Shares of ONGC were gaining on Tuesday as the oil explorer and producer received a strong recommendation from a global research firm.

What Happened: Jefferies retained its “buy” call on ONGC, noting that the central government’s policy continuity should keep the oil public sector firm’s profitability elevated.

Since the election verdict was announced on June 4, with the BJP unable to cross the 272 mark to attain a simple majority, investors have offloaded their holdings in ONGC, weighing on its share price, the brokerage said.

See Also: Why IndiGo Share Price Is Falling Over 2% Today

Jefferies said this correction appears overdone and can prove to be an attractive entry point for investors. The brokerage has a target price of ₹390 per share on ONGC, reflecting a 50% upside potential from current levels.

ONGC’s ramp-up in Krishna Godavari basin production in the third quarter of the current fiscal year and accretion to profitability are key triggers to monitor, the brokerage added.

Overall, Jefferies remains confident that ONGC’s profitability will remain elevated compared to its past averages.

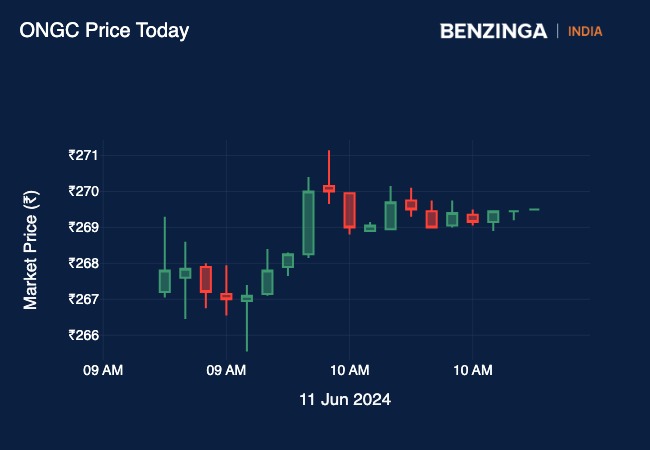

Price Action: ONGC’s share price was up 3.94% at ₹269.35 in morning trade on Tuesday. The stock has gained over 30% so far this year.

Read Next: Why Brokerage Sees Tata Motors Shares Going Up Another 13%

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.