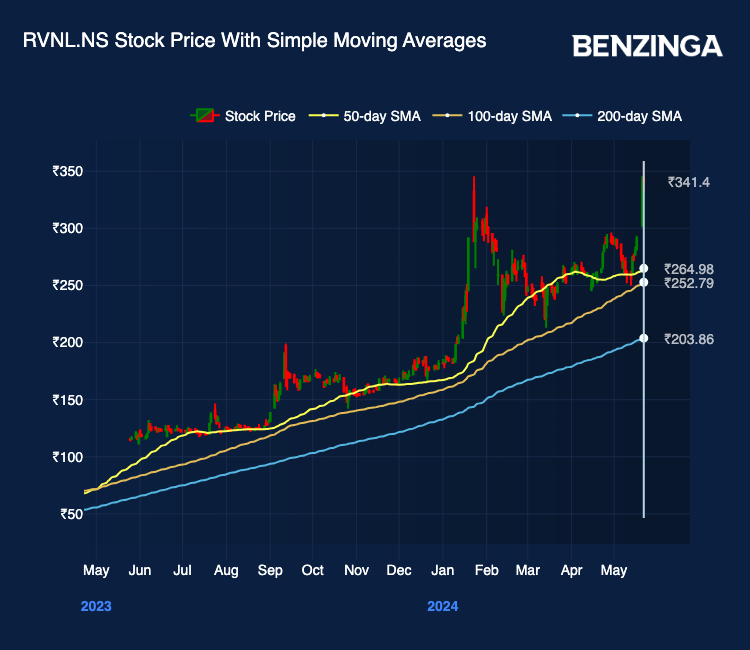

RVNL’s share price continued to rally for the eighth consecutive session on Thursday going up over 9% to hit a new all-time high of ₹374.

What Happened: Shares of the railway major have been on a great run over the past year. The recent release of the March quarter results has also helped catapult the RVNL share price to new heights.

The company’s net profit for the quarter came in at ₹478.40 crore, marking an increase of around 33% from ₹359.25 crore in the same quarter last year. Revenue from operations for the March quarter came in at ₹6,714 crore. The order book stands at a massive ₹85,000 crore.

See Also: IRCON Shares Back In Green But Analyst Advises Caution

What Are Analysts Saying: Anshul Jain, head of research at Lakshmishree said that RVNL has broken out of the mini coil pattern. “In my analysis of Rail Vikas Nigam Limited (RVNL) on the monthly chart, the stock has been in a three-month inside bar, mini coil pattern. This technical formation has effectively coiled the stock's volatility, leading to a period of consolidation. Recently, RVNL has burst out of this pattern, breaking through the crucial 340 level,” he added.

He adds that this breakout is technically significant, suggesting a strong upward momentum. His immediate target for the rail infra stock is 425, with the potential to test 475. “This projection is supported by the significant increase in trading volumes during the breakout, in stark contrast to the dried-up volumes observed during the coil formation,” he told Benzinga India.

“Over the past few weeks, RVNL has been fluctuating within a specific price range, typically oscillating between 250 and 300. However, this week, it has broken out of this range and comfortably remained above it,” Jigar S Patel, senior manager – technical research analyst, Anand Rathi Shares and Stock Brokers told Benzinga India. Patel added that the stock is currently trading above the R4 Camarilla quarterly pivot point (resistance), indicating a strong bullish bias.

“Weekly stochastic indicators have reversed from the 50 level and are now near the overbought zone, further affirming our bullish stance. If RVNL sustains above 345 on a weekly basis, it could reach 492 i.e.R5 Camarilla quarterly pivot point (resistance) within the next 2-3 months. Conversely, if it fails to sustain above 345, support is expected around 310-320. Therefore, traders should consider a buy-on-dip strategy for RVNL,” he added.

“The stock has moved above the previous swing high, which was also the previous all-time high. The trend has improved once again following a brief consolidation. The stock is trading in the blue sky zone and might reach 400 in the short term. Support on the lower end is placed at 354,” said Rupak De, senior technical analyst, LKP Securities

Riyank Arora, technical analyst at Mehta Equities said that the stock has given a strong breakout above its recent resistance mark of 360 and is managing to hold well above the same. “With the outlook being positive and strong for most railway stocks, and volumes surging higher, crossing the average (30-day) volume by almost three times, RSI (14) is also nearing 83, indicating strong momentum. The stock will likely head towards the 400-425 levels as this rally extends further. A strict stop loss should be set at the 350 mark to manage risk well,” he added.

Price Action: RVNL’s share price was up 8.48% to trade at ₹370.35 in the early hours of trading on Thursday.

Read Next: Nykaa Shares Jump 4% After Q4 Numbers But Analysts Remain Mixed

Don't miss a beat on the share market. Get real-time updates on top stock movers and trading ideas on Benzinga India Telegram channel.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.