On Tuesday, Nifty 50 closed 0.78% to 23,721.30 powered by financial and banking stocks. Nifty hit an all-time high of 23,754.15 in the session. 26 stocks advanced while 23 ended in the red and one remained unchanged.

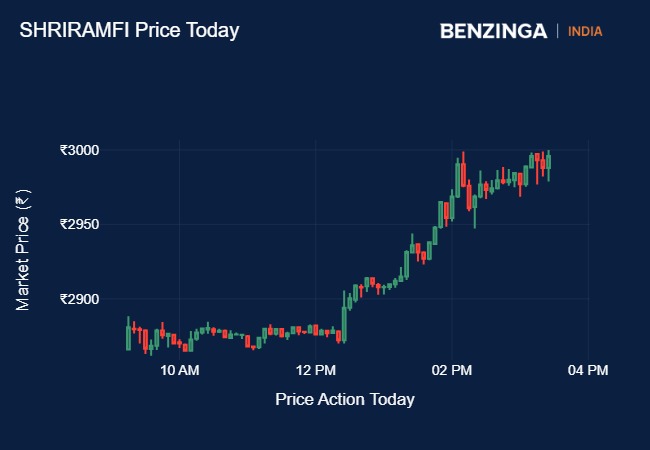

Shriram Finance was the biggest gain of the day with a 3.73% gain to ₹2989.85 from ₹2882.25 in the previous session.

See Also: Why Is Moody’s Worried About India’s Water Crisis? Steel, Coal Most At Risk

Top Gainers

| Stock | Current Price | Last Close | % Change |

|---|---|---|---|

| Shriram Finance | ₹2989.85 | ₹2882.25 | 3.73% |

| Axis Bank | ₹1271.45 | ₹1228.1 | 3.53% |

| ICICI Bank | ₹1197.95 | ₹1170.1 | 2.38% |

| HDFC Bank | ₹1711.35 | ₹1672.4 | 2.33% |

| HDFC Life | ₹590.95 | ₹579.5 | 1.98% |

Axis Bank and ICICI Bank also showcased strong performances with gains of 3.53% and 2.38% respectively, further underscoring the robust momentum within the banking sector. HDFC Bank gained 2.33% to ₹1711.35 after Bernstein maintained an "outperform" rating. The surge in stock price took it past ₹13 lakh crore market cap for the first time since December.

HDFC Life also saw a 2% increase in its stock value.

On the other end of the spectrum, BPCL emerged as the session’s biggest loser, with its shares falling by 2.93% to close at ₹296.30.

Top Losers

| Stock | Current Price | Last Close | % Change |

|---|---|---|---|

| BPCL | ₹296.3 | ₹305.25 | -2.93% |

| Eicher Motors | ₹4775.05 | ₹4870.9 | -1.97% |

| Power Grid | ₹327.4 | ₹332.95 | -1.67% |

| Asian Paints | ₹2858.45 | ₹2896.05 | -1.3% |

| Tata Steel | ₹175.68 | ₹177.96 | -1.28% |

Eicher Motors and Power Grid also recorded declines of 1.97% and 1.67% respectively. Asian Paints and Tata Steel also fell during the session.

Commenting on the day’s performance, Ajit Mishra senior vice president, research, Religare Broking said, “The markets edged higher, gaining over half a percent, signalling a resumption of the uptrend after a brief pause. Following an initial uptick, Nifty traded within a range during the first half, but selective buying in heavyweight stocks, particularly from the banking sector, spurred a sharp surge as the day progressed. Besides banking, the IT sector also performed well, whereas the realty, metal, and energy sectors ended in the red. Amidst all this, the broader indices were slightly on the back foot, closing flat to marginally lower.”

Deepak Jasani, head of retail research at HDFC Securities said, “A rally in the banking stocks pushed Nifty to hit another record – 34th time this year though a host of other sectors ended in the negative. At close, Nifty was up 0.78% or 183.5 points at 23.721.3. Cash market volumes on the NSE rose about 3% to ₹1.25 lakh crore. Broad market indices ended marginally in the negative even as the advance-decline ratio fell to 0.80:1.”

Read Next: Stanley Lifestyles IPO Day 3: Subscriptions Climb Over 44 Times, Check Latest GMP

Engineered by Benzinga Neuro, Edited by Ananthu CU

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.