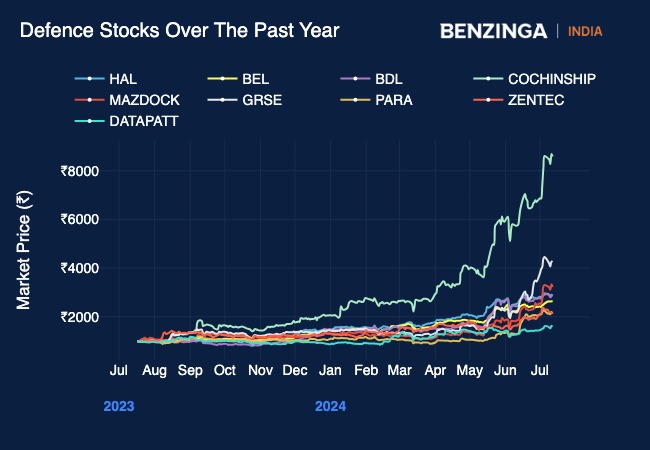

Several of these stocks have given multibagger returns in the past year. For instance, since the start of the year, HAL shares have increased over 80%, while BEL shares have surged 76%. Mazdock shares have surged over 130% while BDL’s share price has gone up 85%.

However as evident, from the chart above the best return has been delivered by Cochin Shipyard going up over 300% just this year. In the past 365 days, the stock has surged a massive 700%.

A notable exception today among the stocks was Garden Reach Shipbuilders, which saw its shares soar after bagging a fresh order.

Earlier in the day, ICICI Securities in a note said that it was optimistic about the sector. The brokerage noted an improvement in defence orders following the Lok Sabha elections and that the stocks in this sector have healthy order pipelines.

Among the defence public sector firms, the brokerage did not have any “buy” recommendations but did have an “add” recommendation for HAL, BEL, and BDL.

Price Action: Here’s how defence sector stocks performed on Tuesday:

Hindustan Aeronautics shares traded down 3.27% at ₹5,324.75.

Paras Defence and Space Technologies Ltd traded 2.58% lower at ₹1,394.00.

Bharat Dynamics shares traded 1.69% lower at ₹1,601.30.

Bharat Electronics shares traded 1.64% lower at ₹325.95.

Data Patterns’ shares traded 1.18% lower at ₹3,297.90.

BEML Ltd shares traded 1.01% lower at ₹4,954.50.

Zen Technologies traded 0.47% lower at ₹1,354.50.

Cochin Shipyard shares traded 0.024% lower at ₹2,744.00.

Mazagon Dock Shipbuilders traded 0.17% higher at ₹5,401.80.

Read Next: Tata Power vs Adani Power: Which Stock Performed Better In The Past Year

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.